They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage. Getting back to just even with February instead is becoming a distant probability, the kind of non-transitory shortfall with which we’ve grown far too accustomed. Therefore, “they” now salivate (reported to be...

Read More »Consumer Confidence Indicator: Anesthesia

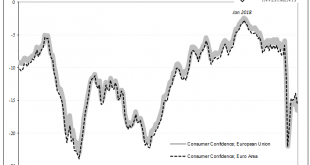

Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom. To interrupt now what has already proved to be a seriously impaired rebound should get people thinking more realistically about 2021. Once...

Read More »It Just Isn’t Enough

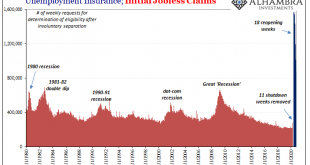

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state. Government officials have decided to pause their efforts for two weeks so as to try and sort out what “might” be widespread fraud. The state is also using this time to get after a substantial backlog of previous initial claims yet to be...

Read More »Who’s Negative? The Marginal American Worker

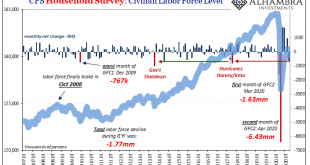

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments. The Establishment Survey. Its cousin is called the Household Survey, or CPS, the Current Population Survey,...

Read More »Monthly Macro Monitor – September (VIDEO)

[embedded content] Alhambra CEO Joe Calhoun and Alhambra’s Bob Williams look at data from the past month and discuss what it means for the economy. You Might Also Like Monthly Market Monitor – July 2020 Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy...

Read More »Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground. And so it was also in the bond market....

Read More »What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying. Zambia did what everyone does, the country floated its first Eurobond ($750 million). At that point, copper was only down modestly from its 2011 peak. By 2014,...

Read More »Monthly Macro Monitor – September 2020

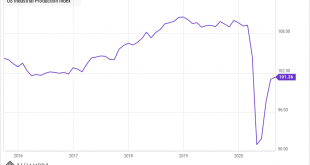

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end. 2nd quarter was a giant downdraft and 3rd quarter saw an initial rapid climb out the giant hole dug by the shutdowns (an own goal of epic...

Read More »Uh Oh, The Dollar Has Caught A Bid

Anyone who follows Alhambra knows that we keep an eye on the dollar. It is a very important part of our process of identifying the economic environment. A rising dollar, when combined with a falling rate of growth, can be a lethal combination. That was the situation in March and of course during the financial crisis of 2008. So the recent rally is something that has got our attention. For now, though, we don’t see any significant stresses in the system that would...

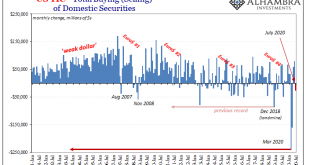

Read More »If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets. Mostly US Treasuries, especially in official hands, but not entirely those. That much is perfectly clear; you can actually see the difference on every chart despite all the QE’s and trillions in bank reserves...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org