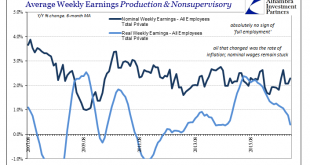

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them. Consumers receive no significant boost to their incomes, but are starting to pay more (in comparative terms) for things...

Read More »A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it. Chairman of the Federal...

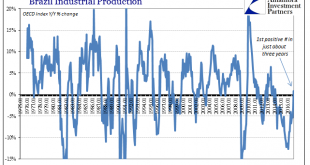

Read More »Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it. Since the Great “Recession”, which was global, no matter what...

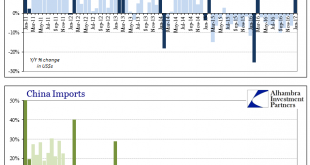

Read More »No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays. Unlike Western holidays that are but a single day, the Golden Week is a week, and therefore when the calendar points do not...

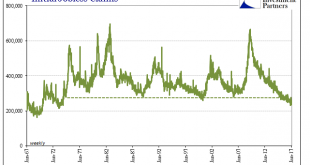

Read More »Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years. Unemployment insurance...

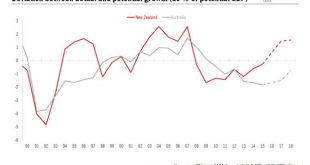

Read More »Currency opportunities emerge Down Under

The difference in macro outlooks means prospects are brightening for the New Zealand dollar against its Australian equivalent.At their February monetary meeting, both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) kept their official cash rates unchanged at 1.50% and 1.75% respectively.However, given our view that New Zealand’s economic fundamentals are better than Australia’s, the temporary weakness of the New Zealand dollar that stemmed from the forward...

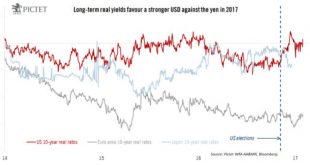

Read More »US dollar looks well supported this year

Given a widening real yield differential, we see the dollar continue to rise, especially against the yen, while further sterling downside looks limited.Our latest forecasts for individual currencies in 2017 can be summarised as follows:US dollar. The USD is likely to remain strong on the back of an improving US growth and inflation outlook as well as continued monetary policy divergence. Our base case scenario is for a Trump administration that puts the emphasis on growth without too much by...

Read More »Environment is supportive of US dollar

Macroview While near-term Fed rate hike has been priced in, other factors favour the greenback in the medium term. Alternatives like the Swiss franc and Australian dollar look less attractive. With a December rate hike already largely priced in, further dollar support from Fed tightening could be fairly limited in the next few months, especially as the Fed is likely to lower its rate forecasts for the coming years to take into account increasing concerns about the decline in ‘neutral’ real...

Read More »Currencies: persistent market volatility should support funding currencies

The risks implied by the Fed’s tightening cycle and the new Chinese monetary regime, among other things, will favour funding currencies over carry currencies in the next twelve months. Instead of looking at single currencies, it is sometimes interesting to look at broader themes to have a better understanding of how a certain group of currencies might behave. Among the best-known themes or strategies are carry trades, which are based on the principle of systematically buying...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org