We see little incentive for the ECB to precipitate things at the beginning of the year, especially as core inflation continues to disappoint, but there could be hints at “gradual changes” in forward guidance.We expect no policy decision and no major change in the ECB’s communication at its 25 January meeting. There is no incentive for the ECB to fuel further hawkish market re-pricing at this stage, especially after core inflation disappointed again and the EUR has strengthened once more. The only small change we see as possible is the removal of the optionality in terms of the “size” of quantitative easing (QE), not “duration”.Ultimately, the ECB’s forward guidance and policy decisions continue to be driven by core inflation. It could be that more patience is needed before the ECB sees a

Topics:

Frederik Ducrozet considers the following as important: ECB hawkishness, ECB policy normalisation, ECB preview, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We see little incentive for the ECB to precipitate things at the beginning of the year, especially as core inflation continues to disappoint, but there could be hints at “gradual changes” in forward guidance.

We expect no policy decision and no major change in the ECB’s communication at its 25 January meeting. There is no incentive for the ECB to fuel further hawkish market re-pricing at this stage, especially after core inflation disappointed again and the EUR has strengthened once more. The only small change we see as possible is the removal of the optionality in terms of the “size” of quantitative easing (QE), not “duration”.

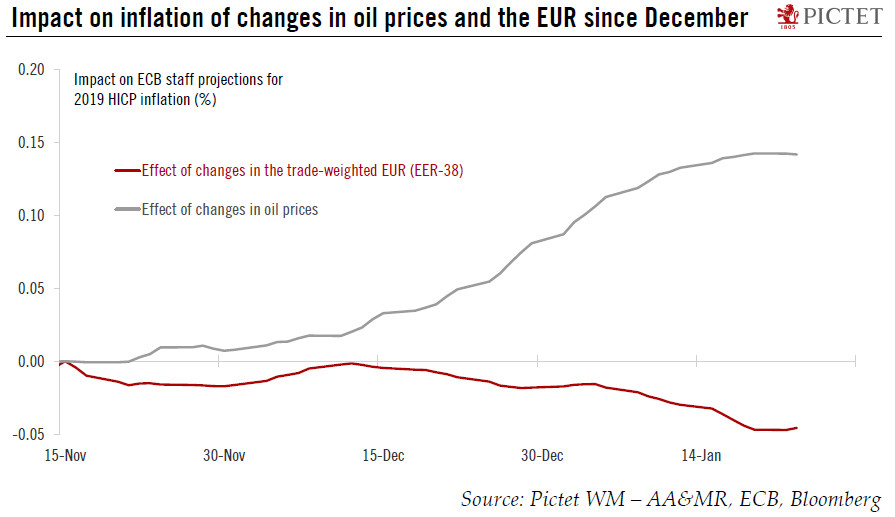

Ultimately, the ECB’s forward guidance and policy decisions continue to be driven by core inflation. It could be that more patience is needed before the ECB sees a “sustained adjustment” in inflation and wages. We see risks tilted towards a more cautious ECB in the very near term due to subdued core inflation and the stronger EUR.

However, once the Italian elections (4 March) are out of the way, and assuming even a modest rebound in core inflation, the ECB will likely shift more rapidly towards a neutral policy stance. Our impression is that not only are the hawks growing impatient, but a broader group within the Governing Council sees further adjustments to the ECB’s forward guidance as warranted. In our view, a more hawkish ECB would shift the focus on the pace of rate hikes in 2019 and beyond, once the normalisation process has started.

For the record, our scenario remains for the ECB to terminate QE by early 2019 and to deliver a first rate hike in September 2019 (specifically, a 20bp hike in the deposit facility rate, to -0.20%, in tandem with a 5bp hike in the main refinancing rate, to 0.05%), with risks tilted towards an earlier move.