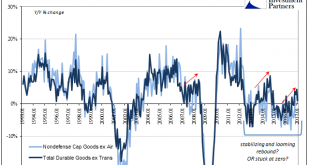

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version. That would suggest that orders as well as shipments were somewhat better than they appear at least in in terms of...

Read More »The Inverse of Keynes

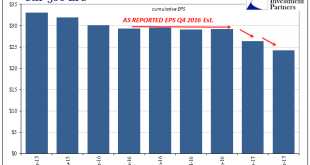

With nearly all of the S&P 500 companies having reported their Q4 numbers, we can safely claim that it was a very bad earnings season. It may seem incredulous to categorize the quarter that way given that EPS growth (as reported) was +29%, but even that rate tells us something significant about how there is, actually, a relationship between economy and at least corporate profits. Keynes famously said that we should...

Read More »Non-Randomly Surveying RMB

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been –...

Read More »Economics Through The Economics of Oil

The last time oil inventory grew at anywhere close to this pace was during each of the last two selloffs, the first in late 2014/early 2015 and the second following about a year after. Those events were relatively easy to explain in terms of both price and fundamentals, though the mainstream managed to screw it up anyway (“supply glut”). By and large, the massive contango of the futures curve that showed up as a result...

Read More »Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule. So much changed after that one day, a buying panic in the...

Read More »All In The Curves

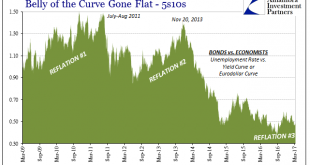

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December. Thus, despite two rate...

Read More »Was There Ever A ‘Skills Mismatch’? Notable Differences In Job Openings Suggest No

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the...

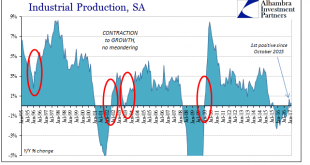

Read More »Industrial Symmetry

There has always been something like Newton’s third law observed in the business cycles of the US and other developed economies. In what is, or was, essentially symmetry, there had been until 2008 considerable correlation between the size, scope, and speed of any recovery and its antecedent downturn, or even slowdown. The relationship was so striking that it moved Milton Friedman to finally publish in 1993 his plucking...

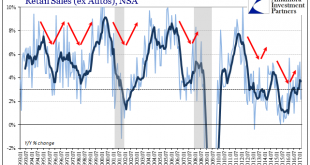

Read More »Retail Sales: Extra Day Likely, no Meaningful Difference

Retail sales comparisons were for February 2017 skewed by the extra day in February 2016. With the leap year February 29th a part of the base effect, the estimated growth rates (NSA) for this February are to some degree better than they appear. Seasonally-adjusted retail sales were in the latest estimates essentially flat when compared to the prior month (January). That leaves too much guesswork to draw any hard...

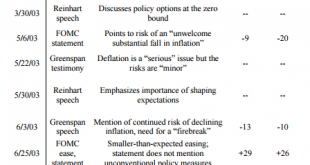

Read More »Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate. In those days, transparency was no virtue but rather it was widely...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org