I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week. I can only see things as they are today and think about similar times in the past and know that it is different this time because it is always different this time. I can look back at history to the Crimean War in the mid-1850s when Russia faced off against the West in part of Ukraine and marvel at how little things have actually changed over the last 170 years. I can read “The Charge of the

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, Bear Market, bonds, commodities, credit spreads, Crude Oil, currencies, economy, Energy, Featured, Federal Reserve, Gold, growth stocks, Interest rates, John Maynard Keynes, Markets, NASDAQ, newsletter, Quantitative Easing, Real estate, Russell 2000, Russia, S&P 500, S&P 500, stocks, Ukraine, value stocks, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week. I can only see things as they are today and think about similar times in the past and know that it is different this time because it is always different this time. I can look back at history to the Crimean War in the mid-1850s when Russia faced off against the West in part of Ukraine and marvel at how little things have actually changed over the last 170 years.

I can read “The Charge of the Light Brigade” and marvel at the bravery – or idiocy – of Brits charging down the Russian guns on horseback armed with swords. But I don’t think I will get much information that will be relevant to managing our portfolios today. Yes, indeed, things are different this time.

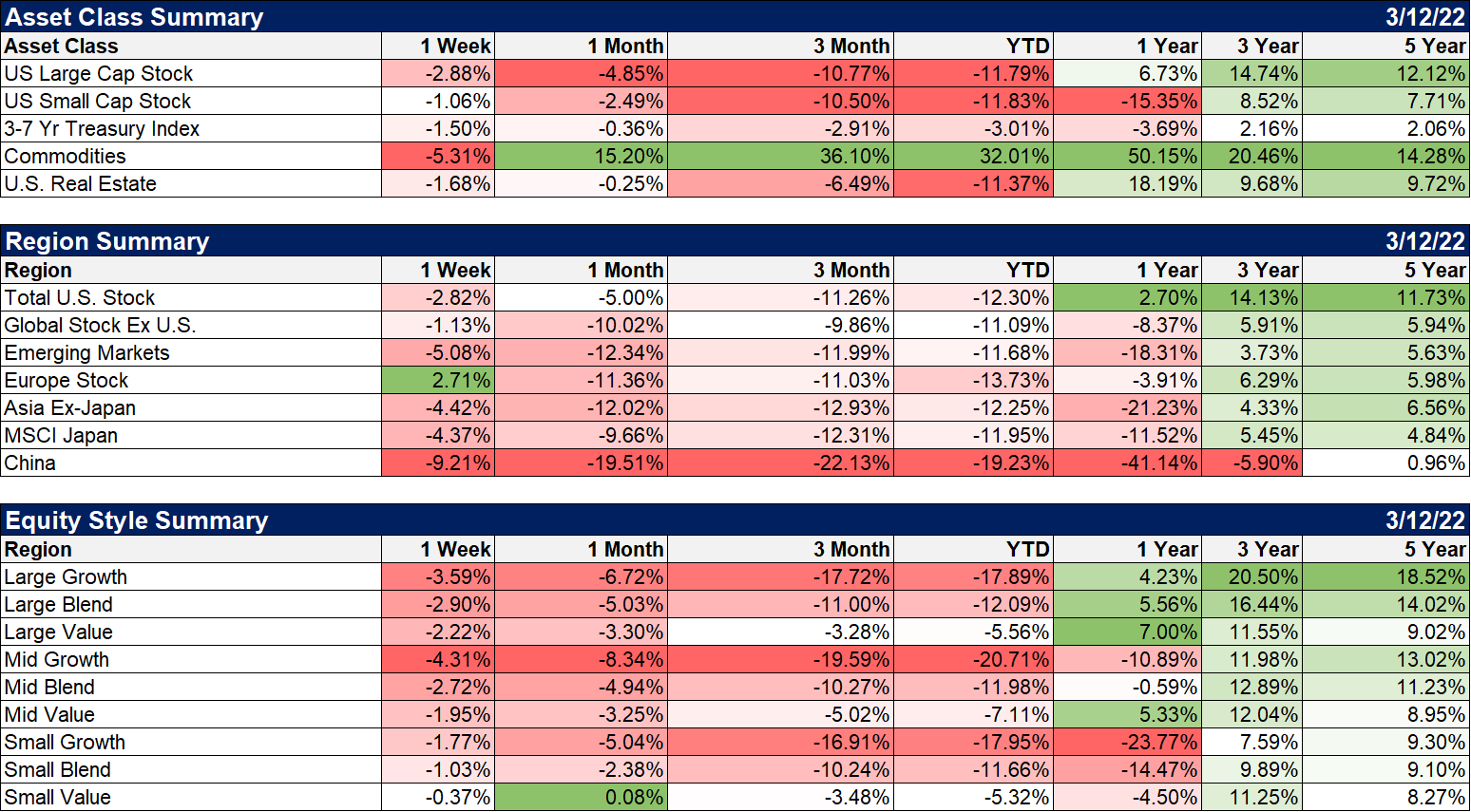

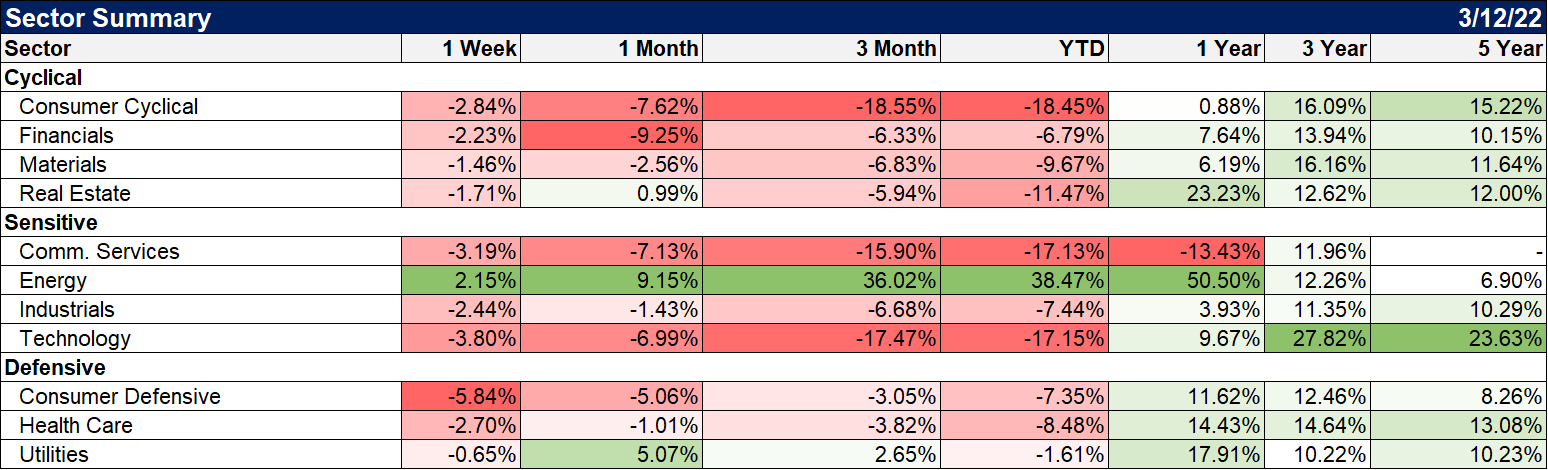

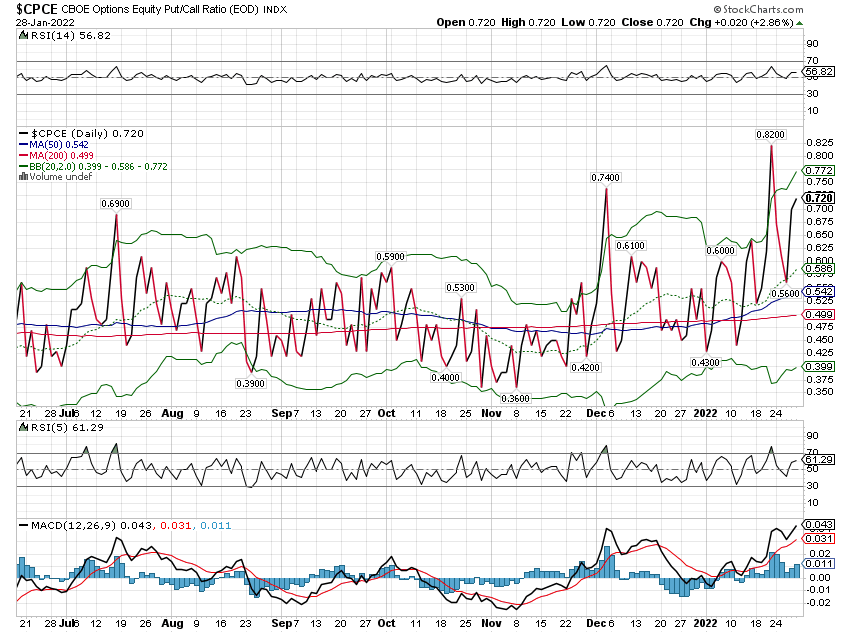

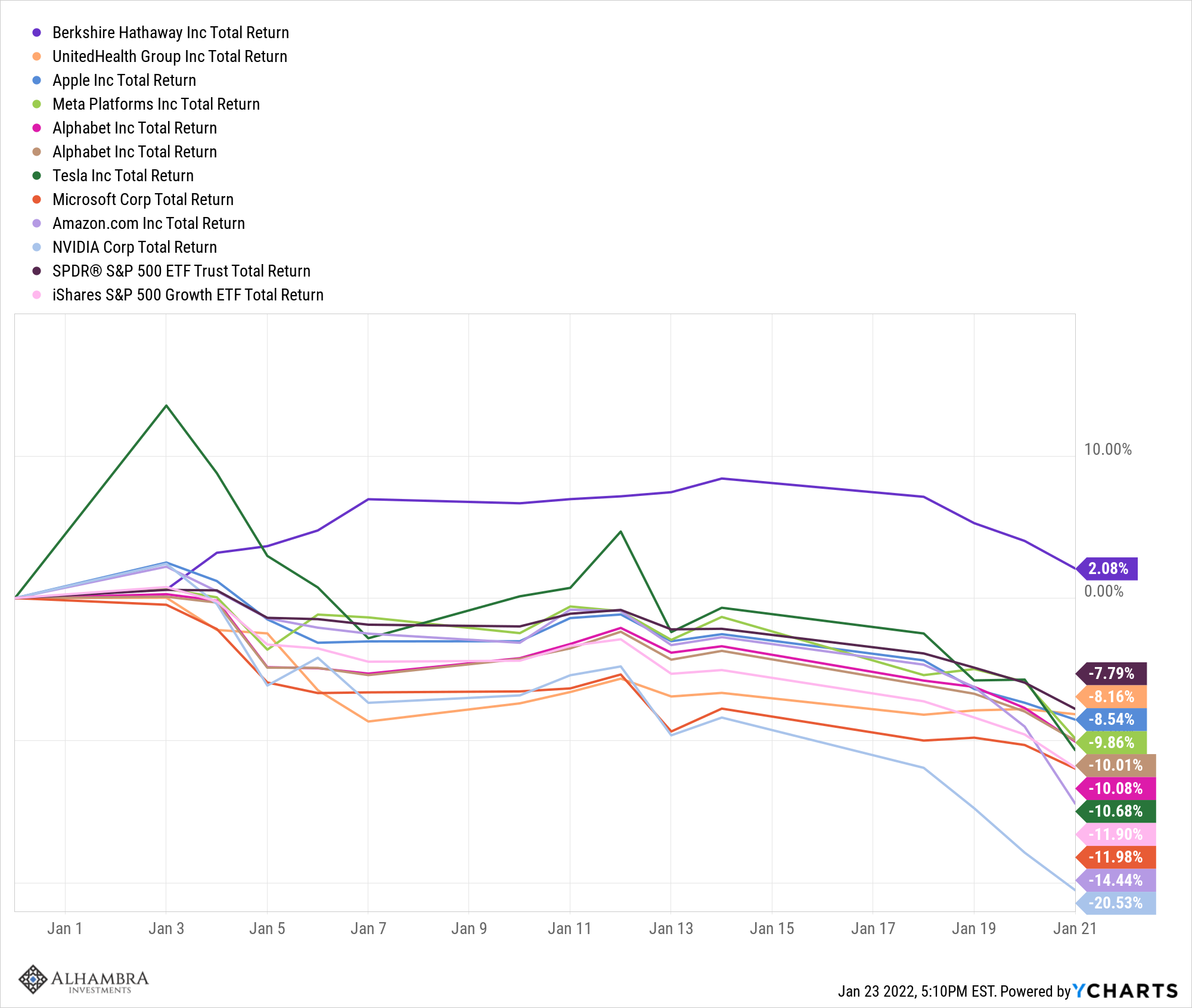

The S&P 500 is down 12.7% from its all-time intraday high, set on the second trading day of this year and so doesn’t qualify for bear market status, which is generally agreed on as -20%. That peak-to-trough drawdown is actually a tad below the yearly average for the S&P 500 since 1950 (-13.6%). In other words, this isn’t anything special although I’m sure it doesn’t feel that way to most people. Why? Because the S&P 500 is just part of the market. The NASDAQ composite index peaked in November and is down 20.8%. The Russell 2000 index of small company stocks peaked in early November, before the NASDAQ, and made its intraday low – so far – on the day Russia invaded Ukraine (-22.9%). Those markets are in a four-month decline that definitely qualifies for the bear tag. European stocks fell 26% from intraday high to intraday low and are still down 21% from the high. That’s a bear market. Chinese stocks (MCHI – iShares MSCI China) are down 49.2% since peaking in February of last year. That is most definitely a bear market. Almost every national stock market in Europe is in a bear market. Korea peaked over a year ago and is down nearly 30%. On the other hand, Latin American markets are up 15.5% YTD despite Chile being in the middle of rewriting their Constitution and Colombia on the verge of becoming the latest country in the region to shift left politically. Who predicted that in their 2022 Outlook?

There are bear markets and bull markets going on all the time. The task of an investor is to own fewer of the former and more of the latter. You’ll never be able to own none of the former and all of the latter – and trying to do so will probably cost you as many bulls as bears.

It is easy to get distracted by all that is going on in the markets and the world more generally. The Fed has stopped QE and will raise interest rates this week by 0.25%. Russia and Ukraine will continue fighting and talking, probably a lot of the first and little of the second. They might come to a ceasefire – or not. Oil prices are up 45% this year and 65% over the last year. That is going to impact the US and global economy but the magnitude is hard to judge. The US is still a large producer of crude oil and we are a lot more energy efficient than in 2008, the last time we had an oil shock. Other commodities are up too, from wheat to corn to palladium. There’s a lot to worry about – and nowhere near a complete list – and there is no way to determine in advance exactly how the economy will adjust to any of them.

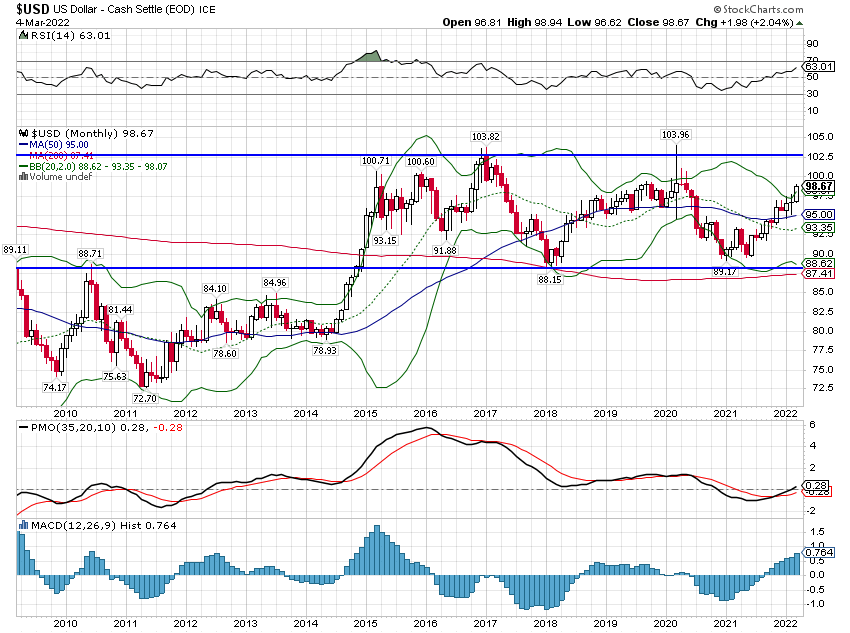

Rather than try to predict how all these things will be resolved – something no one can really do – investors should concentrate on observing and interpreting the present as best as they can. If we didn’t know about Ukraine and were to observe the conditions that exist today in the markets and in the economic data, would we have reason to believe a recession was imminent and that we should change our portfolios in anticipation? That is, after all, what we’re all wondering, right? Recessions are almost always associated with bear markets even if the reverse isn’t necessarily true. So, we all want to see that recession before it gets here and take action to prevent any negative impact on our net worth.

If we block out the emotional impact of Ukraine – which is a horrific situation – and concentrate on the facts we have today, we find this:

- The economy slowed in Q3 last year but re-accelerated in Q4. The first quarter this year is an unknown but the data released so far is not recessionary. The CFNAI actually accelerated to 0.69 in January and the 3-month average sits comfortably above the zero line at 0.42. There are certainly areas to worry about but overall the economic data for January and what we have for February has been solid. The Citigroup Economic Surprise index is positive and rising right now.

- Credit spreads have widened from about 3% at the low to around 4% now. That is a decent rise but nowhere near what we would see in a recession. In 2020, the spread hit 10.9% and in 2008 the spread blew out to 21.8%. It also rose to around 9% in 2011 and 2016 without triggering a recession. Spreads have widened but are not consistent with recession.

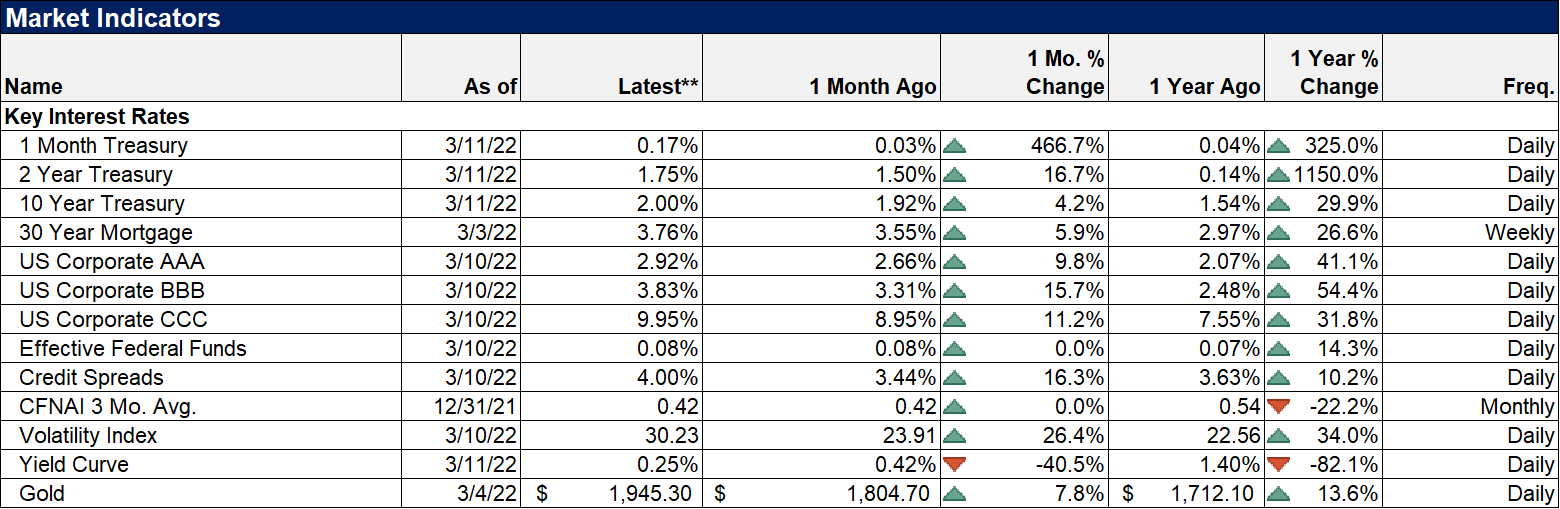

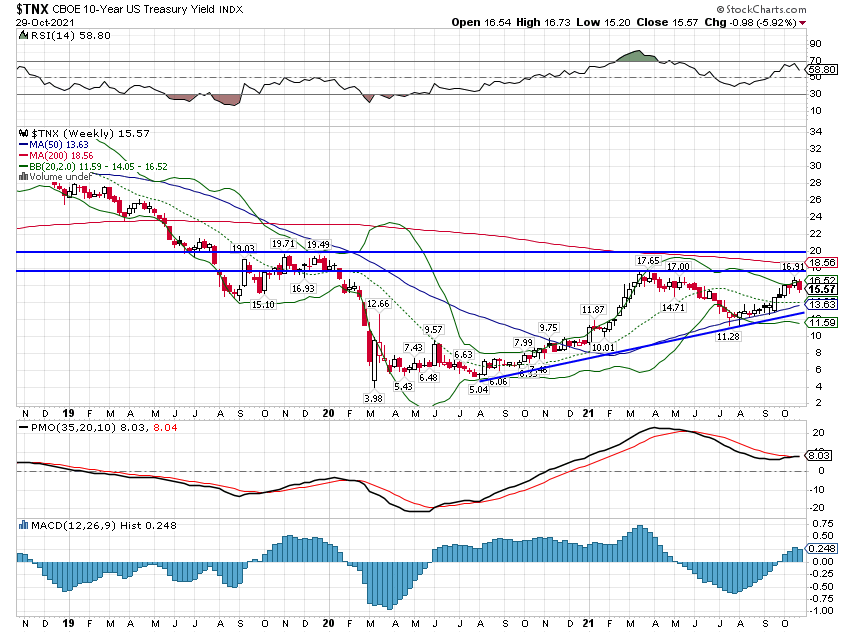

- The yield curve has flattened considerably and the spread between the 2-year and 10-year Treasury yield is currently just 25 basis points. Yield curve inversions are generally associated with recession (although the track record on that isn’t as good as you probably think) so an inversion would be a warning. But we aren’t inverted yet, may not invert and even if we do it is an average of 16 months from inversion to recession.

- Interest rates are rising although real rates remain negative. This is the most worrisome of indicators in my opinion. Negative real rates say absolutely nothing good about future real economic growth. Real rates had been rising prior to the Ukraine invasion so this might be temporary but if not, it probably means rising prices are going to stick around for a while. And it probably also means that real growth isn’t going to be all that robust.

There are some other indicators and markets we track that also show some stress but we don’t see anything that says recession is imminent. The macroeconomic picture does not dictate any change in our strategic allocation. If we thought recession was near, we would shift our portfolios to a more conservative stance but right now we have no evidence on which to base such a change.

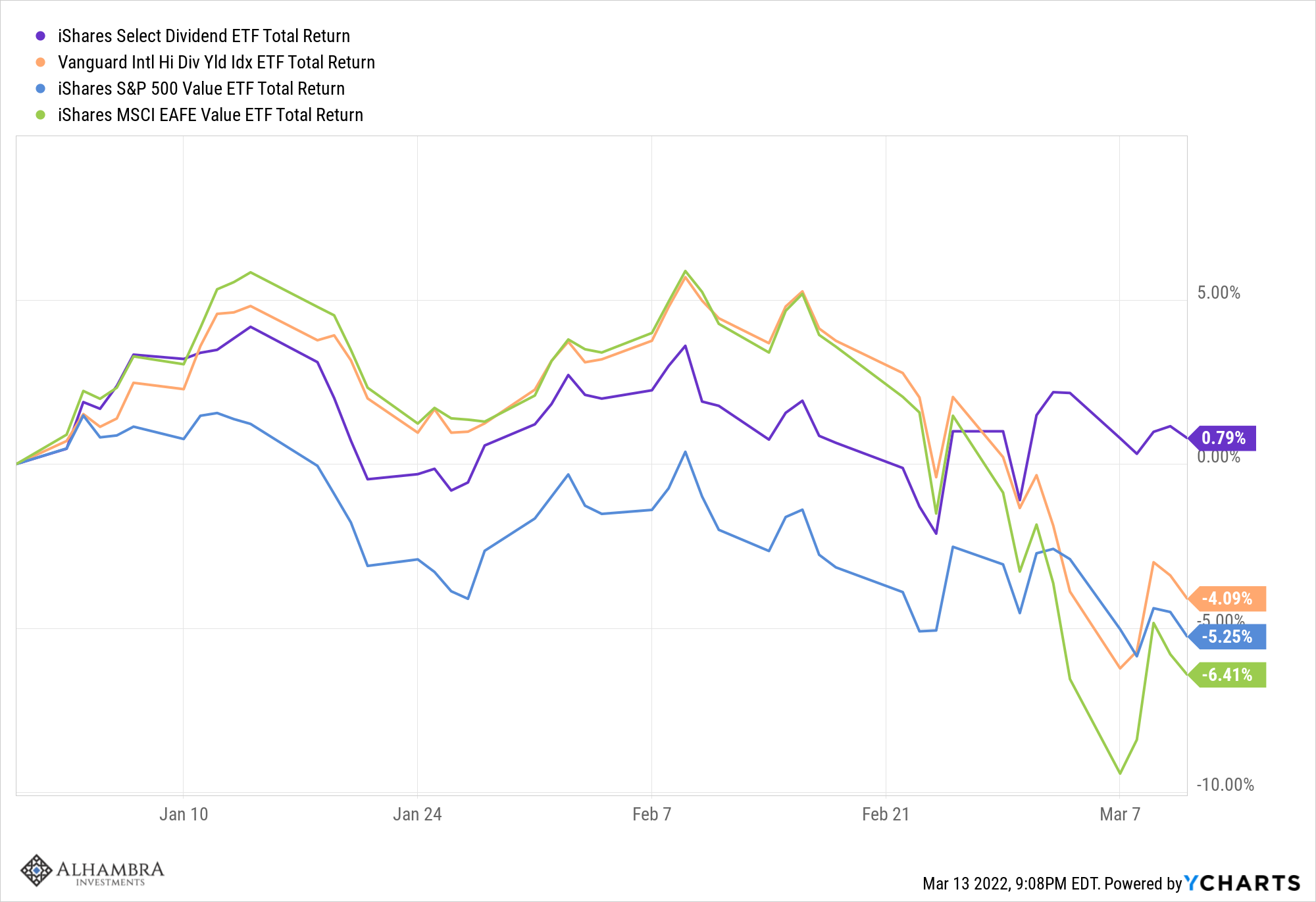

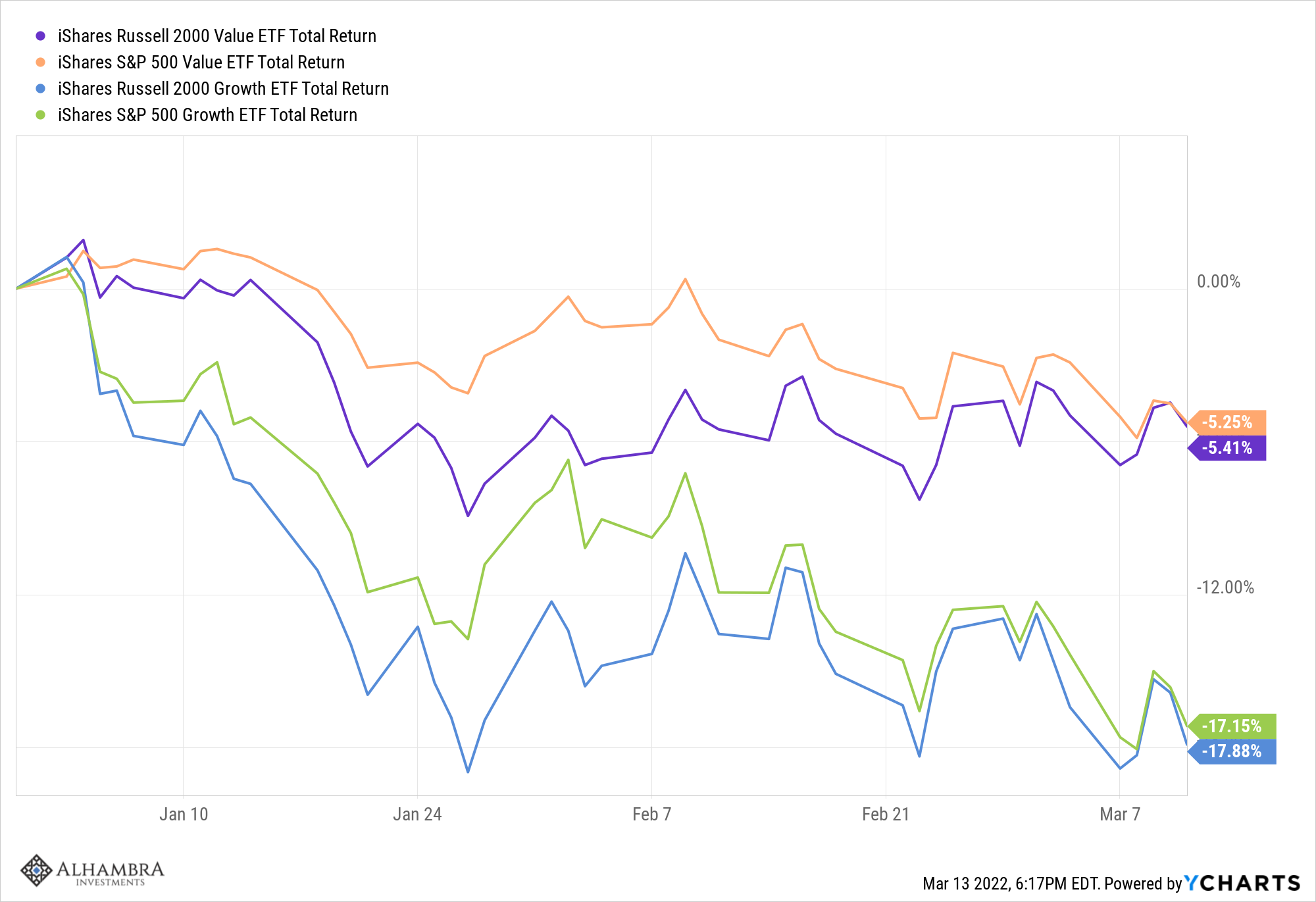

The only thing that should be affecting your portfolio right now is momentum. Value and dividend stocks are leading right now and that is true whether you look at US or non-US stocks:

It seems obvious in retrospect but the key to outperforming during this correction was not to avoid stocks altogether but to avoid growth stocks. Or to put it another way, to pay attention to valuations. We drastically reduced – and never bought for newer clients – the S&P 500 last year and haven’t owned the NASDAQ index. We did that because the valuations made no sense to us – and frankly some of them still don’t. Most of our equity exposure is in value and dividend stocks. We did have an allocation to EM stocks but we sold it last Monday because the rising dollar – and Putin – forced our hand. The impact on our portfolios was negative but small (less than 1% overall for most accounts).

We own all of the above ETFs for ourselves and clients.

Many of the large, popular stocks are still grossly overvalued in my opinion. And you don’t have to get into real speculative names to see what I mean. Clorox was down 10% last week and now 43% since its peak in mid-2020. If you own it, I’m sorry to be the one to tell you but it is still absurdly priced at 30 times next year’s earnings estimate for a company with 5-year average revenue growth of less than 5% and earnings growth even lower. Okay, I hear you, that’s a pandemic stock and doesn’t count so how about Kimberly Clark trading at 20 times earnings and negative earning growth over the last 5 years? That one was down 9% last week. There are still a lot of stocks like these that are overpriced relative to their present and their future. But the list is getting shorter. Only about a third of the stocks in the S&P 500 are above their 200-day moving average, a widely used measure of uptrend vs downtrend, bull or bear. The bad news is that if the S&P 500 does do the complete bear market, that number is likely to fall into the teens.

I would also point out that many of the technology stocks that were so overpriced before this selloff have come down quite a bit. Some of them look downright reasonable compared to Clorox and Kimberly Clark and they’re growing a lot faster. I wouldn’t call tech cheap yet but it is certainly getting there. Only 18% of the NASDAQ stocks are above their 200-day MA. That percentage has been lower in the past but not by much.

For diversified investors, the design of your strategic portfolio (your long-term target allocation) was a big factor for your returns. If you have commodities and gold in your strategic allocation, you have outperformed (we own various commodity and gold ETFs). If you didn’t, it was more likely tactical decisions that determined your return. Did you own growth or value stocks? US or international? Did you own high-quality dividend stocks? The gap between good and bad tactical decisions this year has been wide. The return difference between value, growth, and high dividend is pretty extreme; the Select Dividend ETF (DVY) has outperformed the S&P 500 growth (IVW) by over 17% YTD. But the gap between a strategic portfolio that owns commodities and one that doesn’t is pretty wide too. The standard 60/40 stock/bond portfolio is down over 9% this year. Adding just 5% in gold and 5% in commodities would have reduced that loss by over a third to less than 6%. But there are no free lunches; if you included commodities and gold in your portfolio for the last decade (that’s what a strategic allocation means) they’ve mostly been a drag on performance. But then, the purpose of those assets is to reduce the overall volatility of your portfolio, to act as a hedge against the other assets in your portfolio. And they have proven their worth this year even as bonds – the traditional diversifying asset – have provided little cushion.

“It is better to be approximately right than exactly wrong.”

Not John Maynard Keynes

“Striving to better, oft we mar what’s well.”

The Duke of Albany in King Lear

Or as it is better known:

“A wise Italian says that the best is the enemy of the good.”

Voltaire

Or as we said in the Navy, “keep it simple, stupid”.

Tags: Alhambra Portfolios,Alhambra Research,Bear Market,Bonds,commodities,credit spreads,Crude Oil,currencies,economy,Energy,Featured,federal-reserve,Gold,growth stocks,Interest rates,John Maynard Keynes,Markets,NASDAQ,newsletter,Quantitative Easing,Real Estate,Russell 2000,Russia,S&P 500,stocks,Ukraine,value stocks,Yield Curve