Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

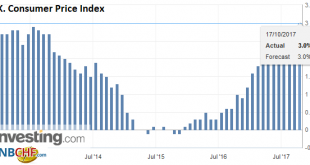

Read More »Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months...

Read More »Central Bank Chiefs and Currencies

Summary: Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election. The market is fickle. It has jumped from one candidate to another as the most likely Fed Chair. Until his belated and mild criticism of the President dealing with race issues,...

Read More »Brief Thoughts on the Euro

Summary: Euro peaked a month ago. The reversal before the weekend marks the end of the leg lower. ECB meeting is next big focus. ECB may focus on gross rather than net purchases. The euro peaked a month ago near $1.2090. It recorded a low near $1.1670 after the weather-skewed US jobs data seen at the end of last week. The euro recovered from the weekend and set new session highs late US dealings. That...

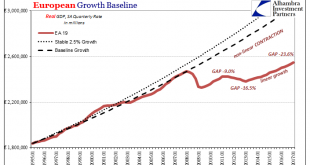

Read More »Eurozone: Distinct Lack of Good Faith

The erosion of social order in any historical or geographic context is gradual; until it isn’t. Germany has always followed a keen sense of this process, having experienced it to every possible extreme between the World Wars. Hyperinflationary collapse doesn’t happen overnight; it took three years for the Weimar mark to disintegrate, and then Weimar Germany. Even Nazism wasn’t all it once. What was required was...

Read More »FX Weekly Preview: Forces of Movement in FX: The Week Ahead

Summary: The dollar has been declining since the start of the year, but the causes have changed. The drag from US politics may be exaggerated, while European and Japanese politics are worrisome. The economic data may continue to be a drag on US yields, especially if core CPI slips again. The US dollar’s sell-off accelerated. It has been selling off since the start of the year. The first phase of the decline at...

Read More »FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

Swiss Franc The Euro has risen by 0.35% to 1.1433 CHF. FX Rates The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that...

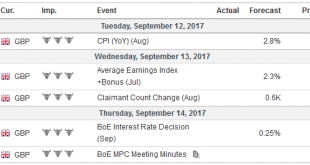

Read More »FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Summary: Following strong Q2 GDP figures, risk is that Bank of Canada’s rate hike anticipated for October is brought forward. ECB’s guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley’s comments are the most important. Four central banks from high income countries hold policy is making...

Read More »Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding. Many investors were looking for policy clues, but these were not forthcoming. The December Fed funds futures contract was unchanged,...

Read More »Markets Exaggerate, That is what They Do

Summary: FOMC minutes were not as dovish as spins suggest. ECB record was not as dovish as market response appears. Divergence is still intact. First, we told you that the FOMC minutes were not as dovish as the dollar and US Treasury yields may have suggested to many observers. Neither timing of the balance sheet adjustment (Sept announcement) or the odds of a rate hike before year-end changed. The dollar and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org