Macroview While near-term Fed rate hike has been priced in, other factors favour the greenback in the medium term. Alternatives like the Swiss franc and Australian dollar look less attractive. With a December rate hike already largely priced in, further dollar support from Fed tightening could be fairly limited in the next few months, especially as the Fed is likely to lower its rate forecasts for the coming years to take into account increasing concerns about the decline in ‘neutral’ real rates. However, policies should remain broadly supportive of the US dollar in the medium term, especially given low market expectations for Fed funds rises in 2017. Our forecasts for US economic growth for the rest of the year (2.5% in Q3 and 2.0% Q4 2016) and for 2017 (2.0%) should also support the USD.After the 21 September FOMC meeting, the US presidential elections in November are likely to grab the attention of financial markets. US elections are unlikely to have a meaningful impact on the US dollar. Both candidates favour increased infrastructure spending and some form of international tax reform that could lead to repatriation of funds held abroad by American firms, although a victory by Donald Trump would likely be more USD supportive.

Topics:

Luc Luyet considers the following as important: Australian Dollar, currencies, Macroview, Swiss Franc, US dollar, US dollar appreciation

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

While near-term Fed rate hike has been priced in, other factors favour the greenback in the medium term. Alternatives like the Swiss franc and Australian dollar look less attractive.

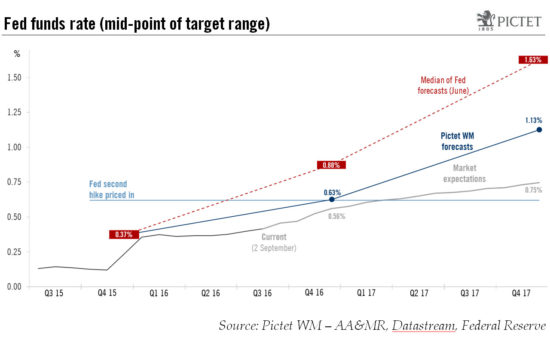

With a December rate hike already largely priced in, further dollar support from Fed tightening could be fairly limited in the next few months, especially as the Fed is likely to lower its rate forecasts for the coming years to take into account increasing concerns about the decline in ‘neutral’ real rates. However, policies should remain broadly supportive of the US dollar in the medium term, especially given low market expectations for Fed funds rises in 2017. Our forecasts for US economic growth for the rest of the year (2.5% in Q3 and 2.0% Q4 2016) and for 2017 (2.0%) should also support the USD.

After the 21 September FOMC meeting, the US presidential elections in November are likely to grab the attention of financial markets. US elections are unlikely to have a meaningful impact on the US dollar. Both candidates favour increased infrastructure spending and some form of international tax reform that could lead to repatriation of funds held abroad by American firms, although a victory by Donald Trump would likely be more USD supportive. Any potential tariff war following the election would hurt the currencies of countries that have a trade surplus with the US, notably Mexico and China.

Among G10 currencies, the USD seems especially attractive against the Australian dollar and the Swiss franc.

We currently estimate the Australian dollar is 11.3% overvalued against the US dollar. We acknowledge that the AUD could continue to be carried by a tide of optimism, but with volatility readings already low, it may be hard for risk appetite to appreciate much further. The Swiss franc is also overvalued and it offers a much lower yield than the USD. Furthermore, the Swiss National Bank is highly sensitive to further unwanted CHF strengthening. The USD thus seems poised to appreciate more than the CHF.

Among emerging market currencies, we continue to expect a gradual depreciation of the Chinese yuan against the USD. This depreciation should significantly weigh on the currencies of Singapore or South Korea.