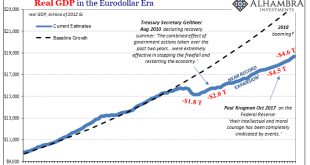

Men have long dreamed of optimal outcomes. There has to be a better way, a person will say every generation. Freedom is far too messy and unpredictable. Everybody hates the fat tails, unless and until they realize it is outlier outcomes that actually mark progress. The idea was born in the eighties that Economics had become sufficiently advanced that the business cycle was no longer a valid assumption. The mantra,...

Read More »It’s Not That There Might Be One, It’s That There Might Be Another One

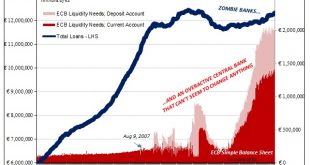

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality. At the end of November, Mario Draghi went...

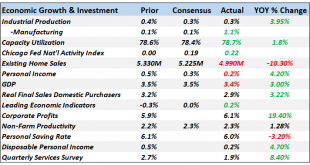

Read More »Monthly Macro Monitor – January 2019

A Return To Normalcy In the first two years after a newly elected President takes office he enacts a major tax cut that primarily benefits the wealthy and significantly raises tariffs on imports. His foreign policy is erratic but generally pulls the country back from foreign commitments. He also works to reduce immigration and roll back regulations enacted by his predecessor. This President is widely rumored to have...

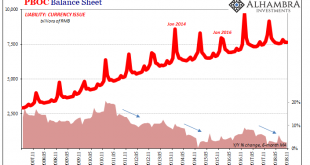

Read More »China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream. Only, you can see just on the other side of the hill the bright reflective lights of one of China’s many glittering modern cities. Not only are you reminded of the stark difference between what...

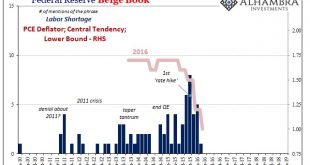

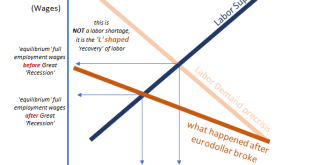

Read More »Hall of Mirrors, Where’d The Labor Shortage Go?

Today was supposed to see the release of the Census Bureau’s retail trade report, a key data set pertaining to the (alarming) state of American consumers, therefore workers by extension (income). With the federal government in partial shutdown, those numbers will be delayed until further notice. In their place we will have to manage with something like the Federal Reserves’ Beige Book. It may not be close to the same...

Read More »That’s A Big Minus

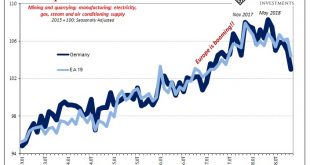

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention. China put up some bad trade numbers for last month, but Europe’s goods downturn came first. According to...

Read More »Spreading Sour Not Soar

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve. There are real economic processes underneath....

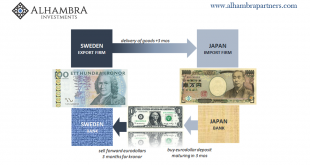

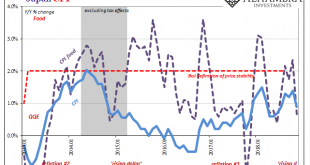

Read More »Insight Japan

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost. In yesterday’s article the topic in the East was China. Today,...

Read More »Rate of Change

We’ve got to change our ornithological nomenclature. Hawks become doves because they are chickens underneath. Doves became hawks for reasons they don’t really understand. A fingers-crossed policy isn’t a robust one, so there really was no reason to expect the economy to be that way. In January 2019, especially the past few days, there are so many examples of flighty birds. Here’s an especially obvious, egregious one...

Read More »2019 Outlook

A discussion of the outlook for 2019 in the markets and the economy by Alhambra CEO Joe Calhoun and the Head of Alhambra Global Investment Research Jeff Snider. [embedded content] Related posts: Euro Credit: 2019 Outlook Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC Core Euro Sovereign Bonds 2019 Outlook A Couple...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org