The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history. Then, suddenly, consumer prices skyrocketed and it left many Americans wondering if there would ever be an end to the massive volatility. At its peak in March 1947, the US CPI had gained 19.67% (unadjusted) year-over-year. The price trend began in July 1946, spiraling out of control just that quickly. Worse, while consumer prices did substantially decelerate after March ’47, they would continue rising at better than an 8% rate (apart from a single month) all the way until August ’48. That had

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, CPI, currencies, Deflation, economy, eurodollar futures, Featured, Federal Reserve/Monetary Policy, FOMC, inflation, jay powell, Markets, newsletter, rate hikes, supply shock, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history. Then, suddenly, consumer prices skyrocketed and it left many Americans wondering if there would ever be an end to the massive volatility.

At its peak in March 1947, the US CPI had gained 19.67% (unadjusted) year-over-year. The price trend began in July 1946, spiraling out of control just that quickly. Worse, while consumer prices did substantially decelerate after March ’47, they would continue rising at better than an 8% rate (apart from a single month) all the way until August ’48. |

|

| That had meant for two years, yes, still “transitory” “inflation.”

Though those out the Federal Reserve had been utterly convinced otherwise, because of course, how this sharp and intense burst of price gains really was true inflation. Chairman Thomas McCabe went up to Capitol Hill practically begging Congress for discretionary authority to restrict credit using reserve requirements (even after the massive debacle of 1937). How sure was McCabe that out-of-control money was going to unleash further consumer price hell? He told the House Banking and Currency Committee (why don’t they call it that anymore?), “We are convinced that, so long as the present situation lasts, it is important to restrict further credit expansion and to promote a psychology of restraint on the part of both borrowers and lenders.” Even back then, so much psychology; at least they were more open about it. Anyway, this was August 1948. As it would turn out:

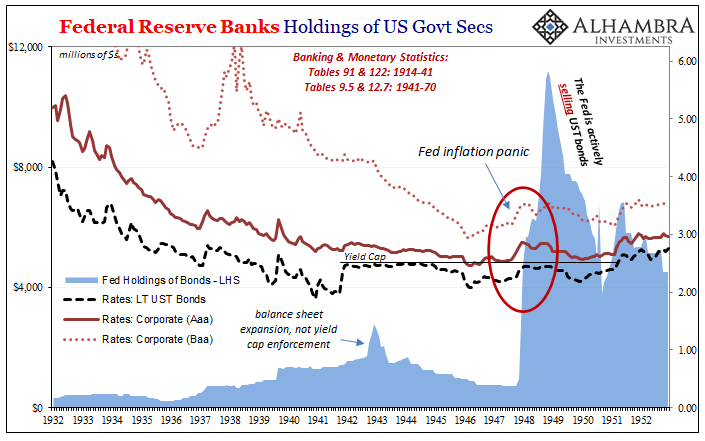

The Fed would even go on rebating Treasury bonds back into banks’ awaiting hands, particularly since outright deflation would yet again revisit the American economy. Back and forth it would go, intense transitory price spikes followed by recession and price reversals – another such would follow in 1950-51. |

|

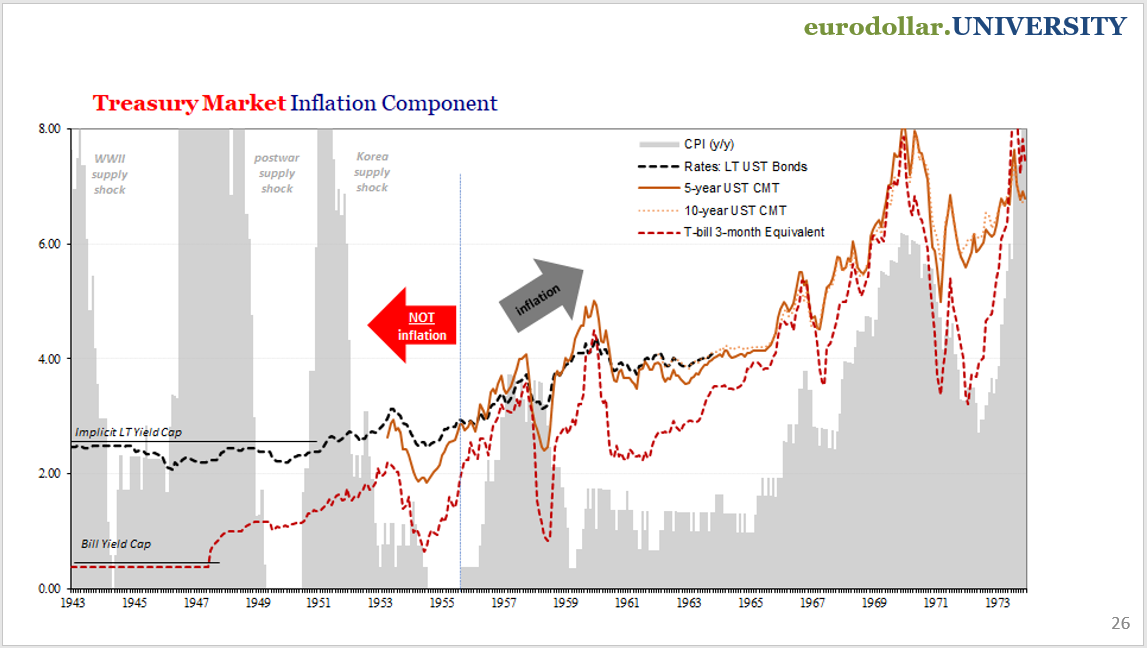

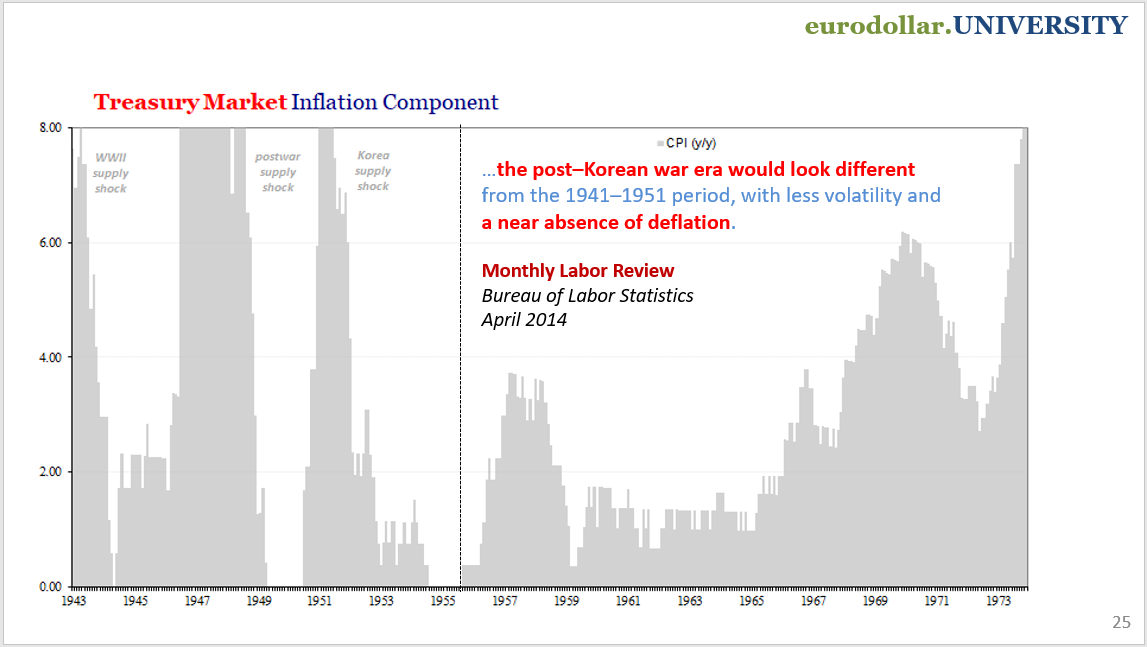

And so it went in the era immediately following 1929 up to around the mid-fifties, an unmistakable pattern which eighty-five years later the government’s CPI administrator, the BLS, couldn’t help but notice the remarkable distinction, though, to this day, offering no explanation for it.

|

|

| Although severe inflation and even price controls would return, the post–Korean war era would look different from the 1941–1951 period, with less volatility and a near absence of deflation.

What could possibly have rearranged the entire order of consumer price behavior around, oh, 1955 or so? |

|

|

|

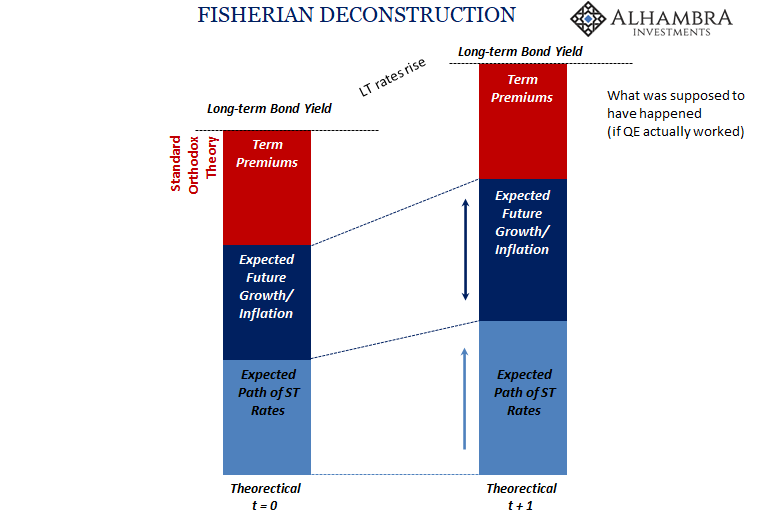

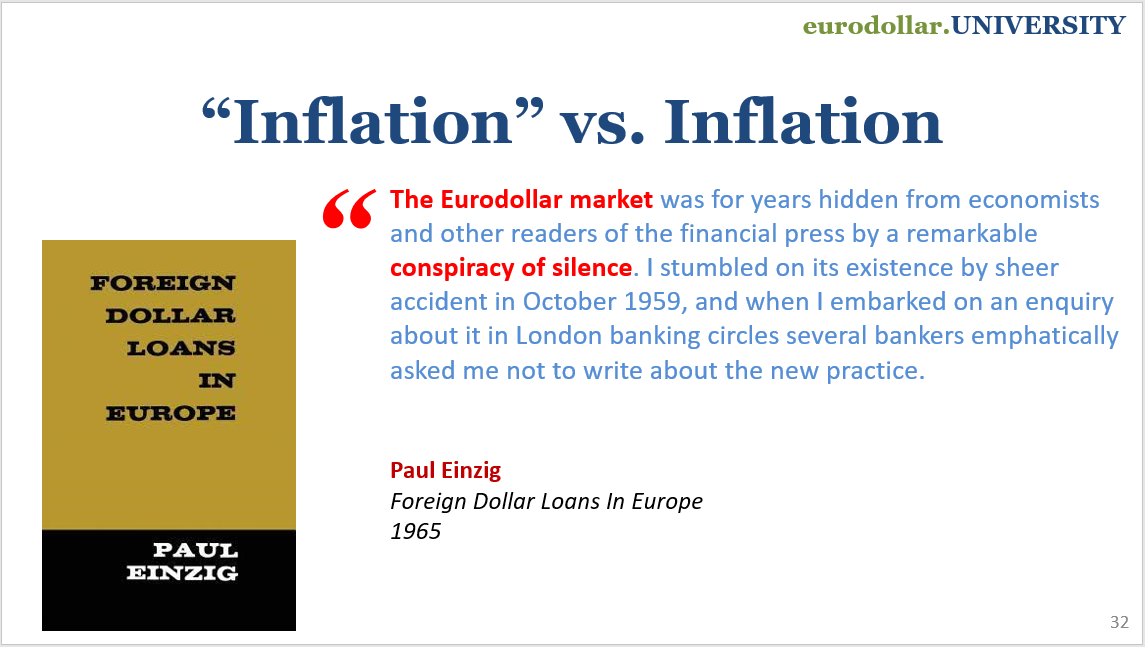

Par for the official course, it wouldn’t be until 1964 when the BIS finally got around to looking into this whole eurodollar thing. One reason why scholars there undertook the examination (not published until the organization’s 34th Annual Report) were growing concerns and even complaints that such a radical shift in global money might represent exactly what’s noted by the charts above.From that report:

As to the latter, circumventing domestic currency, yep, that was that whole Italy thing (read about it here). |

|

Insofar as the former, “hampers efforts to control inflation”, authorities at the BIS responded with a big nothing; reassuring how no one should need to worry about it.

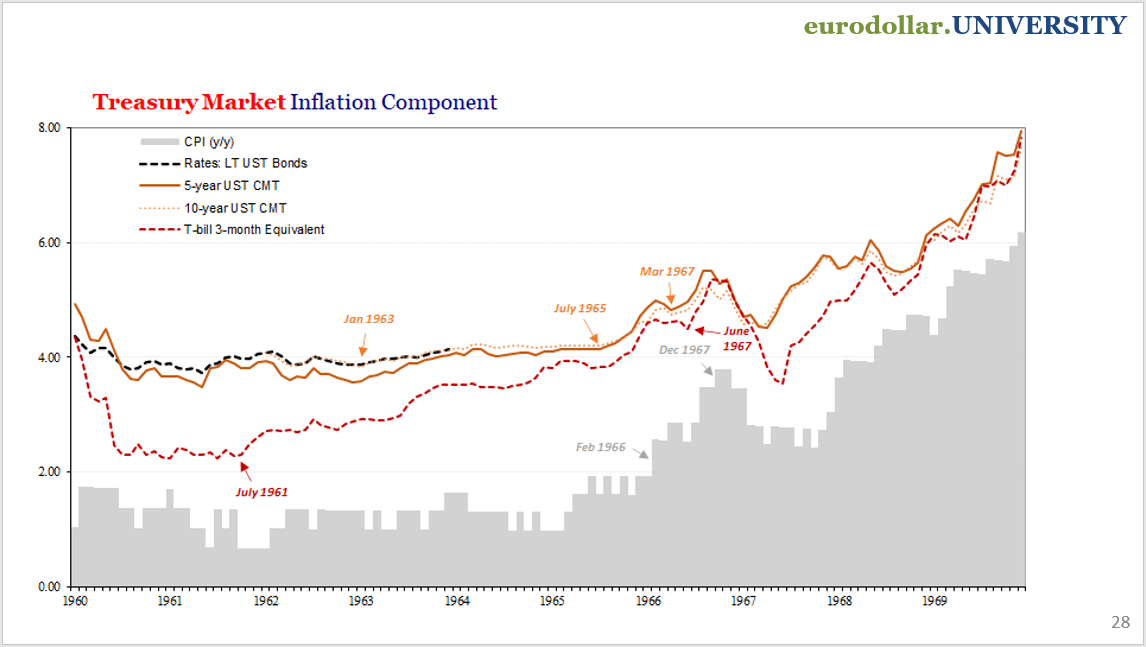

Yeah, this was written, the world told not to worry about any inflationary dangers from such gross monetary upheaval, in…1964. After having messed up the Great Depression, they spent more than a decade fearing an inflationary aftermath only to then abandon those concerns right in time for money to change and the Great Inflation to begin. How can authorities everywhere, the BIS, the Fed, whatever, continuously be so bad at this whole money, banking, and inflation/deflation business? For one, they never listen to bonds. On the contrary, the default position – going all the way back a century – always seems to be to discount their deeply fundamental signal for various imaginary reasons if only to dismiss it particularly when that signal doesn’t fit the overall narrative (be it inflation or deflation); which seems to be most of the time. Some things never do change. |

|

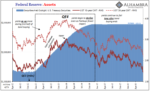

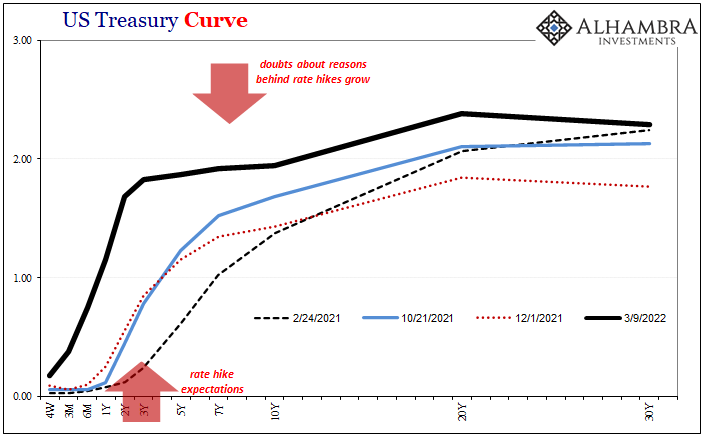

| The Federal Reserve is once more seeing red on inflation when, yields and bonds, there remains none to be found. Rate hikes will start in a matter of days regardless.

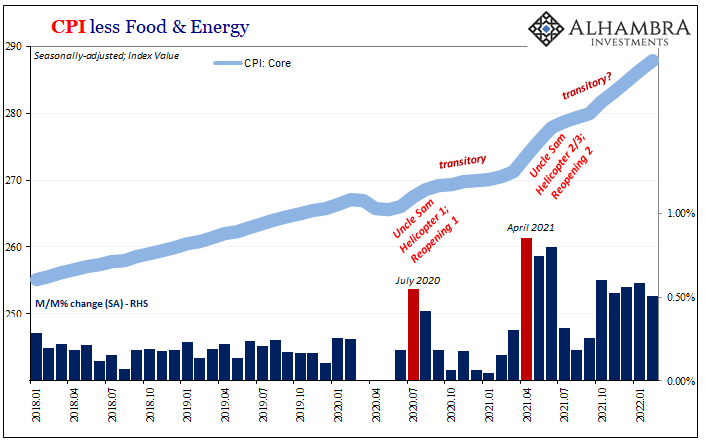

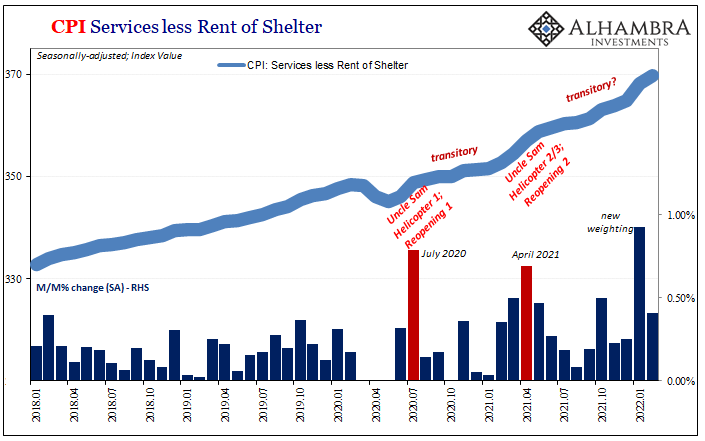

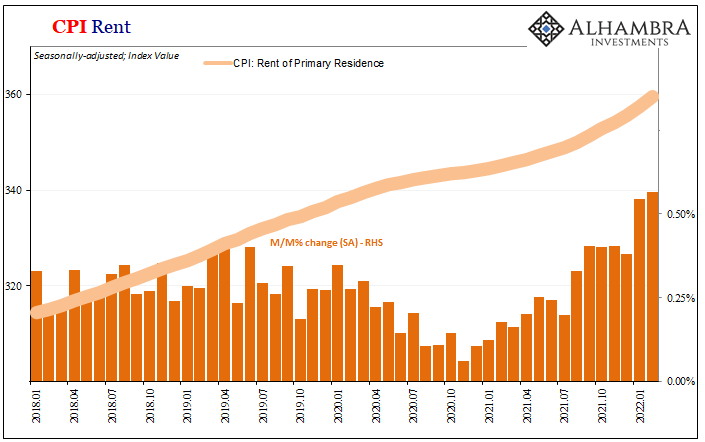

For consumers, they are caught in a vise of supply shocks, with all the basics of living, gasoline, food, and now rent, contributing the most. For everyone, this is indistinguishable from inflation; and if it can be sorted as for a different cause, no one really cares given the pain being forced on them. Causation does matter; if there isn’t money, there isn’t inflation. And supply shocks can go on for some time wreaking havoc on economic balances, but they will end. |

|

|

|

|

|

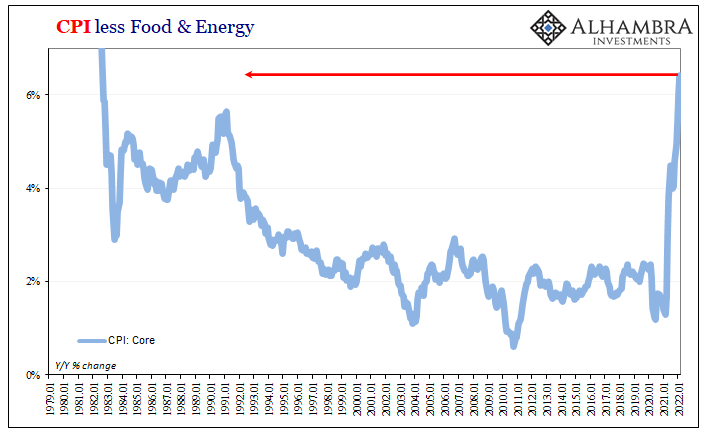

| According to the latest CPI report for the month of February 2022, we’ve reached a whole year; long enough that few remain to be swayed back to the notion this can still be temporary.The only good part, if you want to see it that way or call it such, is how the rate of change for the overall price bucket remains nowhere near 19.67%. Instead, the headline rate has accelerated to 7.87% which is more than enough for anyone to stop caring about any distinction between those numbers. After all, the core CPI was up 6.41%, too.

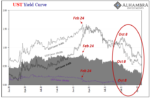

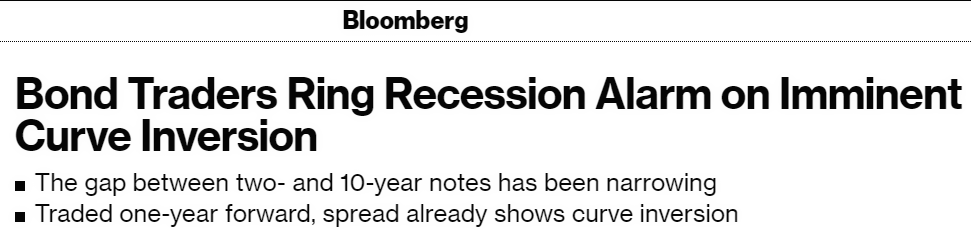

There are only degrees of pain here. And it’s not like the bond market is offering some tangible shade of hope by refusing to climb aboard and side with Mr. |

|

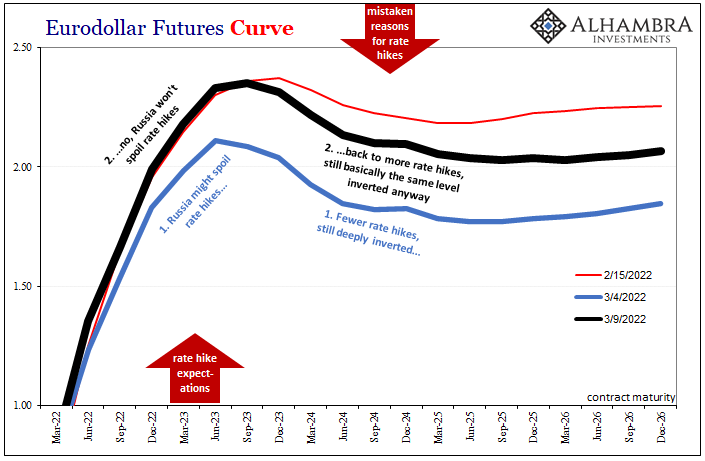

| Powell. While yields are clearly pricing “transitory” still to this late date, they’re doing so increasingly in the expectation of some maybe inevitable degree of demand destruction as the trend’s result.

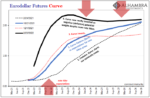

Go back to the BLS in 2014 for the non-eurodollar expansion version of price behavior, an era which had “featured alternating periods of sharp inflation and genuine deflation.” You might ask why the eurodollar futures curve is so upended right now despite these consumer price numbers and the Federal Reserve clearly claiming an itch to hawkishly rampage. The good news, such that it might be, being in the post-2008 monetary condition which means, like the pre-1955 condition, the consumer price shock bad as it is will not actually last for decades (as one unfortunately money-illiterate former policymaker has recently claimed). The bad news is that whole thing about frying pans and fires. |

|

|

|

Tags: Bonds,CPI,currencies,Deflation,economy,eurodollar futures,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,jay powell,Markets,newsletter,rate hikes,supply shock,U.S. Treasuries,Yield Curve