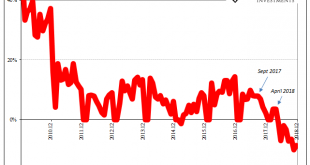

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective. Before the...

Read More »Globally Synchronized…

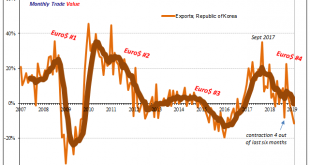

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death. What that meant in the context of globally synchronized growth, 2017’s repeatedly dominant narrative, wasn’t the end of synchronized as many tried to...

Read More »Durably Sideways

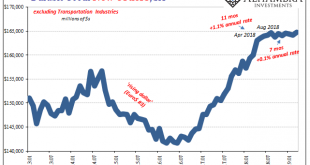

Next month, in the durable goods series, the Census Bureau will release the results of its annual benchmark changes. In May 2019, the agency will revise the seasonal adjustments going back to January 2002. Unadjusted data will not be, well, further adjusted. None of this, apparently, will include any information gleaned from the comprehensive 2017 Economic Census. I haven’t closely followed the progress of the latter,...

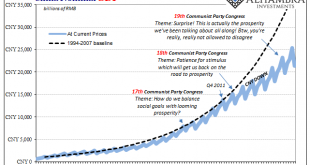

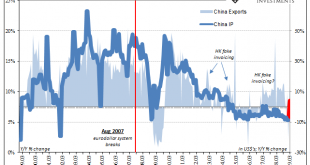

Read More »The Eurodollar, Unfortunately, Is What Is Rebalancing China’s Services Economy

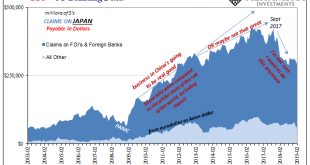

If the “equation” CNY DOWN = BAD is valid, and it is, then what drives CNY downward in the first place? In conventional Economics, authorities command the currency to affect the level of exports. In reality, that’s not at all how it works. The eurodollar system of shadow money is almost purely calculated risk versus return. Before August 2007, everywhere there was believed (far) more return than risk. It’s the nature...

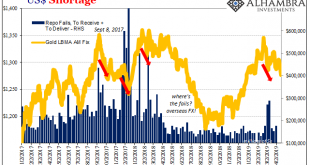

Read More »COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge. Corroboration and consistency are paramount. Gold had been...

Read More »China’s Blowout IP, Frugal Stimulus, and Sinking Capex

It had been 55 months, nearly five years since China’s vast and troubled industrial sector had seen growth better than 8%. Not since the first sparks of the rising dollar, Euro$ #3’s worst, had Industrial Production been better than that mark. What used to be a floor had seemingly become an unbreakable ceiling over this past half a decade. According to Chinese estimates, IP in March 2019 was 8.5% more than it was in...

Read More »Green Shoot or Domestic Stall?

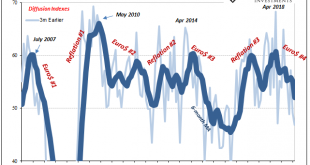

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it...

Read More »Coloring One Green Shoot

China’s Passenger Car Association reported last week that retail sales of various vehicles totaled 1.78 million units in March 2019. The total was 12% less than the number of automobiles sold in March 2018. This matches the government’s data, both sets very clear as to when Chinese economic struggles accelerated: May 2018. For decades, there was just one way for China’s car market: up. Once the trend abruptly reversed...

Read More »Why 2011

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing. What was going on in the shadows wasn’t...

Read More »Monthly Macro Chart Review: April 2019

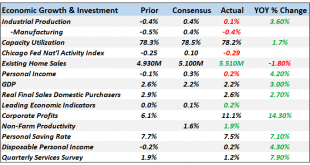

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed. On a more positive note, housing seems to have found its footing with lower rates and employment is still fairly robust....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org