The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely. Demand for foreign exchange outstripped that for yuan for the 26th month in a row, with customers purchasing a net 27.6 billion yuan (.2 billion) of overseas currency in August, according to data released by the State Administration of Foreign Exchange on Monday. While the figure was the smallest in a year, it caught market watchers off guard because they

Topics:

Jeffrey P. Snider considers the following as important: $CNY, China, currencies, Dollar, economy, EuroDollar, eurodollar system, Featured, Federal Reserve/Monetary Policy, Liquidity, Markets, newslettersent, PBOC, RMB

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely.

Demand for foreign exchange outstripped that for yuan for the 26th month in a row, with customers purchasing a net 27.6 billion yuan ($4.2 billion) of overseas currency in August, according to data released by the State Administration of Foreign Exchange on Monday. While the figure was the smallest in a year, it caught market watchers off guard because they had used the yuan’s surge last month to predict a turnaround.

“The deficit was surprising amid the reversal of yuan depreciation expectations,” said Ken Cheung, a senior currency strategist at Mizuho Bank Ltd. in Hong Kong. “It takes time for confidence to be restored. It may take longer for China to see a surplus — it may not happen until the end of this year.”

It isn’t so much the buying and selling of dollars but the borrowing and unborrowing of them. The further you travel into the bowels and recesses of the wholesale system, it is more the case deeper down underneath what can be seen even in these fleeting instances of hard data.

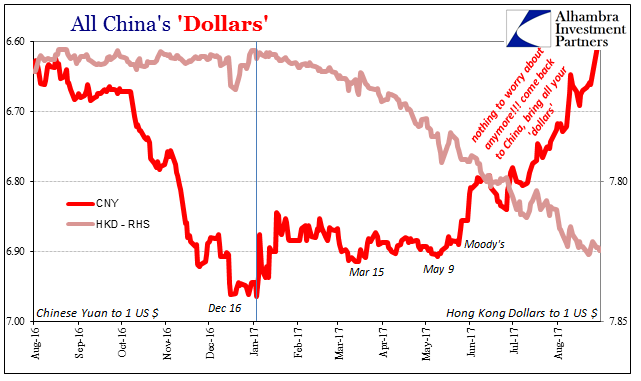

| Economists and commentators are surprised that CNY’s surge wasn’t as much as it appeared to be. We are not. The sharp rise in CNY against the dollar was immediately recognizable for what it was, artificial PBOC policy through whatever secondary channels. But because orthodox economics dominates the media perspective, a market price is believed to be the market price cleared exclusively by market dynamics.

Central banks tend to be so ham-fisted. In this case, it was almost too obvious, starting with the starting point for the move in the aftermath of the Moody’s downgrade. The PBOC changed the rules for the floating currency band so that this would be the inevitable result. And that was surely just the start for what the central bank might have been up to. |

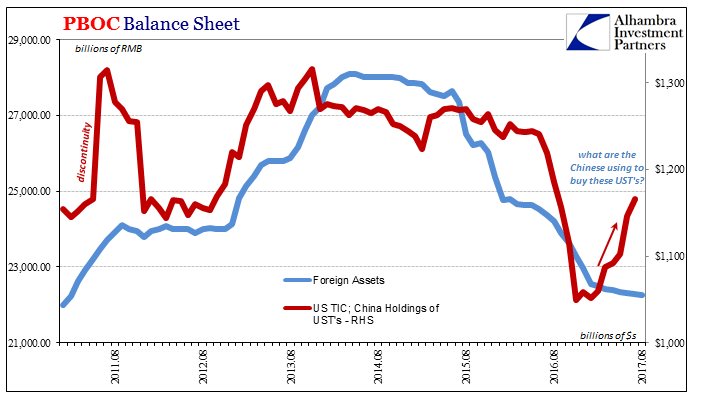

PBOC Balance Sheet, Aug 2010 - 2017 |

Their reasons have become equally obvious in that China government policy has abandoned the tactical programs of the past few years in favor of now a currency policy and extreme focus. The strategic goal remains the same: economic growth. As I wrote yesterday in describing all this in PBOC balance sheet terms:

Small wonder they turned to this approach. The media and mainstream bought it hook, line, and sinker, just as China’s central bank tacticians knew they would. What’s left of figure out, and ultimately what may matter the most, is what this cost them to achieve. The word “Pyrrhic” immediately springs to mind. |

China's Dollars, Aug 2016 - Sep 2017 |

Tags: $CNY,China,currencies,dollar,economy,EuroDollar,eurodollar system,Featured,Federal Reserve/Monetary Policy,Liquidity,Markets,newslettersent,PBOC,RMB