Authored by Kevin Muir via The Macro Tourist blog, After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side, and then abandon the trade right before it goes parabolic. - Click to enlarge But when I examine the current environment, I worry the credit expansion wave that has been dragging stocks higher is about to crest. Before I go into my reasons for switching sides, let’s take a

Topics:

Kevin Muir considers the following as important: 10 Year Treasury, Bank of Japan, Bond, Business, Central Bank, Citibank, Congress, Dutch Financial Revolution, ECB, Economic history of the Netherlands, economy, Economy of the European Union, Featured, Federal Reserve, Federal Reserve system, Financial services, FOMC, Japan, Market Crash, Monetary Policy, Money, Musical Chairs, newslettersent, Real-time gross settlement, SNB, Swiss National Bank, Target2, US Federal Reserve, Volatility, Zerohedge on SNB

This could be interesting, too:

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

Authored by Kevin Muir via The Macro Tourist blog,

| After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side, and then abandon the trade right before it goes parabolic. | |

| But when I examine the current environment, I worry the credit expansion wave that has been dragging stocks higher is about to crest. Before I go into my reasons for switching sides, let’s take a moment to remember how we got here.

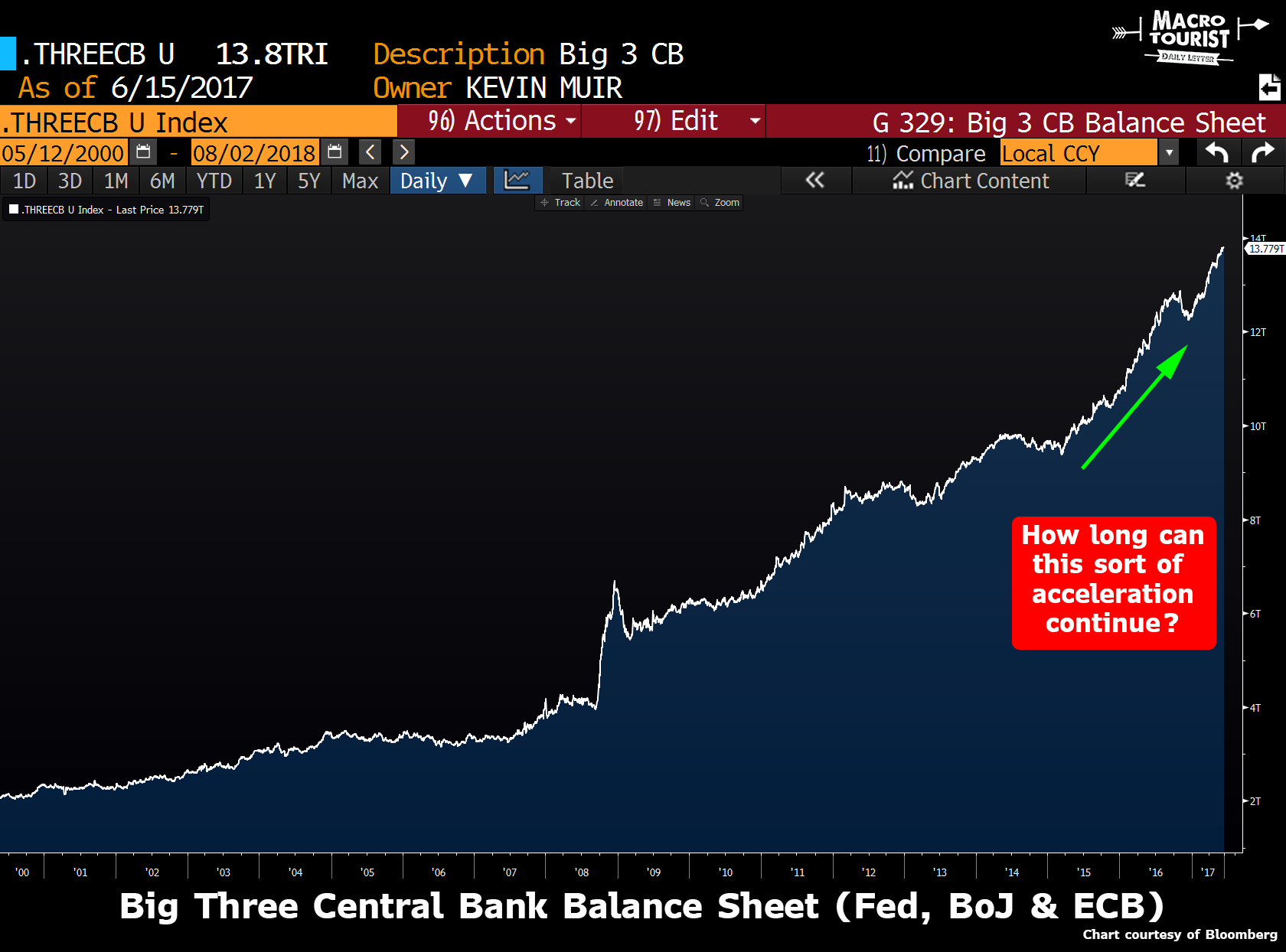

I’ve been bullish for a while. Not because I thought things were well in the world. No, I was bullish for almost the opposite reason. As I stared at the massive expansion in the ECB, Bank of Japan and Swiss National Bank’s balance sheets, I thought there was no point in standing in front of the monetary expansion freight train. The amount of printing by these banks was truly staggering. We have become somewhat numb to these sorts of numbers, but a combined $14.5 trillion dollar Central Bank balance sheet is Johnny Depp crazy. For a while we had the perfect storm of good news. A new American President who promised tax cuts, deregulation and fiscal infrastructure spending. The ECB and the Bank of Japan were filling blue tickets as fast as their clerks received fills. The Federal Reserve was tightening, but they had not yet pulled out any pink tickets for their inventory, and it appeared the US economy would be able to weather slightly higher rates. |

SPX, 2015 - 2017 |

| Stocks exploded higher. Even with some very accomplished hedge fund veterans preaching caution, the price just kept rallying in their face. The more bearish they got, the more it rallied. |

Big Three Central Bank Balance Sheet , 2000 - 2017 |

| But over the past few months, slowly the story broke down. The President, once revered by Wall Street, failed to pass his health reform legislation, which pushed the tax cuts further into the future. Shortly thereafter it became obvious the much salivated infrastructure stimulus would also be difficult to pass through Congress. Almost overnight, the President become more of a liability for US equities than an elixir. |

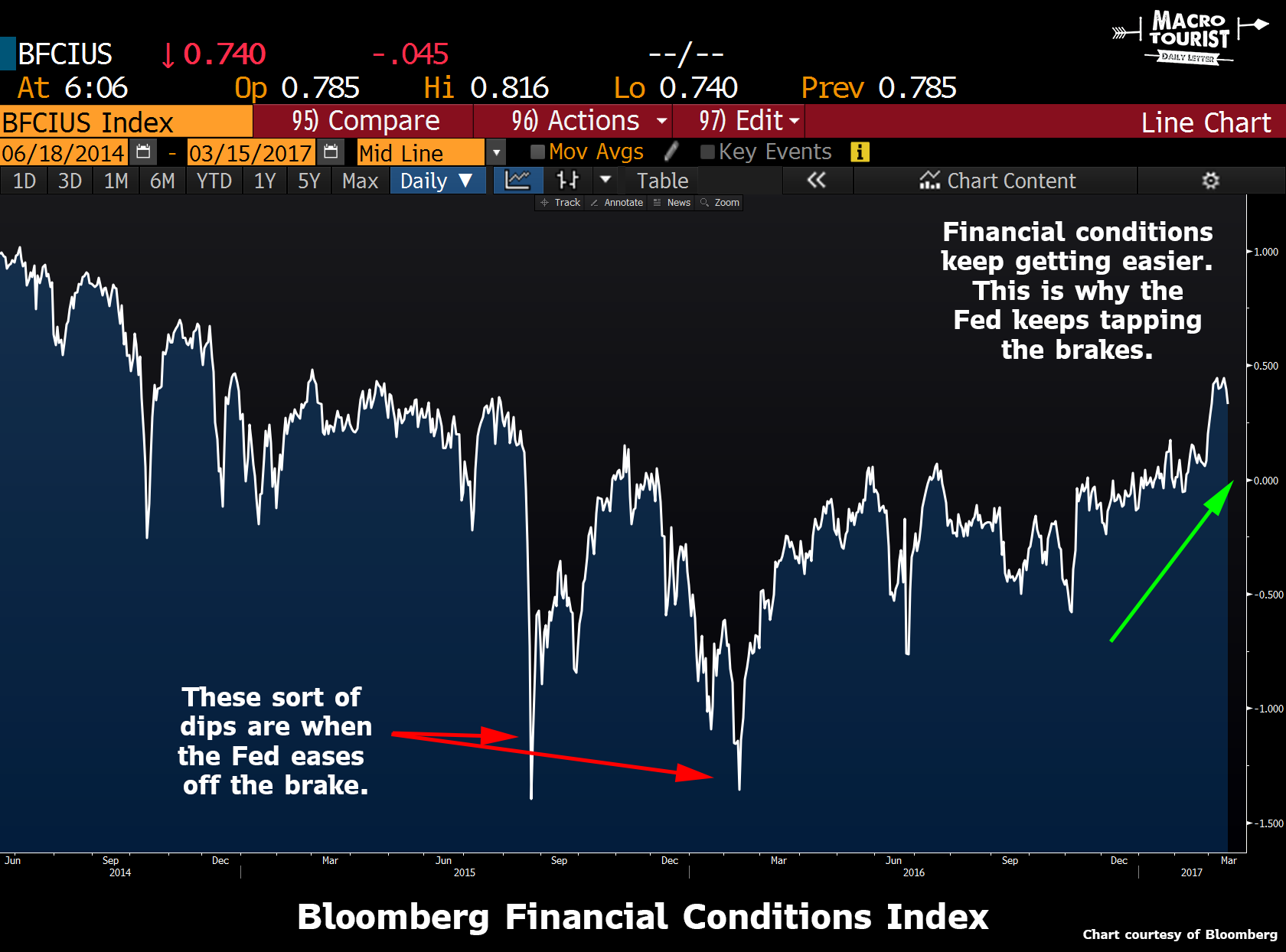

Financial Conditions, June 2014 - June 2017 |

| Yet stocks kept rising. Even in the face of troubling political news from President Trump, US stocks pushed to new highs. Almost makes you think the rally had nothing to do with Trump in the first place. |

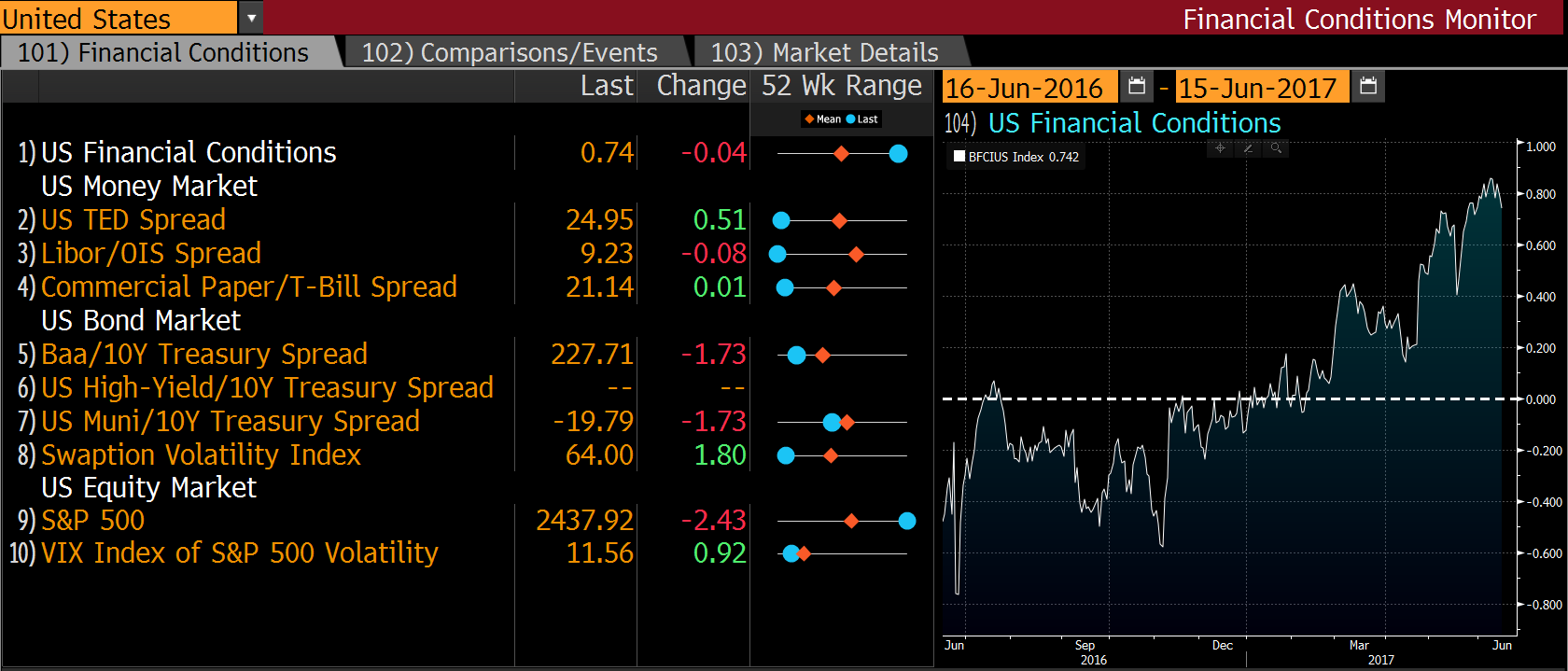

Conditions, June 2016 - June 2017 |

| And maybe it didn’t. Maybe it is as simple as the ECB and Bank of Japan’s batshit crazy money printing overwhelming the financial markets. |

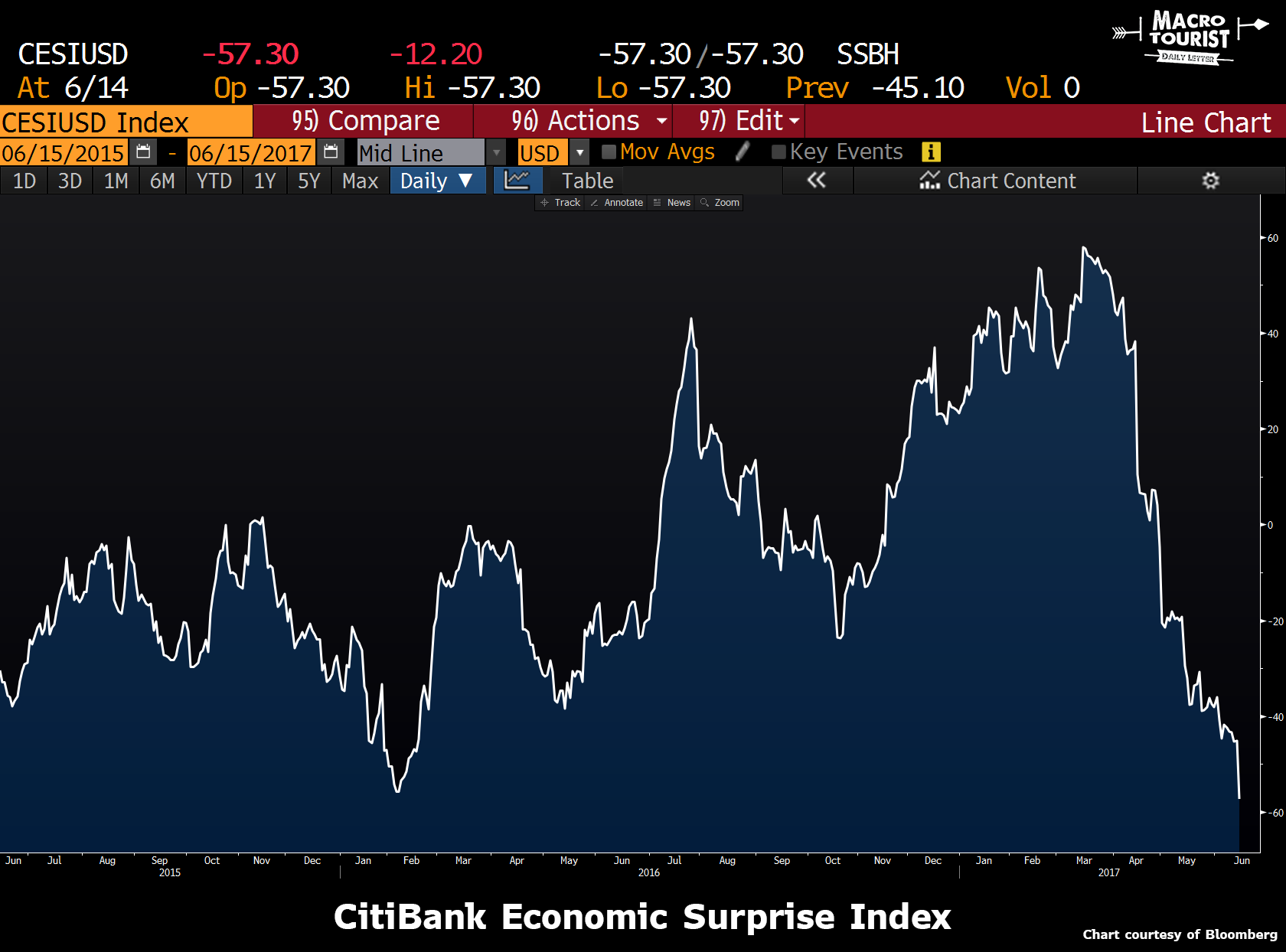

CitiBank Economic Surprise Index, 2015 - 2017 |

| Look at the chart of the combined balance sheet for the Fed, BoJ and ECB closely. The acceleration is mind boggling. You don’t throw that sort of liquidity into the global financial system and not expect it to have an effect. It’s actually surprising that stocks didn’t run even farther.

Yet stock markets are forward discounting mechanisms. Although the ECB has not yet signaled a taper, the writing is on the wall. Like a child playing musical chairs, markets are eyeing the exit with a worrisome determination. Everyone knows the next move for the ECB is to reduce stimulus, it’s only a question of timing. As for the Bank of Japan, even crazy Kuroda is putting out feelers for the slowing down of stimulus. The rate of balance sheet expansion for the ECB and BoJ has peaked for the time being. |

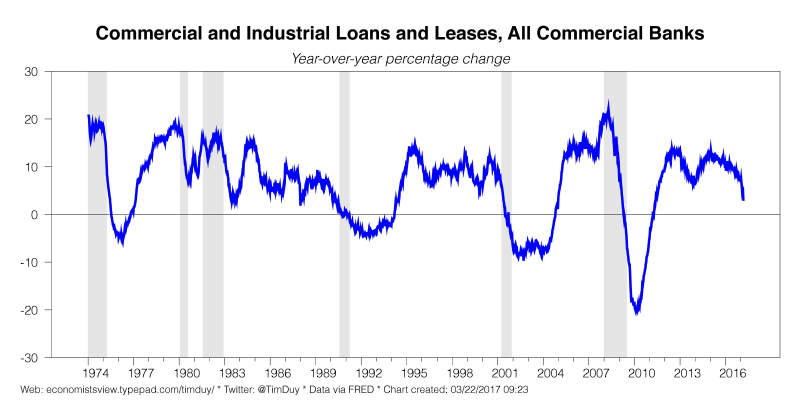

Commercial and Industrial Loans, 1974 - 2017, 1974 - 2017 |

| This might be enough on its own to cause stocks to pause. But when you combine it with Fed policy, it becomes clear that the punch bowl has been removed, and it’s time to go home.

When I wrote my piece yesterday about Yellen being more of a hawk than the common narrative suggested, Sam Gruen from Lightfield Capital messaged me to say that although the Federal Reserve has a dual mandate, some FOMC members have adopted an unofficial third mandate – financial conditions. Here is Sam explaining it in his own words:

If you don’t follow Sam, then you should get right on it. Although I intuitively realized the Fed was more apt to ease when markets were in turmoil, I didn’t put together that the opposite was also true. The Fed was more likely to tighten when financial conditions were easy. |

US 2/10 Year Treasury Yield Curve Spread, 2015 - 2017 |

| Have a look at the chart of financial conditions over the past few years:

When financial conditions plummet, the Fed eases up on the brakes. And when financial conditions accelerate, the Fed presses down harder. But what are financial conditions? Here is a screen shot of what goes into the Bloomberg calculation. It’s a combination of credit spreads, stock prices and volatility measures. Basically, all the things that are positive correlated to the stock market. So when the critics complain about the Fed supporting the stock market in moments of weakness, they have a point. Yet they are missing the fact that the Fed is also targeting the stocks when they rise. I have become convinced the Fed will continue to tighten and wind down their balance sheet until financial conditions retreat. In the meantime, the US economy is rolling over. The Citibank Economic surprise index keeps hitting new lows: And credit growth is collapsing. Here is a terrific chart from Tim Duy: And the bond market is screaming that the economy is about to slow down. The US 2/10 year Treasury spread is below 80 bps. Inflation breakevens are plummeting. |

US 5 Year Breakevens, 2015 - 2017 |

| There are a million other little signs the US economy is rolling over, but that’s not important. What is important is the realization that until financial conditions back up, the Fed will not ease off the brake.

To top it all off, the Fed is not only braking, but they are also preparing the market for a balance sheet unwind. This is like QE in reverse. It’s a perfect storm of negativity. An overly tight Fed that is determined to withdraw monetary stimulus even in the face of a declining economy. There are a bunch of different trades that will arise from these developments, but at the end of the day, the Fed will keep removing stimulus until financial conditions retreat. Why fight them? Given the fact that the ECB and BoJ are more likely to also slow down their stimulus rather than increase, global liquidity will be going down in the coming months. Stocks have a tough time rising without liquidity. I am shorting US stocks with the idea of covering them into a retreat of financial conditions that forces the Fed to change their tune. I have been waiting for quite a while to rejoin the dark side, I think it’s finally time. |

Tags: 10 year treasury,Bank of Japan,Bond,Business,Central Bank,Citibank,Congress,Dutch Financial Revolution,ECB,Economic history of the Netherlands,economy,Economy of the European Union,Featured,Federal Reserve,Federal Reserve System,Financial services,FOMC,Japan,Market Crash,Monetary Policy,money,Musical Chairs,newslettersent,Real-time gross settlement,Swiss National Bank,Target2,US Federal Reserve,Volatility