We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data.Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB will act in 2018, announcing a tapering of its asset purchase programme in the summer, in our view—but not overreacting to strong economic data.In 2018, we expect the ECB to ‘talk the talk’, adjusting its communication as the outlook for inflation improves, but not to ‘walk the walk’, as it sticks with the current exit sequencing, tapering its asset purchases from Q3 2018

Topics:

Frederik Ducrozet considers the following as important: 2018 ECB outlook, ECB asset purchases, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data.

Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB will act in 2018, announcing a tapering of its asset purchase programme in the summer, in our view—but not overreacting to strong economic data.

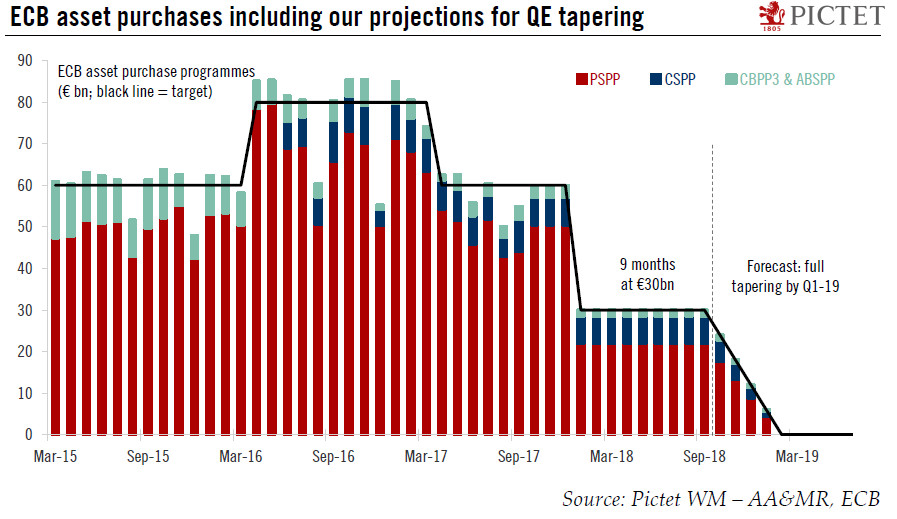

In 2018, we expect the ECB to ‘talk the talk’, adjusting its communication as the outlook for inflation improves, but not to ‘walk the walk’, as it sticks with the current exit sequencing, tapering its asset purchases from Q3 2018 before hiking rates by Q3 2019. Specifically, we expect the ECB to prepare markets in June 2018 for a tapering decision which could be made in July and implemented in Q4 2018 (see Q3).

While turning more hawkish, we expect the ECB to stick with the guiding principles that have shaped its recent decisions. It will be “accompanying” the economic expansion by “recalibrating” all dimensions of its monetary stance. And, of course, it will remain true to its current mantra of “Confidence, Patience, Persistence, Prudence”.

Our baseline scenario remains for the ECB to terminate QE by early 2019 and to deliver a first rate hike in Q3 2019, with risks tilted towards an earlier move.