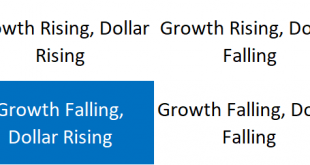

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around. Or at least that’s how it’s remembered. Whether the cigar-chomping central banker was really...

Read More »Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past...

Read More »Weekly Market Pulse: A Very Contrarian View

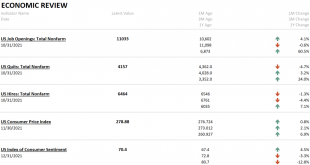

What is the consensus about the economy today? Will 2022 growth be better or worse than 2021? Actually, that probably isn’t the right question because the economy slowed significantly in the second half of 2021. The real question is whether growth will improve from that reduced pace. The Atlanta Fed GDPNow tracker now has Q4 growth all the way down to 5% from the 6.8% rate expected just a week ago (a result of a less than expected retail sales report). That’s still a...

Read More »Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More Inflation is Soaring.. America’s Inflation Burst This morning on Face The Nation, Mohamed El-Erian, former Harvard endowment manager, former bond king apprentice, economist and the man who seems to have a permanent presence on CNBC, had this to say: The characterization of inflation as transitory...

Read More »Weekly Market Pulse: Growth Scare?

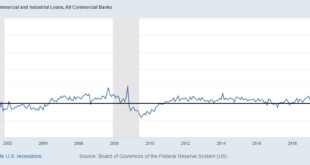

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved. I wrote nearly 2000 words last week about that change in inflation expectations and I’m so glad you took the time to read it. And now you can forget it because over the next four days all but 2 basis points of the move in the...

Read More »Weekly Market Pulse: Inflation Scare!

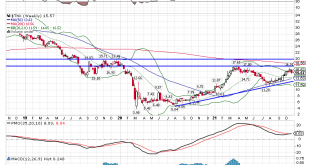

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year. Or are we? Well, yes, the 10 year is back where it was but that doesn’t mean everything else is and, as you’ve probably...

Read More »Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it. When nominal rates fell from April through July, real rates fell right along with them. The nominal bond yield fell by 63 basis points and the 10 year TIPS yield fell by 57....

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »Weekly Market Pulse: What Is Today’s New Normal?

Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be: “a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the economy; in which the...

Read More »Weekly Market Pulse: Buy The Dip, If You Can

[unable to retrieve full-text content]If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org