Accurately measuring the scope of global wealth inequality is a notoriously difficult undertaking – a fact that was brought to light last year when the International Consortium of Investigative Journalists published the Panama Papers, exposing clients of Panamanian law firm Mossack Fonseca. As the papers revealed, Mossack Fonseca, which is only the world’s fourth-largest provider of offshore financial services, boasted...

Read More »Harvey’s Muted (Price) Impact On Oil

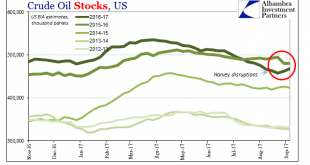

The impact of Hurricane Harvey on the Gulf energy region is becoming clear. There have been no surprises to date, even though the storm did considerable damage and shuttered or disrupted significant capacity. Most of that related to gasoline, which Americans have been feeling in pump prices. According to the US Department of Energy, as of August 31, 10 refineries had been shut down with a combined capacity of 3.01...

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

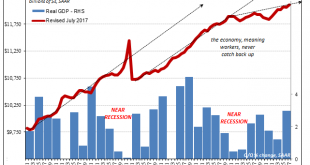

Read More »When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More »The JOLTS of Drugs

Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary...

Read More »COT Report: Black (Crude) and Blue (UST’s)

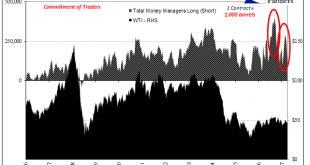

Over the past month, crude prices have been pinned in a range $50 to the high side and ~$46 at the low. In the futures market, the price of crude is usually set by the money managers (how net long they shift). As discussed before, there have been notable exceptions to this paradigm including some big ones this year. It was earlier in February when money managers piled in to WTI longs, apparently expecting better things...

Read More »Canada’s RHINO(s)

The Bank of Canada “raised rates” again today, this time surprising markets and economists who were expecting more distance between the first and second policy adjustments. The central bank paid typical lip service to being data dependent. It has a vested interest if you, as any Canadian reader, believe that to be a fact. But what we really find in Canada is what we find everywhere else. The end of the “rising dollar”...

Read More »Former UBS Trader Arrested, Charged With Rigging Gold Prices

Three years after we first identified the former head of UBS's gold desk in Zurich as someone directly implicated in the rigging of precious metals prices, Bloomberg reports that Andre Flotron, a Swiss resident, was arrested while visiting the U.S., according to people familiar with the matter. Having been "on leave" since 2014, it appears Andre's hope that he was gone but "keen to return in due time" are now up in smoke. As Bloomberg reports, Flotron was...

Read More »US Export/Import: ‘Something’ Is Still Out There

In January 2016, just as the wave of “global turmoil” was cresting on domestic as well as foreign shores, retired Federal Reserve Chairman Ben Bernanke was giving a series of lectures for the IMF. His topic wasn’t really the so-called taper tantrum of 2013 but it really was. Even ideologically blinded economists like Bernanke could see how one might have followed the other; the roots of 2016 in 2013. In May and June of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org