Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on auctions as the sole...

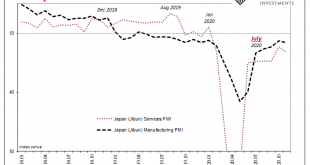

Read More »Deflation Returns To Japan, Part 2

Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic. For a country with a population of more than 126 million, the case counts and mortality rates suggest something in the nation’s favor. Total reported coronavirus cases didn’t top 100,000 until the end of...

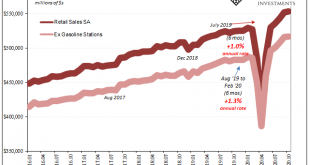

Read More »Extending the Summer Slowdown

A big splurge in September, and then not much more in October. While it would be consistent for many to focus on the former, instead there is much about the latter which, for once, is feeding growing concerns. Retail sales, American consumer spending on goods, has been the one (outside of economically insignificant housing) bright spot since summer. If it succumbs to the slowdown every other economic account is displaying, that could only mean it really has been...

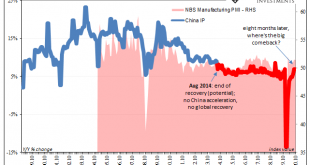

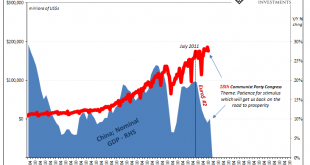

Read More »Six Point Nine Times Two Equals What It Had In Twenty Fourteen

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.” In 2014, the clock was ticking but expectations were extremely high nonetheless. In September 2014, however, massive setback. Though it had been building all year by...

Read More »Where Is It, Chairman Powell?

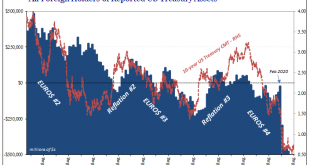

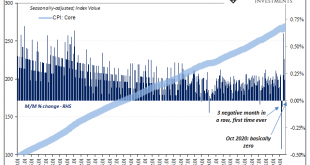

Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance. Inflationary pressures were supposed to have been visible by now, seven months and counting, when instead it is disinflation which is most evident...

Read More »The Prices And Costs Of What Xi Believes He’s Got To Do

It does seem, at first, a huge contradiction. On the one hand, what we know so far of China’s 14th 5-year plan apparently will lean heavily on new technologies not-yet invented to rescue the country’s economy from the pit of de-globalization the eurodollar system had thrown it into years ago. If the global economy isn’t going to recover, and there’s absolutely no sign that it will, then the one seemingly logical (though far-fetched) way forward would be if the...

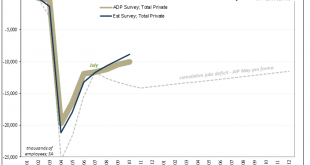

Read More »Good Payrolls Still Say Slowdown

The payroll report for the month of October 2020 was a very good one. This shouldn’t be surprising, perfect BLS publications appear with regularity even during the most challenging of circumstances. Headlines and underneath, everything looked fine last month. It wasn’t perfect, however, and it’s the same things that leave it short of perfection which are entirely too familiar for this last decade of the occasional perfect payroll publication. Meaning, yes,...

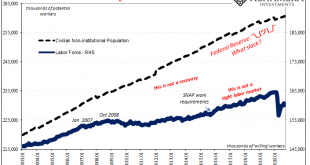

Read More »Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too. The rebound is still rebounding, of course, and this upturn...

Read More »Meanwhile, Outside Today’s DC

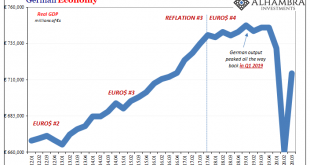

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage. Either way, Europe gets at it first. In 2018, what had been...

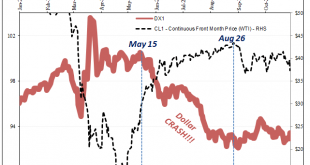

Read More »What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here? What you’ll hear or have already heard is something about Europe and more lockdowns, fears about a second wave of the pandemic. No, that doesn’t fit the herdlike change in direction you can observe across many different markets (below)....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org