Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic. For a country with a population of more than 126 million, the case counts and mortality rates suggest something in the nation’s favor. Total reported coronavirus cases didn’t top 100,000 until the end of October. And the latest estimates attributing fatalities to the disease say there’s still less than 2,000 – total, since the beginning. Aso talked about “mindo” being the answer for these miniscule results. How it might translate into different languages, that’s part of the Minister’s problem. Having been

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Core CPI, CPI, currencies, Deflation, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, inflation, Japan, jibun manufacturing pmi, jibun services pmi, Markets, newsletter, QE, QQE, summer slowdown

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic. For a country with a population of more than 126 million, the case counts and mortality rates suggest something in the nation’s favor.

Total reported coronavirus cases didn’t top 100,000 until the end of October. And the latest estimates attributing fatalities to the disease say there’s still less than 2,000 – total, since the beginning. Aso talked about “mindo” being the answer for these miniscule results. How it might translate into different languages, that’s part of the Minister’s problem. Having been asked directly by politicians and governments from around the world for advice on Japan’s apparently super-effective strategies, Aso wasn’t shy:

It might better be translated as “cultural level”, or cultural standards. “The United States imposed fines on people who broke lockdown rules, and France did so too. But we didn’t have to do such a thing, and we made it only by requesting.” Whatever the reason or reasons, whichever term the Deputy Prime Minister used or meant to use, the Japanese people report they are growing concerned anyway. Why not? COVID dominates the news media everywhere simply because it draws people’s attention. Even in a country of 126 million where fewer than 2,000 have died. People are people. |

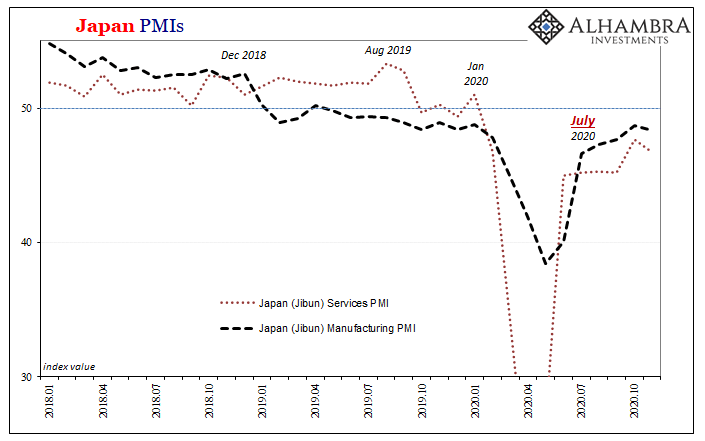

Japan PMIs, 2018-2020 |

And that also means they often say one thing while doing the complete opposite.

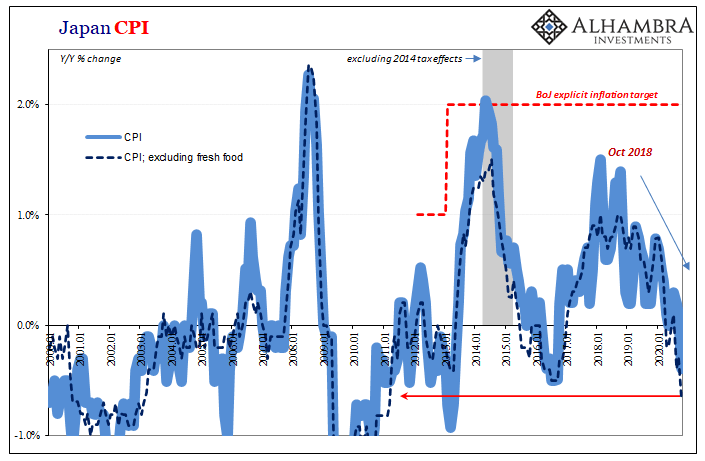

“Record” cases in Japan means a few more hundred per day. Same planet, different virus world. Same economic trajectory, though, and that’s really the point. There’s nothing wrong with keeping a wary eye on how the global pandemic is unfolding. But that doesn’t appear to be Japan’s big economic problem. Instead, despite the absence of lockdowns or any big virus outbreaks, the Japanese system is sinking anyway. As noted earlier, deflation is back in a big way. QQE to the moon, no matter. The reason why is simple, and nothing to do with COVID one way or the other. Like so many other places around the world, Japan has experienced the same summer slowdown which looks to have developed into an autumn of non-virus alarm. An insufficient rebound stopped well short of recovery, and now there’s questions about whether or not it is even still a rebound. Recent PMI’s for the month of November 2020, released today by Jibun Bank in conjunction with IHS Markit, piled on to the picture of potential misery. In addition to the deflationary CPI figures, Jibun believes the services economy took a significant step back this month, leaving it to still contract at around the same rate as in June-July. |

Japan CPI, 2001-2020 |

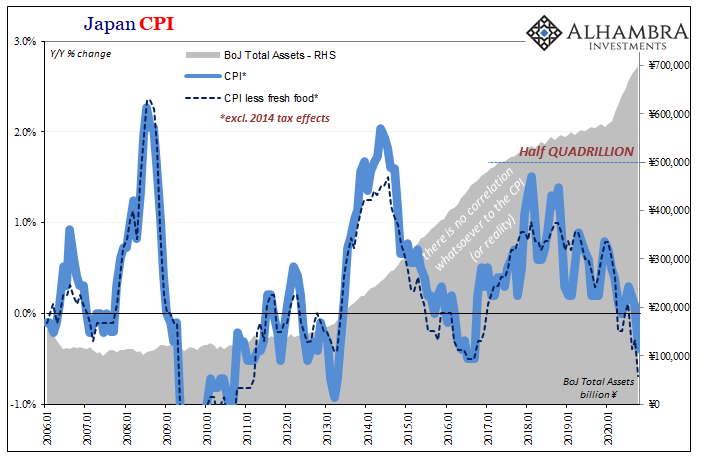

| Like Europe’s economy, the Japanese system had been at best flirting with recession since well over a year ago. Japan’s manufacturers had been in their own kind of contraction going back much longer. That’s a long time to be under the gun.

Throughout all of it: QQE, YCC, and a bogus promise to “overshoot” on inflation made now more than four years ago. More than enough time yet again to understand how Japan’s economic fortunes aren’t made or broken by Japan nor its central bank. COVID’s not the world’s big problem anymore. There’s an impediment to the machinery of exchange and it seems to have renewed itself almost half a year ago. And now it, unlike the coronavirus, is everywhere. They don’t have much of the pandemic in Japan, but they do show all the same symptoms of the world’s ongoing deflationary dollar disease. |

Japan CPI, 2006-2020 |

Tags: Core CPI,CPI,currencies,Deflation,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,inflation,Japan,jibun manufacturing pmi,jibun services pmi,Markets,newsletter,QE,QQE,summer slowdown