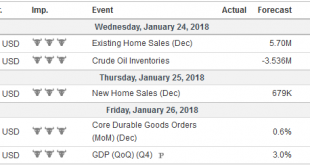

ECB President Draghi was unable to arrest the US dollar’s slide and euro’s surge. But he did not try particularly hard. While many investors are a bit stumped by the pace and magnitude of the dollar’s slump, Draghi seemed to imply that it was perfectly understandable given the recovery of the eurozone economy. The economy is the strongest it has been in more than a decade, but the US is no slouch. The US reports the...

Read More »FX Daily, January 25: And Now, a Word from Draghi

Swiss Franc The Euro has fallen by 0.59% to 1.1656 CHF. EUR/CHF and USD/CHF, January 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates With a backdrop of concern about US protectionism and a possible abandonment of the 23-year old strong dollar policy, and among the weakest sentiment toward the dollar in at least a decade, the ECB takes center stage. What a turn of events...

Read More »FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore. Another weight on...

Read More »FX Daily, January 12: Euro Jumps Higher

Swiss Franc The Euro has risen by 0.45% to 1.1735 CHF. EUR/CHF and USD/CHF, January 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is one main story today and it is the euro’s surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month’s ECB meeting surprised the market with its seeming willingness to change the...

Read More »Cool Video: Bloomberg TV Clip on Central Banks

- Click to enlarge I joined Alix Steel and David Westin on the Bloomberg set earlier today. Click here for the link. In the roughly 2.5 minute clip, we talk about the US and and the monetary cycle in Europe. In the US, Q4 was another quarter of above trend growth. The Atlanta Fed says the economy is tracking 2.7%, while the NY Fed puts it at 4.0%. To my way of thinking about the situation, many observers seem to be...

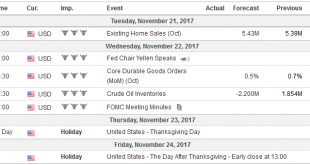

Read More »FX Weekly Preview: FOMC and ECB Highlight Central Banks’ Last Meetings of the Year

No fewer than thirteen central banks meet in the week ahead. The UK and the US report the latest inflation figures, and the US and eurozone report industrial production. The eurozone sees the flash PMI for December, and the Japan’s latest Tankan business survey will be released. Most of the central banks that meet will not be changing policy. Of the major central banks, the Bank of England, which hiked rates last...

Read More »FX Weekly Preview: Another Week that is Not about the Data

The contours of the investment climate are unlikely to change based on next week’s economic data from the US, Japan, or Europe. The state of the major economies continues to be well understood by investors. Growth in the US, EU, and Japan remains solid, and if anything above trend, as the year winds down. The incremental data will likely show that the eurozone economic momentum is intact with the November flash PMI....

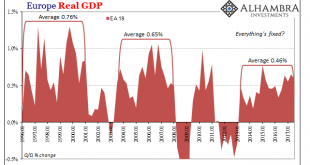

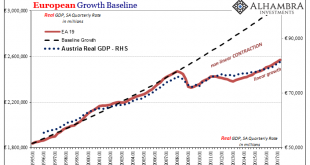

Read More »Europe Is Booming, Except It’s Not

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss. At 0.6%, that doesn’t even equal the average growth rate exhibited from either...

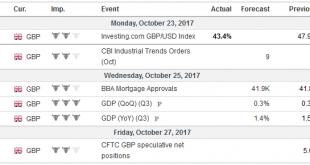

Read More »FX Weekly Preview: Three on a Match: US Tax Reform, ECB and Bank of Canada Meetings

Summary: Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections. Focus below is on the Bank of Canada and ECB meetings and tax reform in the US. The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform. US and German 2-year rates are...

Read More »Distinct Lack of Good Faith, Part ??

It was a busy weekend in retrospect, starting with Janet Yellen and other central bankers uncomfortably facing a global media that has become (for once) increasingly unconvinced. Reporters, really, don’t have much choice. The Federal Reserve Chairman might not be aware of just how much she has used the “transitory” qualifier since 2015, but others can’t be helped from noticing. At the Group of Thirty’s International...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org