There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality). Bathed in the unearned glow of the Great “Moderation”,...

Read More »What Did Hamper Growth ‘In A Few Months’

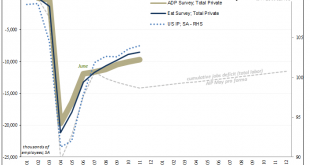

Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign. Summer slowdown extends in Industrial Production. According to the Federal Reserve, the outfit which has kept tabs on this economic sector for more than a century, the...

Read More »This Global Growth Stuff, China Still Wants A Word

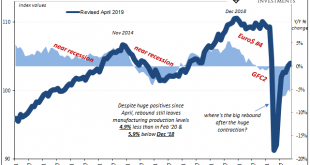

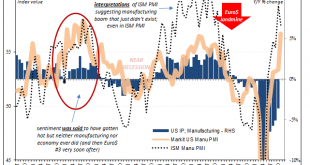

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality. Oddly the same for 2017’s update heading into 2018 and 2019. If currency wars are the...

Read More »Inflation Hysteria #2 (Slack-edotes)

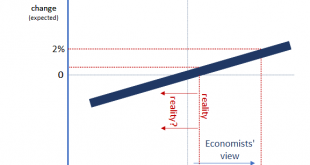

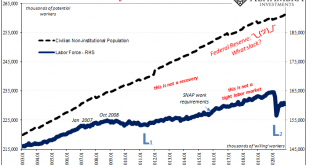

Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them. A labor shortage would’ve meant full or maximum employment, the...

Read More »Inflation Hysteria #2 (WTI)

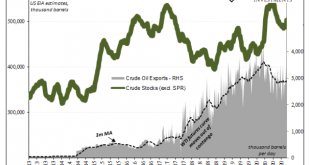

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously. Legacy of the 1970’s experience depending too much on OPEC, subject to embargoes, American oil companies had been prohibited for decades from exporting oil. Not that it would have mattered before 2014, the country never producing near enough to have ever done so. Export limitations removed, shale boom...

Read More »Inflation Hysteria #2 (Nominal UST)

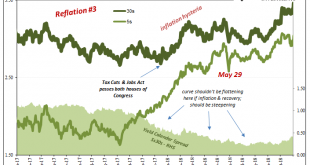

What had given Inflation Hysteria #1 its real punch had been the benchmark 10-year Treasury note. Throughout 2017, despite the unemployment rate in the US, globally synchronized growth being declared around the world (and being declared as some momentously significant development), and whatever other tiny factors acceding to the narrative, longer-term Treasury rates just weren’t buying it. Instead, the eurodollar monetary system continued to cling to these safest,...

Read More »Polar Opposite Sides of Consumer Credit End Up in the Same Place: Jobs

If anything is going to be charged off, it might be student loans. All the rage nowadays, the government, approximately half of it, is busily working out how it “should” be done and by just how much. A matter of economic stimulus, loan cancellation proponents are correct that students have burdened themselves with unprofitable college “education” investments. Without any jobs, let alone enough good jobs, an entire generation of Americans has been hamstrung,...

Read More »Don’t Really Need ‘Em, Few More Nails Anyway

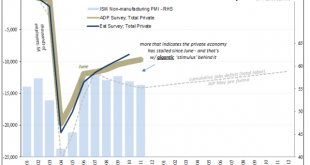

The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.” Since, however, it’s been a slow downward trend that, when realizing early 2019 wasn’t exactly robust, only reconfigures the very nature of this rebound. When comparing comebacks from outsized economic contractions, the best...

Read More »There Have Actually Been Some Jobs Saved, Only In Place of Recovery

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5. At that level, it really wasn’t any different from where it had been at its multi-year high the month before. Neither are indicative of any sort of “V” shaped recovery, or any shaped recovery....

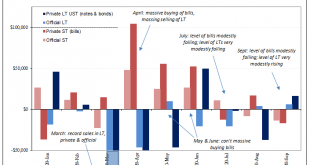

Read More »Just Who Is, And Who Is Not, Selling T-Bills

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral. Best collateral means OTR, and for standard practice this had always meant Treasury bills (as well as, noted yesterday, bonds and notes just auctioned off). According to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org