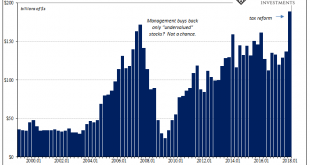

When it comes to the stock market and the corporate cash flow condition, our attention is usually drawn to stock repurchases. With good reason. These controversial uses of scarce internal funds are traditionally argued along the lines of management teams identifying and correcting undervalued shares. History shows, conclusively, that hasn’t really been true. Last year’s tax reform law was meant ideally to spur...

Read More »China’s Seven Years Disinflation

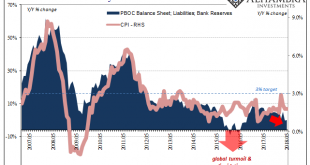

In early 2011, Chinese consumer prices were soaring. Despite an official government mandate for 3% CPI growth, the country’s main price measure started out the year close to 5% and by June was moving toward 7%. It seemed fitting for the time, no matter how uncomfortable it made PBOC officials. China was going to be growing rapidly even if the rest of the world couldn’t. Back then, Western Economists were concerned...

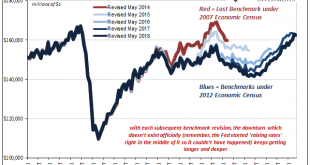

Read More »Revisiting The Revised Revisions

I missed durable goods last month for scheduling reasons, which was a shame given that May is the month each year for benchmark revisions to the series. Since new estimates under the latest revisions were released today, it seems an appropriate time to revisit the topic of data bias, and why that matters. What happens with durable goods (or any data for that matter, the process is largely the same) is that the Census...

Read More »There Isn’t Supposed To Be The Two Directions of IP

US Industrial Production dipped in May 2018. It was the first monthly drop since January. Year-over-year, IP was up just 3.5% from May 2017, down from 3.6% in each of prior three months. The reason for the soft spot was that American industry is being pulled in different directions by the two most important sectors: crude oil and autos. In the middle is the middling performance of manufacturing especially for consumer...

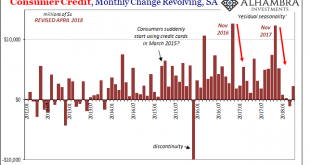

Read More »Recent Concerning Consumer Credit Trends Carry On Into April

US consumers continue to recover from their debt splurge at the end of last year. Combined with still weaker income growth, the Federal Reserve estimates that aggregate revolving credit balances grew only marginally for the fourth straight month in April 2018. To put it in perspective, the total for revolving credit (seasonally adjusted) is up a mere $2.2 billion for all four months of this year combined, compared to...

Read More »Chinese Inflation And Money Contributions To EM’s

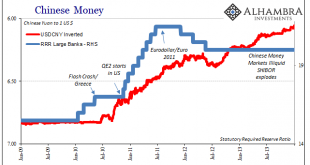

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen. Authorities are not simply contracting one important form of...

Read More »A Slight Hint Of A 2011 Feel

Whenever a big bank is rumored to be in unexpected merger talks, that’s always a good sign, right? The name Deutsche Bank keeps popping up as it has for several years now, this is merely representative of what’s wrong inside of a global system that can’t ever get fixed. In this one case, we have a couple of perpetuated conventional myths colliding into what is still potentially grave misfortune. As noted last time, I...

Read More »Brent’s Back In A Big Way, Still ‘Something’ Missing

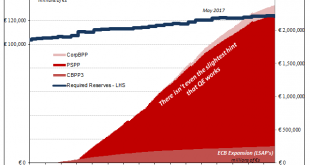

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status. Later on, governments...

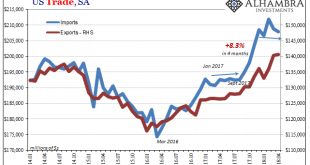

Read More »US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods. Since December,...

Read More »Bi-Weekly Economic Review: As Good As It Gets?

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not. 10 year yields fell nearly 40 basis points in a matter of days as did TIPS yields. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org