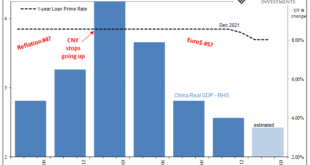

With the 7s10s already inverted, and the 5s today mere bps away, making a macro case for the distortion isn’t too difficult. Despite China’s “upside” economic data today, even the Chinese are talking more about their downside worries (shooting/hoping for “stability”) than strength. In the US or Europe, no matter the CPIs in either place there are cyclical (not just inventory) warning signs all over the place. Aside from these economic concerns, is there a pure money...

Read More »China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

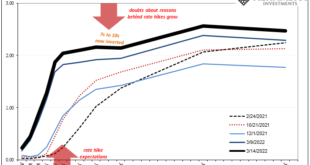

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated. The FOMC will vote to raise the federal funds range (and IOER plus RRP) for the first time since December 2018 Over in China, however, it’s nearly certain to be the opposite....

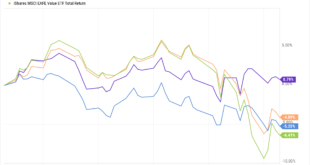

Read More »Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week. I can only see things as they are today and think about similar times in the past and know that...

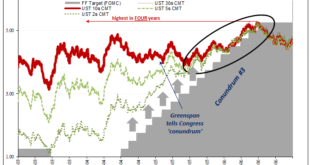

Read More »Another One Inverts, The Retching Cat Reaches Treasuries

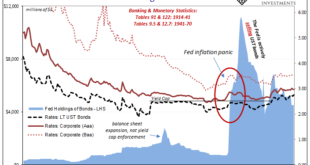

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite. Thus, between July 2005 and June 2006, the entire curve...

Read More »Consumer Prices And The Historical Pain(s)

The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history. Then, suddenly, consumer prices skyrocketed and it left many Americans wondering if there would ever be an end to the massive volatility. At its peak in March 1947, the US CPI had gained 19.67%...

Read More »So Much Fragile *Cannot* Be Random Deflationary Coincidences

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened. Too much money, they said. It began with the Fed’s Reverse Repo (RRP) use suddenly going nuts. From seemingly out of nowhere, this was mid-March last year, and, from what...

Read More »Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past...

Read More »Houston, We Have An Oil (and inventory) Problem

If only, like in the aftermath of the Apollo 13 explosion, we could just radio Houston to get started in figuring out just the way out of our fix. Mission Control would certainly buzz all the right people with the right stuff, summoning the best engineers and scientists from their quiet divans to the frenzied and dangerous work ahead. Sadly, in this context all we could ever turn to is Economists. And from Houston, we aren’t like to extract any more oil. The US...

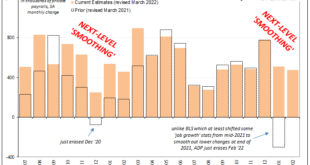

Read More »For The Fed, None Of These Details Will Matter

Most people have the impression that these various payroll and employment reports just go into the raw data and count up the number of payrolls and how many Americans are employed. Perhaps the BLS taps the IRS database as fellow feds, or ADP as a private company in the same data business of employment just tallies how many payrolls it processes as the largest provider of back-office labor services. That’s just not how it works, though. In fact, sampling and...

Read More »SWIFT Isn’t The ‘Nuclear Option’ For Russia, Because Russia can sell the dollars elsewhere and NOT via Swift

As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business. From what little most people know about that essential business, it seems like it has something to do with that thing called SWIFT. Thus,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org