Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance. Inflationary pressures were supposed to have been visible by now, seven months and counting, when instead it is disinflation which is most evident – and it is spreading. The latest consumer price data in the form of the CPI further dispels some of the myths. CPI less Food & Energy, 1983-2020 - Click to enlarge It had been reopening – not QE – which had rescued the economy just in the nick of time from a possible outright deflationary trap.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Consumer Prices, Core CPI, CPI, currencies, disinflation, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, inflation, jay powell, Markets, money printing, newsletter, QE, services

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance. Inflationary pressures were supposed to have been visible by now, seven months and counting, when instead it is disinflation which is most evident – and it is spreading.

The latest consumer price data in the form of the CPI further dispels some of the myths. |

CPI less Food & Energy, 1983-2020 |

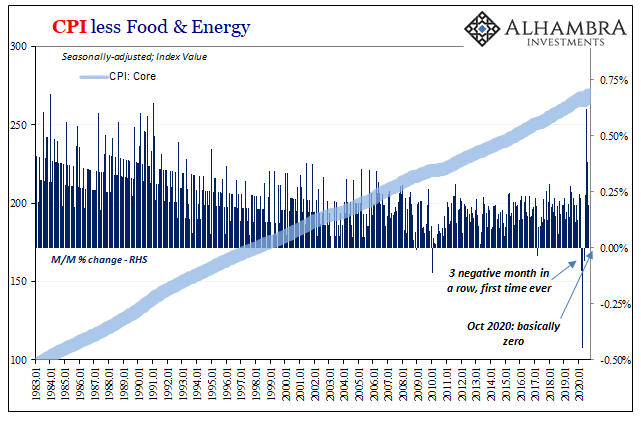

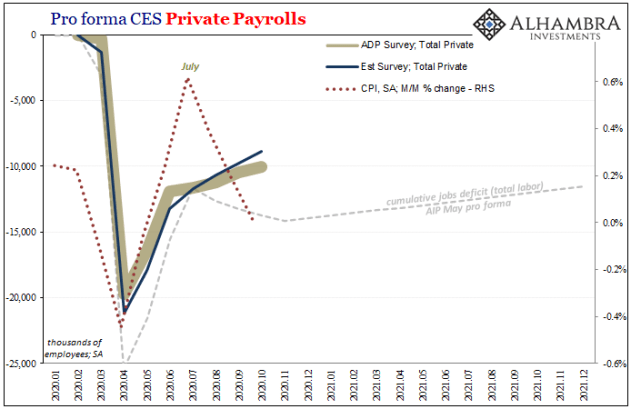

| It had been reopening – not QE – which had rescued the economy just in the nick of time from a possible outright deflationary trap. Recall that the seasonally-adjusted core CPI index had fallen for three consecutive months beginning with March, the first time that had ever happened. |

Pro forma CES Private Payrolls, 2020-2021 |

|

The rebound which derived from reopening then pushed core consumer prices back up, sharply in July. QE was nowhere to be found (see: markets). Since July (there’s that month again), the acceleration in non-food and energy consumer prices has become once more deceleration. In the latest monthly estimate for October 2020, released today, the index was practically a flat zero last month (+0.0119%). Like negative monthly changes, one so close to zero is also a rare occurrence. And while there’s much to argue over when it comes to price indices and the buckets they are derived from (the hedonics which go into the buckets as much as, at times, consumer prices), as we’ve noted since April you can’t deny the correlation of negatives – low and negative core rates closely associate with some of the worst of economic times. With October, that makes four out of the last eight months down in a range which defines Jay Powell’s nightmares. |

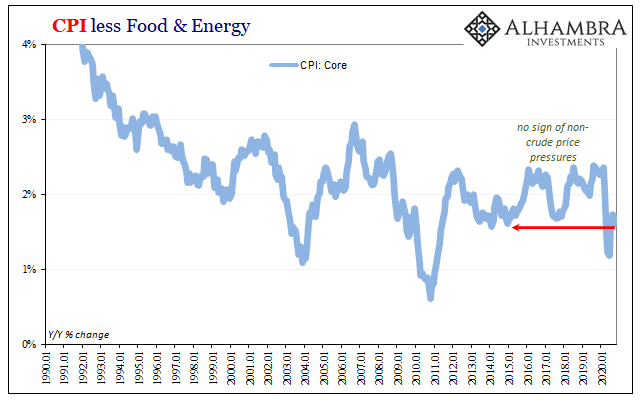

CPI less Food & Energy, 1990-2020 |

| So much for all that money printing and average inflation targeting hype. |

CPI Changes on Energy, 1995-2020 |

|

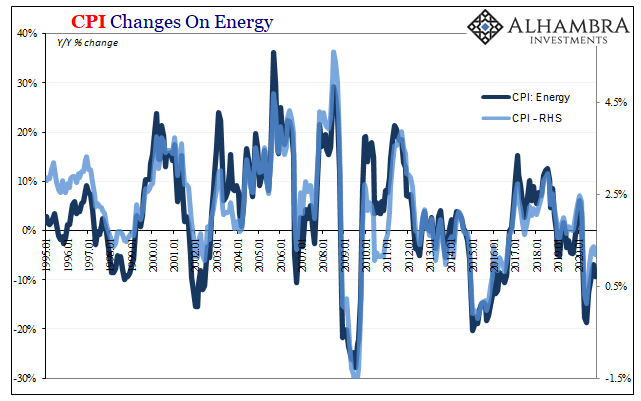

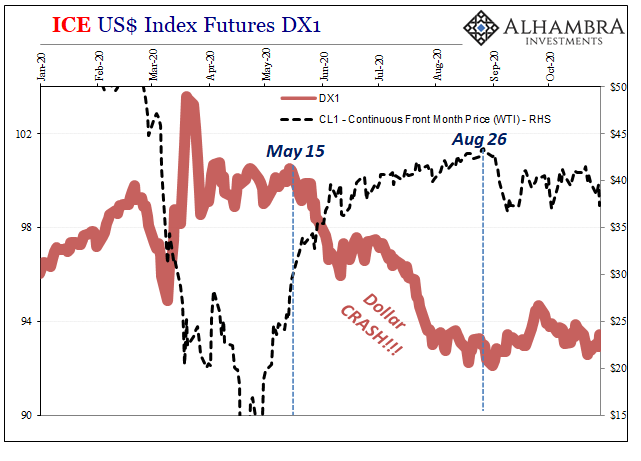

By the numbers, the headline inflation rate (CPI) rose by just 1.18% year-over-year in October, down from 1.37% in September. The post-August (Jay Powell J-hole) WTI hangover keeps weighing down the top-level inflation measures. Oil prices were significantly lower, on average, -27% year-over-year, which contributed to the -18% for the CPI’s motor fuel component, and therefore -9.3% for the overall energy portion of the basket. The US might be (for now) better off than Europe or China where disinflation is concerned (in Europe, outright deflation), but it’s neither oil nor food prices that are most concerning right now in the US piece of the global system. One of the primary problems in this low-work environment (no matter what the unemployment rate indicates) is the inability of so many Americans to be able to rent shelter.

Such weak fundamentals (earned income, meaning work or labor) are fundamentally disinflationary. And that’s just what we find in the CPI: |

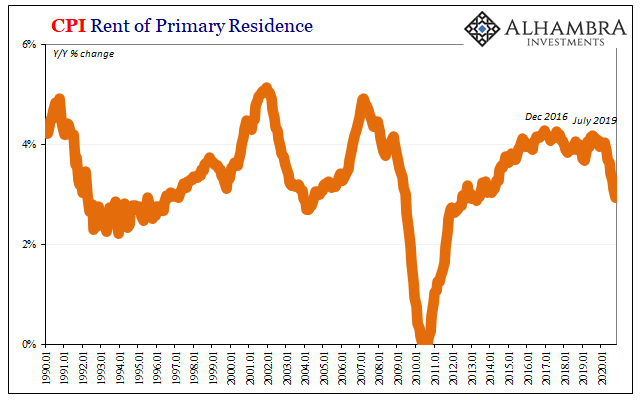

CPI Rent of Primary Residence, 1990-2020 |

|

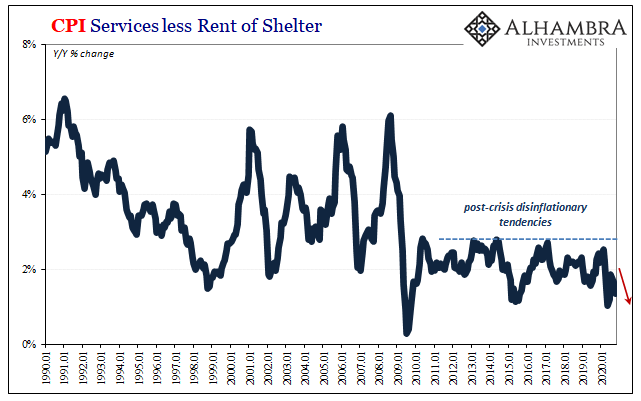

The rental index increased by less than 3% for the first time since 2013, and with the obvious deceleration showing no signs of letting up (and no sign whatsoever of monetary flooding through either Fed or federal government means) it’s not all that far from the being the lowest in a decade as it is likely to drop that much and more in the coming months. But it’s not just rent, either. Outside of this key expense, price advances elsewhere also unrelated to oil and food are slowing down, too. Another key “core” CPI component highlights the service sector outside of housing and rent (below). This important estimate slackened considerably in October, rising 1.35% year-over-year compared to 1.67%, 1.72%, and 1.86% in September, August, and July, respectively Those were already low levels; the rebound, it does seem, didn’t get very far before being turned around. |

CPI Services less Rent of Shelter, 1990-2020 |

|

All kinds of signs for weak demand leading to less price gains because of increased discounting both services as well as goods outside of the energy segment (which is just down). Not one thing that suggests inflation is about to show up, let alone spike up and remain that way under irresponsible monetary policy. As to average inflation targeting, yet another month that makes clear its absolute absurdity:

The Fed doesn’t do money, therefore there’s no way the Fed can have its monetary inflation. |

|

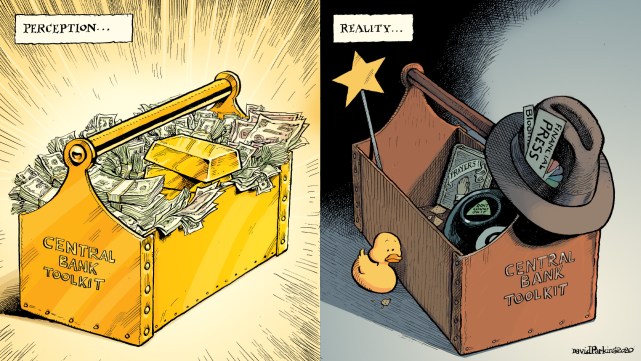

Monetary officials – in name only, MOINO – have sunk to believing that pretending to print money and having the media write story after story after story declaring as much, as well as how ultra-loose and ultra-accommodative it is, that such belief alone will be enough to convince consumers and businesses to act accordingly (in a predictably inflationary manner).

Yes, money-less monetary policy really is just this ridiculous. What isn’t so absurd is the fact that consumer prices, like a bevy of other economic accounts, are right now also confirming the summer slowdown showing up right when and where the reopening rebound was supposed to have accelerated (along with broad consumer prices).

That’s not COVID. No, this is a second wave of economic problems, second and third order effects already making their way through and rotting out economic processes while obscured by the gigantic positives of that initial rebound.

Maybe you don’t like the CPI when it allegedly understates inflationary circumstances, and there’s reason for this allegation. But when it fails to account in that manner, you have to pay attention because on the downside, at least, there’s tons of both recent as well as historical confirmation. Perhaps it doesn’t give us much about inflation, but it sure does about disinflation.

In this case, as every other for decades, the Fed’s got nothing to do with it. Otherwise, where is it, Jay?

Tags: Consumer Prices,Core CPI,CPI,currencies,disinflation,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,inflation,jay powell,Markets,money printing,newsletter,QE,services