Swiss Franc EURCHF - Euro Swiss Franc, April 26(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Last week Theresa May called a snap General election due to take place on 8th June. Historically a snap election has caused the currency in question to weaken, however on this occasion Sterling strengthened. It was a shrewd move by May to call an election while the competition is so weak. A conservative...

Read More »Ultra-Loose Terminology, Not Policy

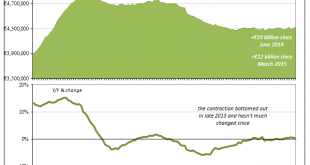

As world “leaders” gathered in Davos in January 2016, they did so among financial turmoil that was creating more economic havoc than at any time since the Great “Recession.” Having seen especially US QE as the equivalent of money printing, their focus was drawn elsewhere to at least attempt an explanation for the contradiction. They initially settled on the Fed’s rate hike, where terminating “ultra-loose” policies was...

Read More »Consensus Inflation (Again)

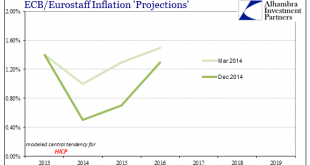

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January...

Read More »FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it...

Read More »The Power of Oil

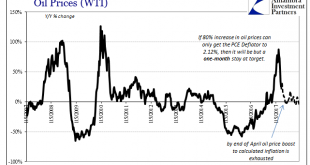

For the first time in 57 months, a span of nearly five years, the Fed’s preferred metric for US consumer price inflation reached the central bank’s explicit 2% target level. The PCE Deflator index was 2.12% higher in February 2017 than February 2016. Though rhetoric surrounding this result is often heated, the actual indicated inflation is decidedly not despite breaking above for once. In many ways 2.12% is hugely...

Read More »FX Daily, March 17: Dollar Remains Heavy

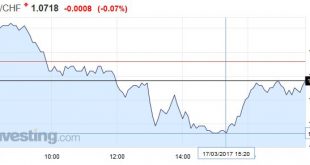

Swiss Franc EUR/CHF - Euro Swiss Franc, March 17(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Article 50 – Invocation Imminent With the House of Commons voting against amendments to the brexit bill, it was passed to the Queen for approval which was really a formality, more a mark of respect to a bygone age. Article 50 is now ready to be invoked at anytime. It is anticipated to be next week. I am of...

Read More »Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

Read More »Patient ECB to wait for underlying inflation to improve

There were no policy changes at today's meeting of the ECB’s governing council (GC). Central bank seems intent on looking through short-term spikes in imported inflation.At today’s press conference following the GC meeting, ECB President Mario Draghi’s message was one of continuity, very much as expected. The stronger momentum in economic activity and headline inflation, he suggested, was no reason to declare victory as long as downside risks remain. Importantly, the ECB’s statement suggests...

Read More »Draghi Lets Steam out of Euro

Summary: US reported stronger than expected series of data, including a large drop in weekly jobless claims for the week of the next NFP survey. Draghi remained dovish, with key phrases retained. Euro needs to break $1.0575 now to confirm a top is in place. Markets still uncertain ahead of the start of the new Administration. The combination of stronger US economy data and a dovish Draghi has seen the US...

Read More »FX Daily, December 08: Dollar Heavy into ECB

Swiss Franc The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer. EUR/CHF - Euro Swiss Franc, December 08(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF rates...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org