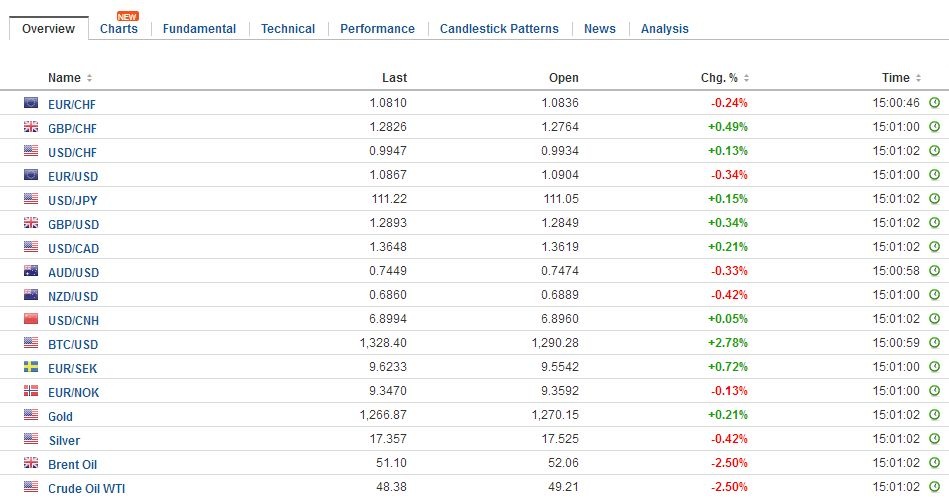

Swiss Franc EUR/CHF - Euro Swiss Franc, April 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday. Also, after a misdirection over pulling out of NAFTA entirely, the US has now signaled its intent to renegotiate the treaty. Global interest rates are mostly firmer, while regional indices for Asia (MSCI Asia-Pacific Index) and Europe (Dow Jones Stoxx 600) are snapping five- and six-day advances respectively. The US dollar is narrowly mixed, mostly trading within yesterday’s ranges. Of note, the Canadian dollar and the Mexican peso are among the strongest currencies today on the US “clarification.” FX Daily Rates, April 27 - Click to enlarge The Swedish krona is the weakest of the majors, losing almost 1% against both the dollar and euro. The Riksbank surprised the market. It announced an SEK15 bln increase in its bond purchases while keeping the deposit rate at minus 50 bp. It also seemed to push back its first hike to mid-2018 from late this year.

Topics:

Marc Chandler considers the following as important: Bank of Japan, ECB, EUR/CHF, Eurozone Consumer Confidence, Featured, FX Daily, FX Trends, Germany Consumer Price Index, Germany GfK Consumer Climate, NAFTA, newsletter, Riksbank, Spain Consumer Price Index, Spain Unemployment Rate, Taxes, U.S. Initial Jobless Claims, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, April 27(see more posts on EUR/CHF, ) |

FX RatesThe ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday. Also, after a misdirection over pulling out of NAFTA entirely, the US has now signaled its intent to renegotiate the treaty. Global interest rates are mostly firmer, while regional indices for Asia (MSCI Asia-Pacific Index) and Europe (Dow Jones Stoxx 600) are snapping five- and six-day advances respectively. The US dollar is narrowly mixed, mostly trading within yesterday’s ranges. Of note, the Canadian dollar and the Mexican peso are among the strongest currencies today on the US “clarification.” |

FX Daily Rates, April 27 |

| The Swedish krona is the weakest of the majors, losing almost 1% against both the dollar and euro. The Riksbank surprised the market. It announced an SEK15 bln increase in its bond purchases while keeping the deposit rate at minus 50 bp. It also seemed to push back its first hike to mid-2018 from late this year. The Riksbank board was split 3-3, meaning that Governor Ingves cast the deciding vote. Swedish bonds have also reacted to the surprise, and the 10-year yield is off nearly four basis points at 0.60%. The euro is approaching last week’s high near SEK9.67, which corresponds to the 38.2% retracement of the euro’s decline since the US election. The 50% retracement is closer to SEK9.75.

Lastly, we note that sterling is breaking out to the upside. It is the strongest of the majors, rising nearly 0.5% to new highs since last October. It had been consolidating by straddling the $1.28 area since rallying on May’s surprise election call. I reached almost $1.2920 today. While $1.30 is the next psychological level, note that the $1.3055 area corresponds to a 38.2% retracement of the fall from last year’s high near $1.50. |

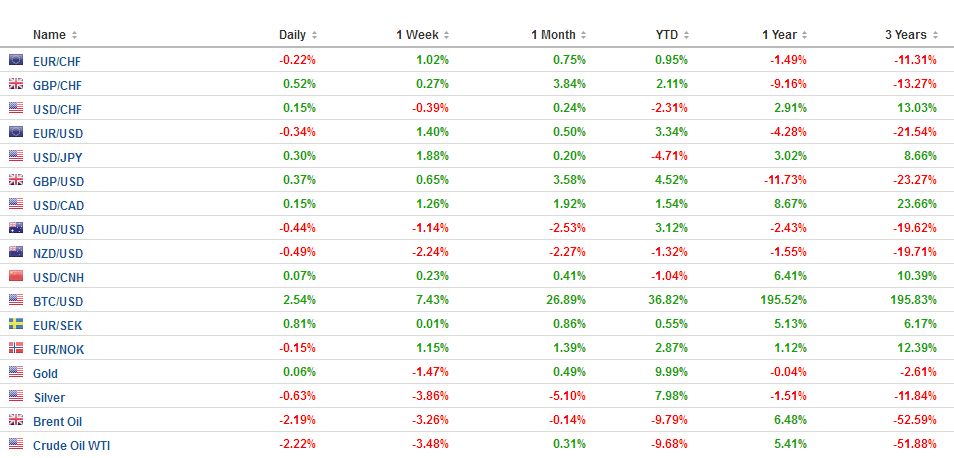

FX Performance, April 27 |

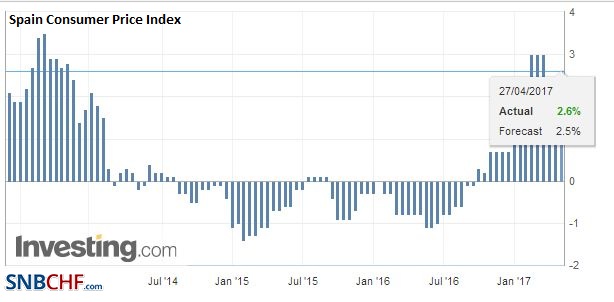

SpainEarlier today Spain reported a larger than expected increase in April CPI (0.9% vs. 0.7% median forecast in the Bloomberg survey), lifting the year-over-year rate to 2.6% from 2.1%. |

Spain Consumer Price Index (CPI) YoY, March 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

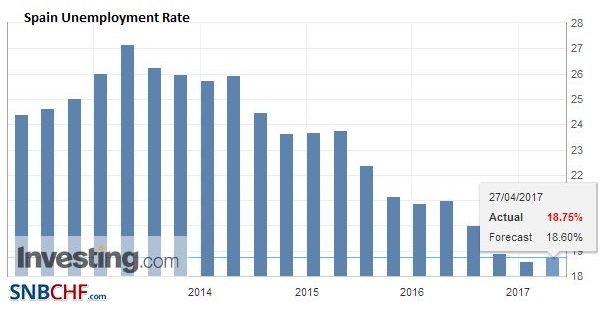

Spain Unemployment Rate, Q1 2017(see more posts on Spain Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

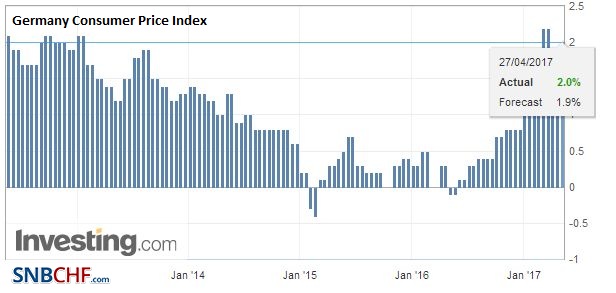

GermanyGerman states reported small month-over-month changes, but due to the base effect, the year-over-year rates rose, and the rise is that the preliminary national report snaps back to 2.0% from 1.5% in March. It had reached 2.2% in February. |

Germany Consumer Price Index (CPI) YoY, March 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

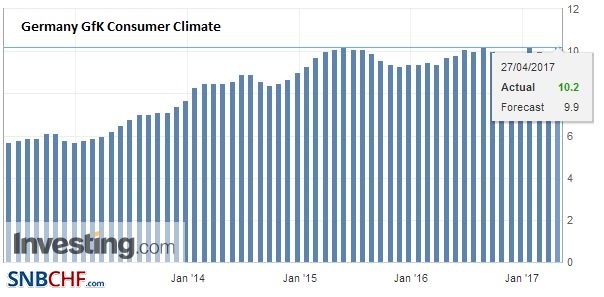

Germany GfK Consumer Climate, March 2017(see more posts on Germany GfK Consumer Climate, ) Source: Investing.com - Click to enlarge |

|

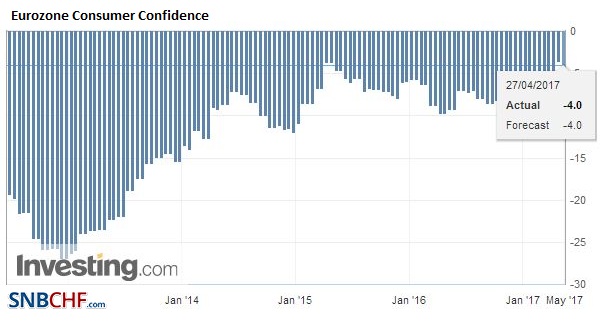

EurozoneThe ECB is most likely to stand pat, and Draghi is likely to reiterate the consensus judgment that while the growth prospects have improved (based mostly on survey data), prices have yet to find sustainable and independent (of the unorthodox monetary policy) path higher. The preliminary estimate of April CPI will be released tomorrow. It is expected to have risen in April after a soft March report. The Easter holiday may have distorted these readings. At the end of last week, Draghi said rates would remain at present or lower levels. There are no reasons not to expect him to repeat this forward guidance. If he does not, it would be seen as a bullish sign for the euro. He also characterized the risks to be improving but still on the downside. There is not a compelling reason to change this assessment. New staff forecasts are available in June, and this seems to be the window that “sources” seemed to note who earlier this week suggested a change in guidance was possible then. On a technical point, the Bundesbank purchases of short-term paper under the Eurosystem’s program may have exacerbated a shortage, which in turn stresses the repo market. Since the ECB’s program began, it indicated it would lend some of the securities back to the banks. However, the conditions and costs are still not as user-friendly as they might be, and it is possible that the ECB adjusts the program again. |

Eurozone Consumer Confidence, March 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

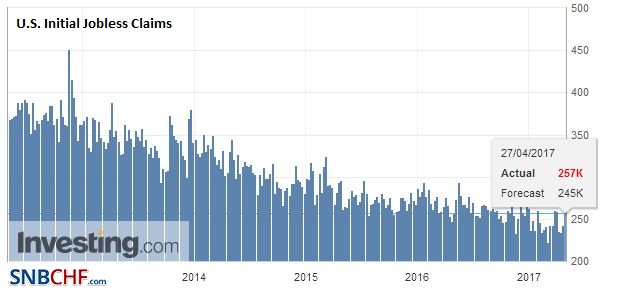

United StatesPresident Trump’s budget proposal was a single page consisting of less than 250 words. The broad strokes were very much in line with some of the suggestions during the campaign. It was very light on details, and this seems to be deterring assessment of the fiscal impact. During the campaign, the Committee for Responsible Federal Budget anticipated it would produce a shortfall of $3 trillion in five years and $7 trillion over 10-years. The budget proposal contained only one revenue increase, and that was the eliminated of the deduction for state taxes. This could raise as much as $1.5 trillion for the Federal government and would be the most felt by three states that Trump did not carry (California, New York, and New Jersey). We suggest that it may be most politically realistic to see the proposal as the broad initial negotiating position, not as anything close to its final shape. If we had to characterize the markets’ response, we’d say “unimpressed.” |

U.S. Initial Jobless Claims, March 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

Japan

The Bank of Japan’s decision to keep policy steady was decided by a 7-2 majority. The two dissenters will be replaced by officials who are more sympathetic to Kuroda when their terms expire in July. The BOJ upgraded its assessment of the economy, suggesting a moderate expansion is underway, helped by exports which are in a recovery trend. It left its JGB purchases at JPY80 trillion, even though in the last 12 months, it has purchased a net JPY74 bln. It lifted its GDP forecast for the fiscal year to 1.6% from 1.5% and FY18 to 1.3% from 1.1%. It introduced an FY19 forecast of 0.7%, due to anticipated retail sales tax increase and the larger capex cycle.

The BOJ still seems (unreasonably) optimistic on inflation. It lowered its 1.5% forecast to 1.4% this year. It left the FY18 forecast unchanged at 1.7%. The initial forecast for FY19 is 1.9%.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Japan,ECB,EUR/CHF,Eurozone Consumer Confidence,Featured,FX Daily,Germany Consumer Price Index,Germany GfK Consumer Climate,NAFTA,newsletter,Riksbank,Spain Consumer Price Index,Spain Unemployment Rate,Taxes,U.S. Initial Jobless Claims