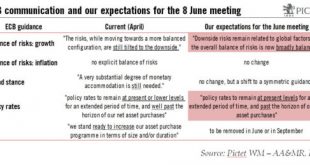

Some high-ranking ECB officials seem open to the idea of raising negative deposit rates before tapering quantitative easing.Recent comments from ECB executive board member Benoît Coeuré have confirmed that the ECB is likely to make further changes to its communication at its 8 June meeting, moving towards a neutral stance despite a likely downward revision to the 2017 inflation staff forecast. Importantly, Coeuré sounded open to further changes to the ECB’s forward guidance, including a...

Read More »ECB preview: less reason to be dovish, but inflation battle not yet over

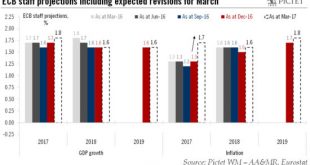

Next week, we expect the ECB to highlight that downside risks to the euro area outlook have diminished further, warranting upward revisions to staff forecasts and a more neutral monetary stance.The latest economic developments are consistent with the ECB turning somewhat more hawkish – or, more accurately, less dovish. Business surveys have improved, pointing to annualised GDP growth of around 2% in Q1. Headline inflation returned to the ECB’s 2% target in February, for the first time in...

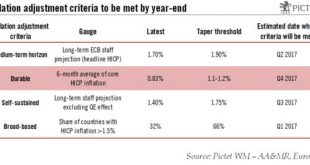

Read More »Inflation and the ECB (part 1): the four criteria

Euro area inflation was well above consensus in January. However, we believe that the ECB will look through this spike in (imported) inflation as underlying price pressures remain subdued.Although euro area headline inflation jumped to 1.8% in January, the closest it has been to ECB’s 2% target since Q1 2013, core inflation remained low at 0.9%. We continue to expect the ECB to wait until September before it announces a tapering of its asset purchases in 2018.A “sustained adjustment in...

Read More »Patient ECB to wait for underlying inflation to improve

There were no policy changes at today's meeting of the ECB’s governing council (GC). Central bank seems intent on looking through short-term spikes in imported inflation.At today’s press conference following the GC meeting, ECB President Mario Draghi’s message was one of continuity, very much as expected. The stronger momentum in economic activity and headline inflation, he suggested, was no reason to declare victory as long as downside risks remain. Importantly, the ECB’s statement suggests...

Read More »Sizing up the changes in ECB’s monetary policy

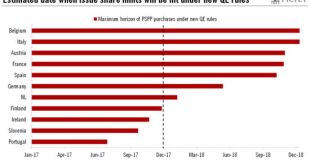

Along with extending its asset-buying programme, the ECB has made a number of changes to the parameters of that programme in a bid to deal with the issue of ‘bond scarcity’. But will it succeed?In December, the ECB made important changes to its quantitative easing (QE) programme, deciding to extend it by at least nine months to December 2017 while scaling down the pace of its asset purchases from EUR80 bn to EUR60 bn from April. The ECB also announced the easing of technical constraints...

Read More »Search for policy flexibility poses dilemma for ECB

Our base forecast is that the ECB will extend QE by six months, but will modify forward guidance.The European Central Bank (ECB) faces a communication dilemma ahead of its 8 December meeting. Amid growing evidence of a more robust recovery and improved policy transmission, there is a case for a reduction in the pace of asset purchases at some point in 2017. However, signalling an eventual tapering of asset purchases now would almost certainly trigger an unwarranted tightening of monetary...

Read More »ECB: rendezvous in December!

Macroview ECB keeps holding pattern, but we expect an extension of bond purchases in December Nothing in today’s ECB press conference challenged our view that quantitative easing (QE) will be extended at the bank’s next policy meeting on 8 December. We continue to expect the bank to use this meeting to announce a six-month extension of its QE programme beyond March 2017, with monthly asset purchases maintained at their current pace of EUR80 bn monthly, resulting in EUR480 bn in extra asset...

Read More »ECB preview — Bank has no shortage of options

Macroview While we expect no concrete action at this week’s policy meeting, we believe extension of QE is coming and bond scarcity issues will be addressed. We do not expect any new action to be announced at the ECB’s policy meeting on Thursday, but we do expect that the ECB will reiterate that the size of its asset-purchase programme and its duration are exclusively a function of the inflation outlook. We also expect that the bank will hammer home the message that it has the flexibility to...

Read More »ECB: tapering is no answer for bond scarcity

Tapering is not an immediate issue for the ECB, which we believe is much more likely to announce an extension of QE and measures to deal with the scarcity of bonds it can purchase. Spokespersons for the ECB have been anxious to beat back a Bloomberg story that the bank was attempting to “build a consensus” around the tapering of its bond purchases, saying the Governing Council (GC) had not even discussed this issue at its last policy meeting in September.The timing of the story is a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org