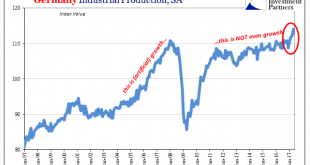

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year. The move was considered by many if not most in the mainstream a prime example of Mario Draghi’s...

Read More »Cool Video: Dollar Drivers on Bloomberg

I had the privilege to be at Bloomberg today and discussed with Vonnie Quin and Mark Barton. A clip to the Cool Video can be found here. There were three talking points. First was the observation that while the President took credit for the record stock market, the strength of the economy, the low unemployment rate, and business confidence, there was no mention of the dollar, which poised to close lower for its seventh...

Read More »FX Daily, July 17: Markets Mark Time, Dollar Consolidates Losses

Swiss Franc The Euro has fallen by 0.05% to 1.1028 CHF. EUR/CHF - Euro Swiss Franc, July 17(see more posts on EUR/CHF, ) - Click to enlarge FX Rates After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major...

Read More »“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

Authored by Kevin Muir via The Macro Tourist blog, After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side,...

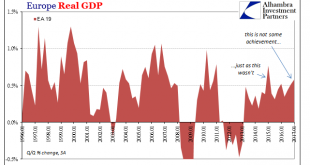

Read More »Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

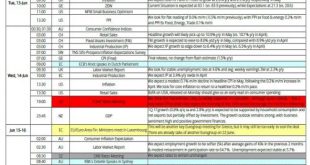

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »Merkel Sends Euro Higher

Summary: Markel said the euro was too weak, so it rallied. This is not a new position for Germany. Merkel may now tack to the left since the AfD appears to have been dispatched. Look for Weidmann to begin moderating views or becoming less antagonistic. The interruption of last week’s steady negative news stream from the US saw the dollar consolidate its recent losses. German Chancellor Merkel’s comments...

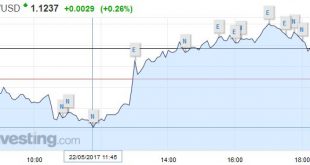

Read More »Euro Drivers

Summary: Correlation between the change in the US-German two-year differential and euro remains robust. The German two-year yield has jumped in recent weeks but looks poised to slip back lower. US two-year yield has eased but is knocking on 1.30%, an important level. There is one variable that explains the euro movement better than any other single variable we have found. The US-Germany two-year interest...

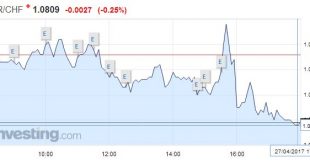

Read More »FX Daily, April 27: Several Developments ahead of the ECB meeting

Swiss Franc EUR/CHF - Euro Swiss Franc, April 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday. Also, after a misdirection over pulling out of...

Read More »Draghi Does Nothing and Talks about It

Summary: Draghi confirms rate on hold and maintains easing bias. Growth risks are becoming more balanced. Inflation has yet to get on a sustained upward path. As widely expected, the ECB left its key rates and asset purchase plan intact. It reiterated its forward guidance that rates will remain at present levels or lower. Draghi was more confident about the economy, suggesting that the downside risks had...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org