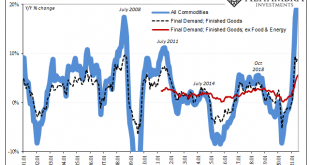

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene. The BLS reports today that its main producer price index (PPI), the one for finished goods, was up 9.19% year-over-year in June 2021....

Read More »Third CPI In A Row, Yet All Eyes On That 30s Auction

Three in a row, huge CPI gains. According to the BLS, headline consumer price inflation surged 5.39% (unadjusted) year-over-year during June 2021. This was another month at the highest since July 2008 (the last transitory inflationary episode). The core CPI rate gained 4.47% last month over June last year, the biggest since November 1991. U.S. Core CPI, Jan 1990 - Jan 2021(see more posts on U.S. Core CPI, ) - Click to enlarge More impressive (or worrisome,...

Read More »Weekly Market Pulse: Is It Time To Panic Yet?

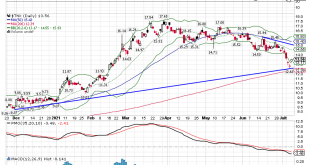

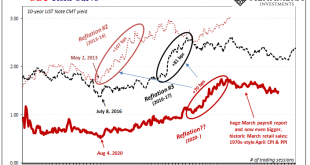

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range. The bond rally since April has been of the stealth variety, the financial press and market strategists dismissing every tick down in rates as nothing. It was a lonely trade to put on and yes...

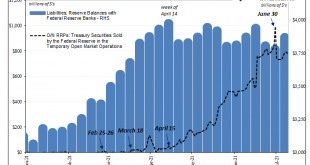

Read More »RRP No Collateral Coincidences As Bills Quirk, Too

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big. To end Q2 2021, financial counterparties “lent” just about $1 trillion to the Fed. Holy cow! A trillion! There’s way too much money! Eh. The RRP, especially around its more informative margins, has little to do...

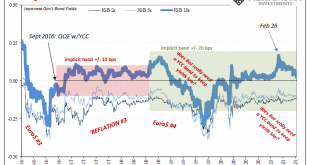

Read More »Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change. Inflation had finally been achieved across multiple geographies, it was widely repeated, and this would create problems, purportedly, as these various places would have to grapple with higher interest rates. The idea behind...

Read More »ISM’s Nasty Little Surprise Isn’t Actually A Surprise

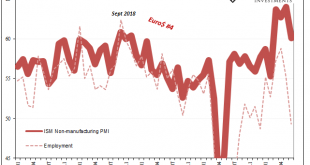

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention. Consistent with IHS Markit’s estimates as well as the ISM’s Manufacturing PMI released last week, there are growing (confirmed) concerns that...

Read More »Anyone Remember That Whole SLR Cliff?

Does anyone remember the SLR “cliff?” Of course you don’t, because in the end it didn’t seem to make any difference. For a few weeks, it was kind of ubiquitous if only in the sense that it was another one of those deep plumbing issues no one seems able to understand (forcing all the “experts” to run to Investopedia in order write something up about it). Whatever this thing was and was going to be, it sounded ridiculously earth-shattering. And then, poof, it was...

Read More »A Clear Balance of Global Inflation Factors

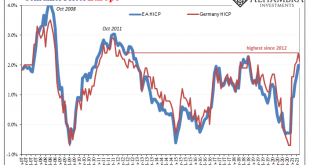

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years. Even using the European “harmonized” methodology (Harmonized Index of Consumer Prices, or HICP), inflation had reached 2.4% year-over-year which was the highest since 2012. Europe HICP and...

Read More »Inflation Isn’t Just The Outlier, The Inflation In It Is, Too

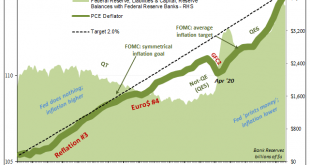

Following the same recent pattern as the BLS and its CPI, the Bureau of Economic Analysis’s (BEA) PCE Deflator ran up hotter in May 2021 than its already high increase during April. The latter’s headline consumer basket rose 3.91% year-over-year, its fastest pace since August 2008. The core rate, which excludes food and energy prices, accelerated to 3.39% from 3.11%, the highest since the early nineties. Having gone through this for two consecutive months, the...

Read More »Sure Looks Like Supply Factors

[unable to retrieve full-text content]If it walks like a duck and quacks like a duck, then it must be inflationary overheating. Or not? As more time passes and the situation further evolves, the more these recent price deviations conform to the supply shock scenario rather than a truly robust economy showing no signs of slowing down.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org