While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too. The rebound is still rebounding, of course, and this upturn from May’s bottom produced the most gigantic GDP ever witnessed in Q3. That aside, there curiously doesn’t seem to be much momentum spared for moving into Q4 and perhaps beyond. Start with the labor market – simply because everything, meaning everyone, that matters is in it. The only question on our

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, ADP, adp employement report, bonds, Crude Oil, currencies, economy, Featured, Federal Reserve/Monetary Policy, Labor market, Markets, newsletter, payrolls, Petroleum, petroleum products, private payrolls, services, U.S. ISM Non-Manufacturing PMI, WTI

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too.

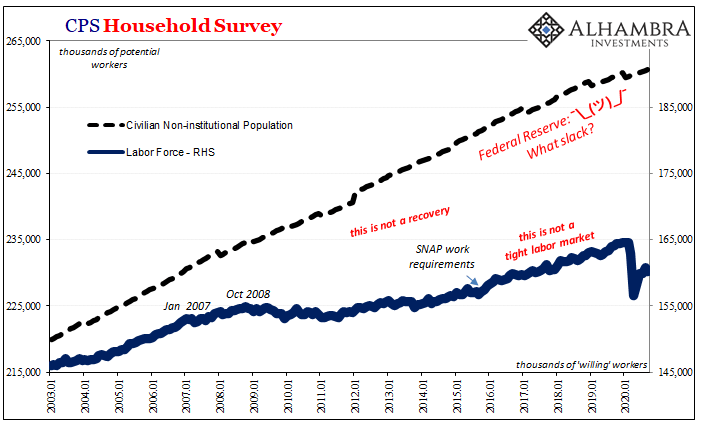

The rebound is still rebounding, of course, and this upturn from May’s bottom produced the most gigantic GDP ever witnessed in Q3. That aside, there curiously doesn’t seem to be much momentum spared for moving into Q4 and perhaps beyond. Start with the labor market – simply because everything, meaning everyone, that matters is in it. The only question on our minds has been if everyone gets to go back to work. Not “most” and definitely not “many.” All the formerly employed workers, which had already been too few dating back more than a decade. |

CPS Household Survey, 2003-2020 |

| Prior to 2008, this had never been a question. Why would it have been? Plucking models and the total banishment of unit roots from econometric assumptions had left the general public with the distinct impression that what goes down will always come back up all the way. Your friendly, neighborhood central banker, the wise and capable monetary steward acting as needed to guarantee nothing stands in the way of this thing called recovery.

In the aftermath of the Great “Recession”, especially from October 2008 onward (why October 2008?), suddenly there appeared “participation problems” and such that neither GDP nor labor regained its prior trajectory. Though they continue to do everything else, Economists honestly looking at all the data could only conclude there does seem to have been a permanent shock after all. The economy did not recover – and that’s what all this fuss about inflation the past several years has truly been about. Having witnessed this one “L” in recent times where a “V” shaped recovery had always previously been, not just recent times, the last time we did a “recession”, we should already be uneasy about the prospects for after this current case. Indeed, central bankers are still puzzled by what happened following the prior one, therefore still in use are the tools and methods that had guaranteed nothing other than one false dawn before another. |

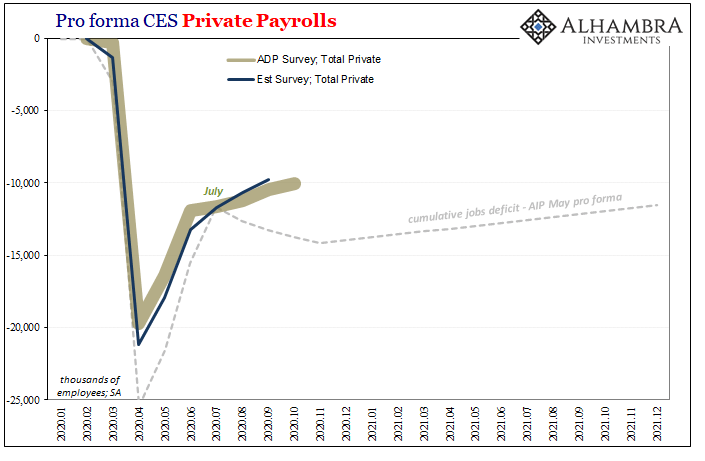

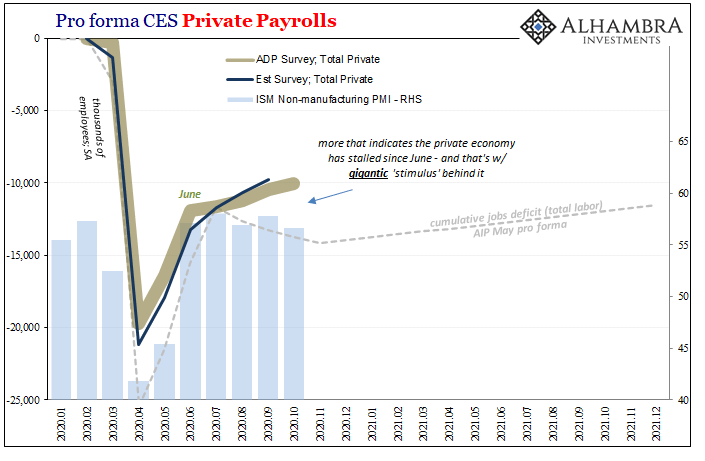

Pro forma CES Private Payrolls, 2020-2021 |

| It is therefore hugely disheartening to see something like what’s below emerge into a multi-month pattern (and counting):

According to ADP today, the number of private payrolls gained during the month of October 2020 was a mere 365k. That much would have counted as a decent month at any other time before March. Given what you see above, private payrolls (ADP series) still just more than 10 million below their prior peak, 365k is a plodding, sluggish pace which raises serious doubts. |

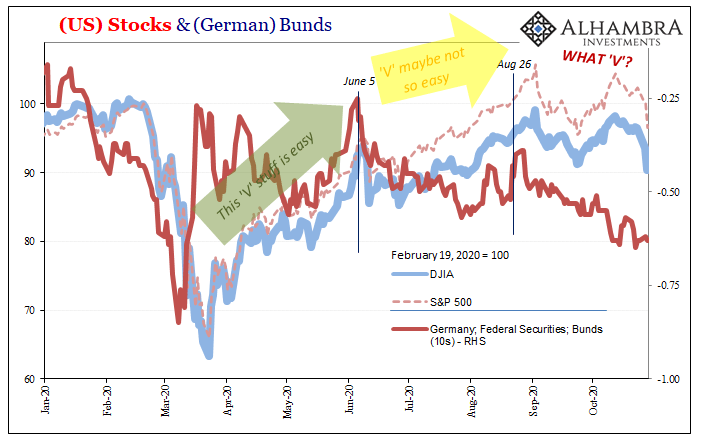

US Stocks & German Bunds, 2020 |

| Not just that, it quite clearly continues what had already transitioned to several months of a curiously plodding, sluggish pace. Did markets nail it in early June, or what? Even stocks (and bunds).

A few hundred thousand jobs added back each month just won’t get it done. This is October data and we’re already in November. The big drop was half a calendar ago. Ten million (in just private payrolls) is an unthinkably enormous deficit, still far greater than what the economy suffered the first time there was a labor market “L” (top to bottom, January 2008 to March 2010, ADP estimates 8.6 million private payrolls shed). |

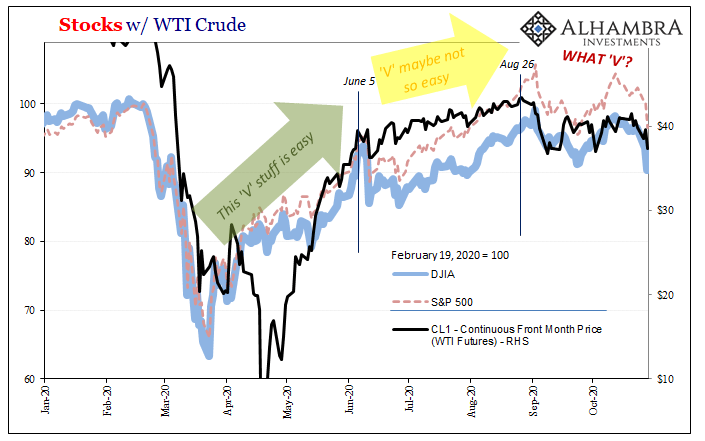

Stocks w/ WTI Crude, 2020 |

|

And 2020 includes the combination of massive “stimulus” being doled out in every form imaginable – real (federal government) as well as imaginary (Federal Reserve).

We’ve already proposed an explanation given what might otherwise seem competing factors: “stimulus”-laden GDP rocketing back higher versus what you see above in a far more subdued labor market. Companies in the private economy clearly are suffering more than government-fueled GDP indicates. The permanent income hypothesis. It’s not just apparent in labor market figures, either. There’s a whole range of data which corroborates the slowdown view. Again, the economy isn’t in re-recession, or even indicated to be on the verge of that sort of setback, for now what’s showing up is still a rebound but one that’s coming up way, way too small/short. This risks something like re-recession moving forward and the longer we’re stuck this way, but, fortunately, we aren’t there yet. |

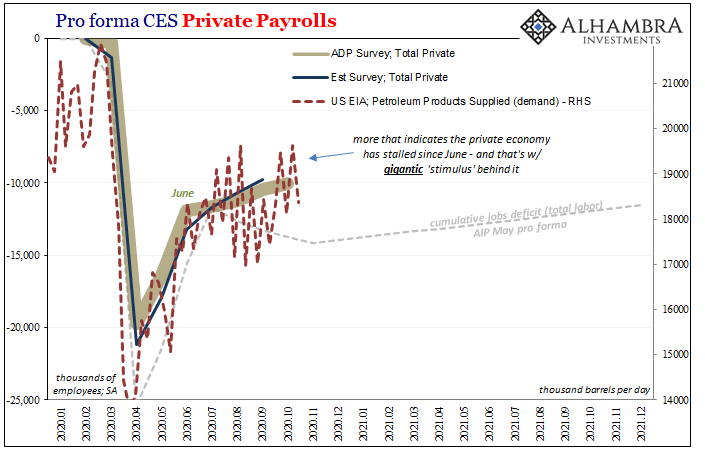

Pro forma CES Private Payrolls, 2020-2021 |

| The ISM reported also today its PMI estimate for the services side of the US economy. The Non-manufacturing index fell slightly in October (56.6) from what it had been in September (57.8). While these numbers may seem and sound terrific, given the reality of the situation and such hugely unfavorable circumstances, the fact that PMI’s like the ISM’s are not up into the high 60s or even low 70s is already a bad sign.

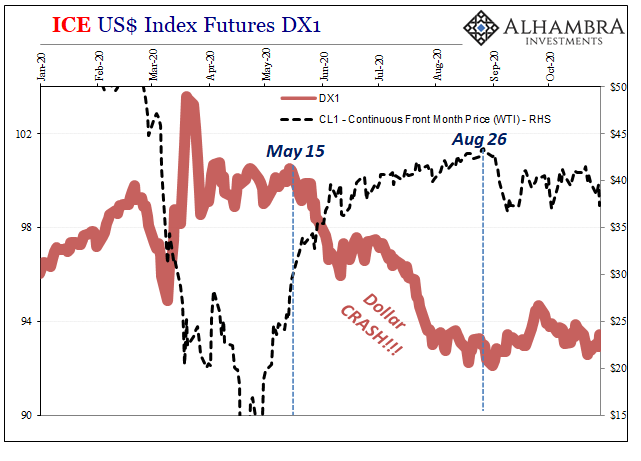

The most worrisome one, however, is that the ISM – like the ADP data – really does seem to have stalled out around July. This is, obviously, consistent with the overall impression; an economy still rebounding but too sluggishly and now no longer accelerating like it badly needs to. And we can further confirm the private economy’s struggle in any number of ways using unrelated data coming up in exactly the same pattern. Here’s (below) the US Energy Information Administration’s weekly estimates for petroleum products supplied (in other words, demand for all the various output distillates): Same thing, and in this case it adds further weight to the same message which has built up in the double inflections seen in WTI futures and prices. Why isn’t the WTI curve out of contango despite massive production cuts? Demand isn’t coming back like the world had hoped. This right here is the biggest challenge facing America (and the rest of the world; see: Europe) right now. It’s not COVID nor the coming lawfare to be waged over hanging chads who apparently escaped from their South Florida haven over the last twenty years and multiplied in each and every contested battleground state. |

Pro forma CES Private Payrolls, 2020-2021 |

The biggest threat continues to be the eurodollar system’s unique ability to un-work what had seemed to work for decades on end; an expanding, harmonious global economy riding the waves of globalization if only up to August 2007. Since that point, political, social, and economic fracturing of the kind which doesn’t ever show up in econometric models stripped of unit root possibilities, but does show up in the real world in what might be shaping up to be multiple failed recoveries.

Though separated by more than a decade, one right after another. “Something’s” different and different in a structural sort of way.

The first “V” already dead, the nail in its coffin surely among one of the datapoints collected above, now hopes for the next “V” hinge upon more of what hadn’t kept the first “V” alive.

No wonder so many of those bond shorts covered today.

Tags: ADP,adp employement report,Bonds,Crude Oil,currencies,economy,Featured,Federal Reserve/Monetary Policy,Labor Market,Markets,newsletter,payrolls,petroleum,petroleum products,private payrolls,services,U.S. ISM Non-Manufacturing PMI,WTI