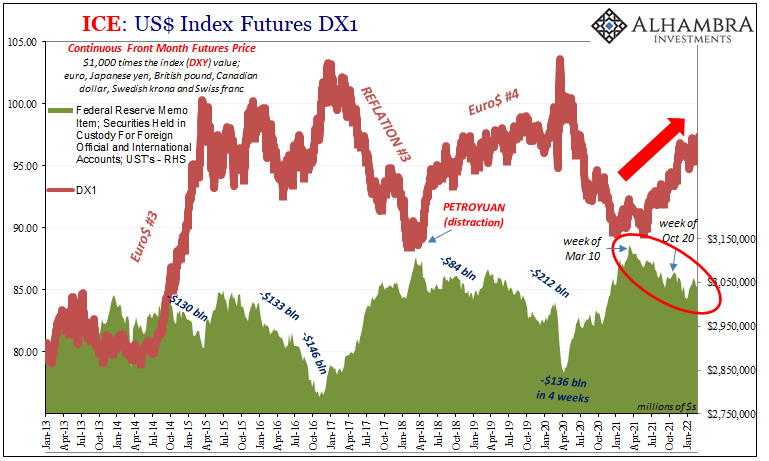

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened. Too much money, they said. It began with the Fed’s Reverse Repo (RRP) use suddenly going nuts. From seemingly out of nowhere, this was mid-March last year, and, from what every last bit of “expert” commentary claimed, a combination of the government drawing down its TGA account in anticipation of debt ceiling difficulties along with the Fed’s gargantuan QE6 still creating bank reserves by the tens of billions per week. The world, they said, was just awash in money.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Collateral, currencies, Deflation, Dollar, economy, Featured, Federal Reserve/Monetary Policy, fedwire, India, Markets, newsletter, Repo, repo fails, reverse repo, rrp, rupee, U.S. Treasuries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened.

Too much money, they said. It began with the Fed’s Reverse Repo (RRP) use suddenly going nuts. From seemingly out of nowhere, this was mid-March last year, and, from what every last bit of “expert” commentary claimed, a combination of the government drawing down its TGA account in anticipation of debt ceiling difficulties along with the Fed’s gargantuan QE6 still creating bank reserves by the tens of billions per week. |

|

| The world, they said, was just awash in money. |  |

|

|

| A veritable flood.Looking for a home, the RRP appeared to be doing its stated job – to “soak up” any and all excess reserves if to maintain short run money rates within stated policy tolerances.

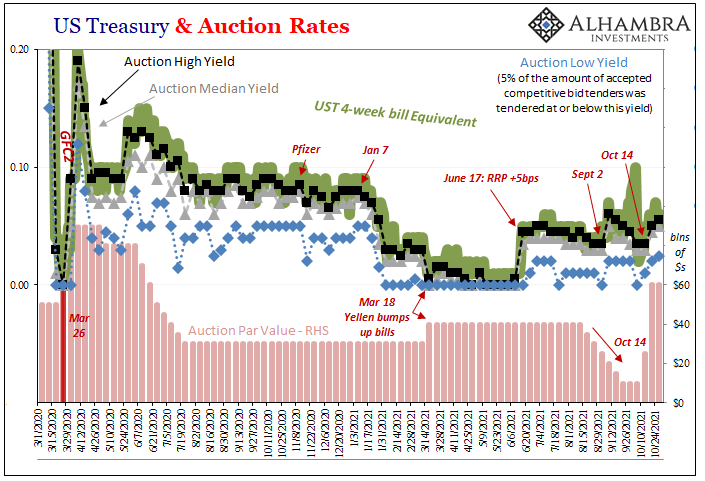

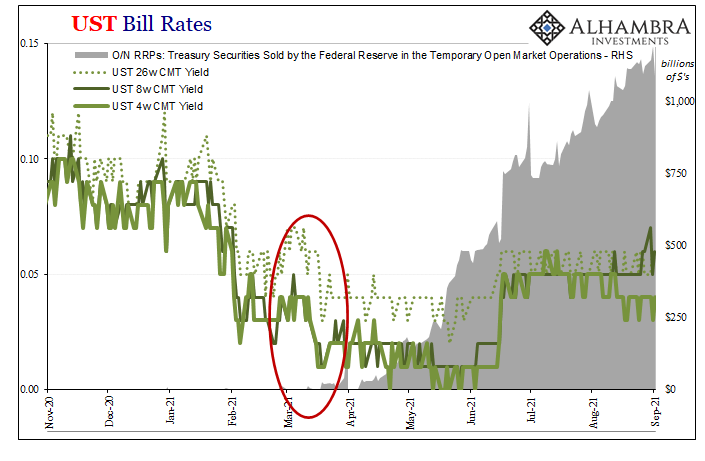

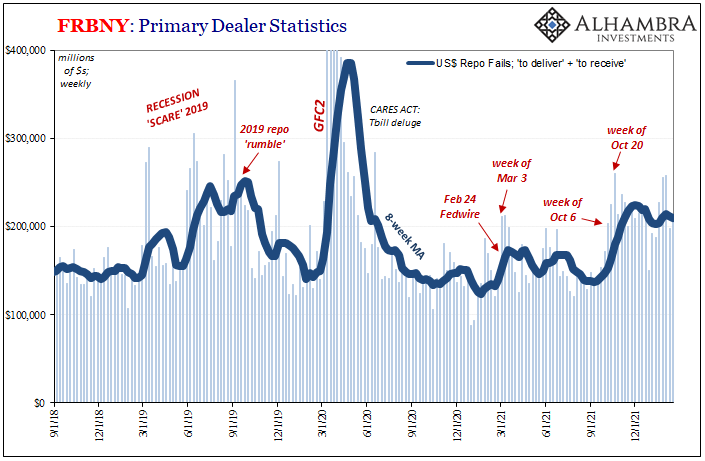

No one ever explained, however, why mid-March. Just out of the blue, the RRP got useful. Other things, big things, happened around the same time, though. For one, repo fails (as discussed last week). And while the mainstream has its preferred excuse for these, too, an eruption of fails was actually consistent with the more likely explanation for RRP – not just what but, very importantly, also when.

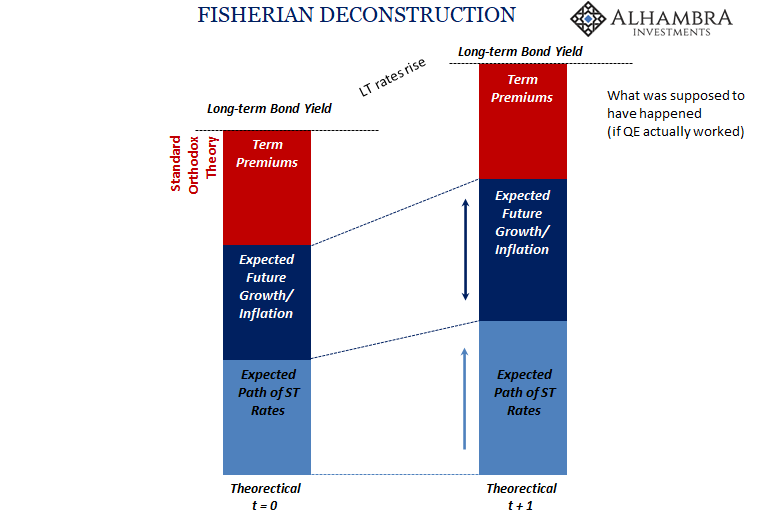

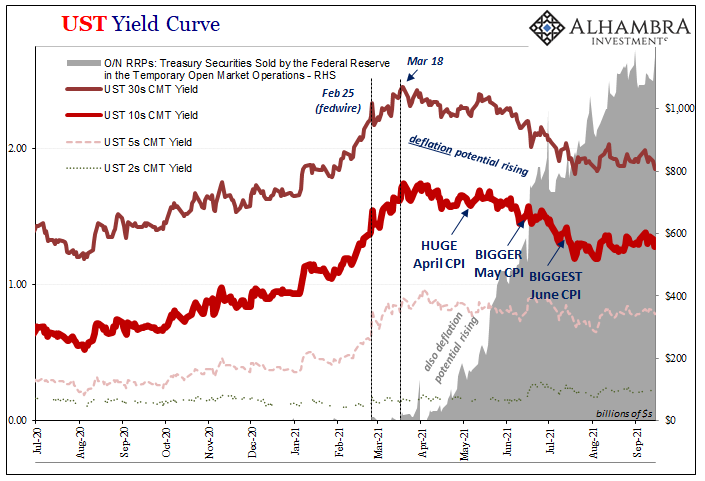

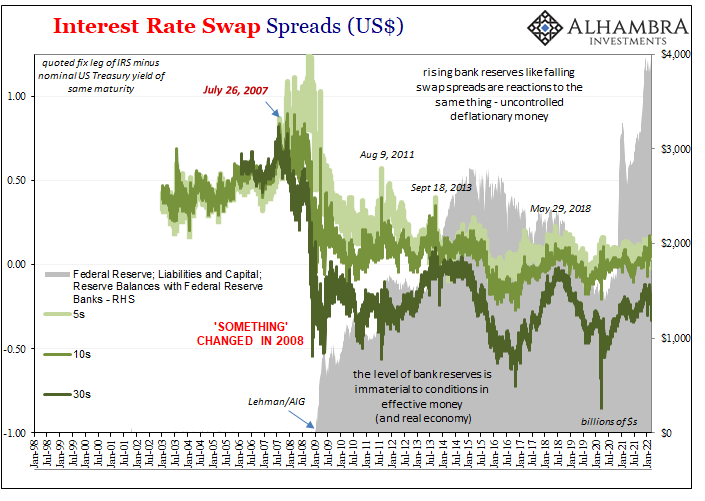

If we view the RRP – explained yesterday – as a possible, even decent indication of collateral constraint or scarcity, then what you see above actually makes perfect sense. Reflation is and has been real, but like all those (three) which came before this latest one it already is being undercut by deflationary, anti-growth monetary deficiencies only starting in the world’s collateral streams. |

|

| Bill prices fell (again) sharply mid-March, meaning higher than usual collateral demand. This appears to have led cash-rich non-banks like MMF’s to scale up at the Fed’s RRP unable to find collateral-rich cash borrowers. Because of this condition, not only are bills in high demand eventually LT UST’s are sought out and bid up as a slightly lesser replacement for sky-high bills.

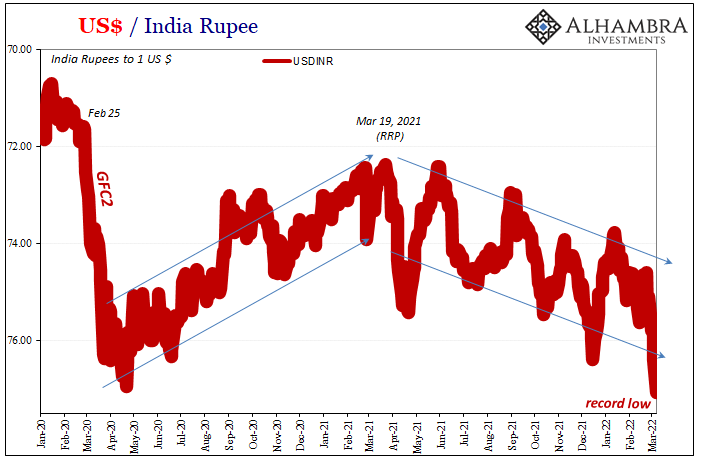

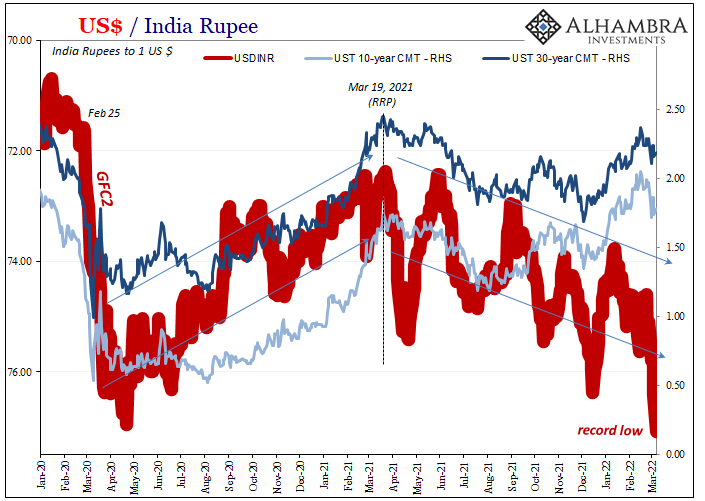

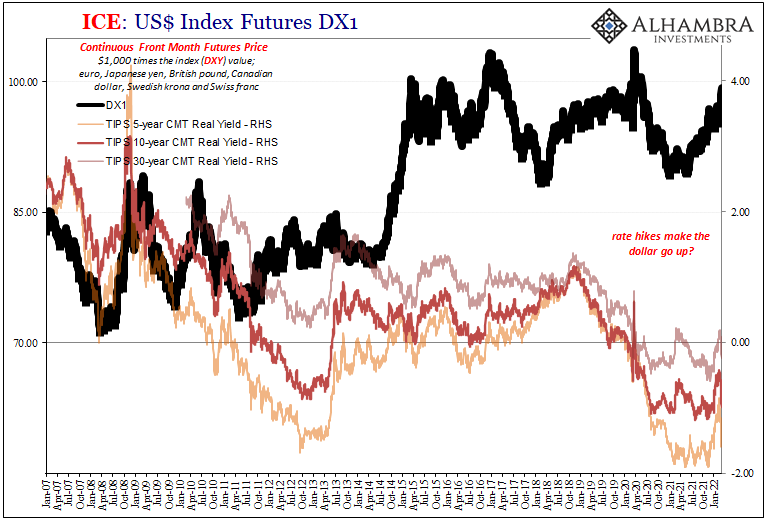

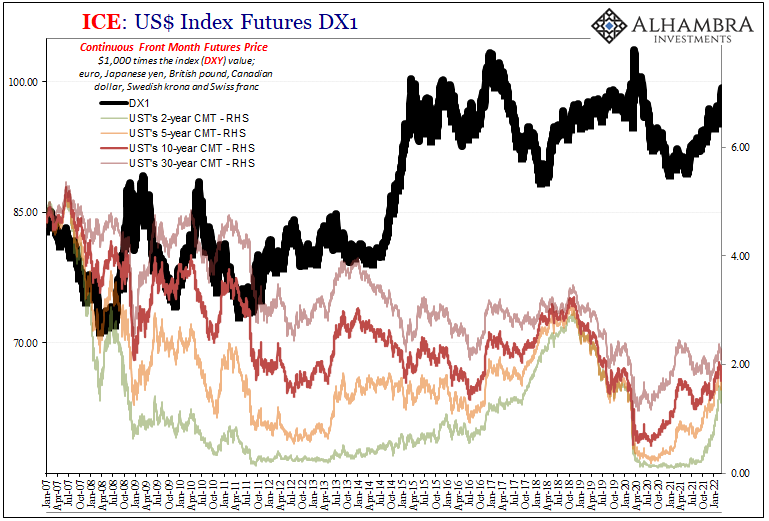

Rather than “too much” money, it was immediately deflationary conditions being mixed with further much greater down-the-road deflationary potential. As such, the RRP correlated only too nicely with falling nominal Treasury yields as well as the preceding rise in repo fails. But, how, why, what India? Among the currency pairs available across the world, here’s one that is as little directly connected as anywhere. The eurodollar touches India as it does everywhere else, of course, but India is, at the margins, a pretty self-contained system at least as one might count nowadays. Too much money, too big a flood of digital dollars, wouldn’t that be hugely dollar negative especially against something like the rupee? The greenback’s exchange value against it really should have been falling if not quickly. Yet, another correlation among all those others: |

|

|

|

|

|

| It’s as clear as day, or at least it would be if the world wasn’t obstructed by so many leftover myths and legends, most of which keep the Federal Reserve and its bank reserves at the center of the world.

Quite simply, the eurodollar system can’t afford the luxury of so much self-denial, not with ever-present, never-fixed liquidity risks paramount among the minds of its global participants. Therefore, February 24, 2021, should have been nothing yet we continue to follow in its darkening shadow. Before then, global reflation. Not quite a flood of money, but at least less of a drag when compared to 2020 (not saying much). |

|

| Then all that stuff late February spilling over into mid-March, suddenly repo fails (collateral), RRP goes nuts (collateral), India’s rupee stops (generally speaking) rebounding, and the yield curve (like other curves) begins to flatten announcing the implication of all these things.

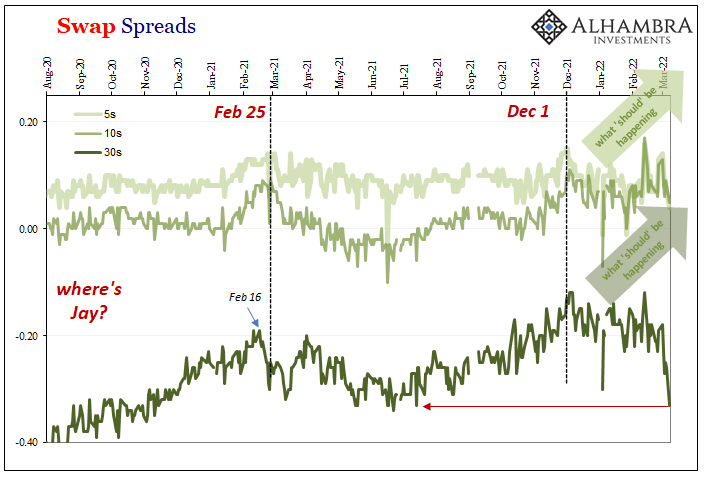

Swap spreads, too, what may otherwise seem a whole bunch of random coincidences is decidedly un-random, all eurodollar, entirely deflationary no matter what and how far the US CPIs. |

|

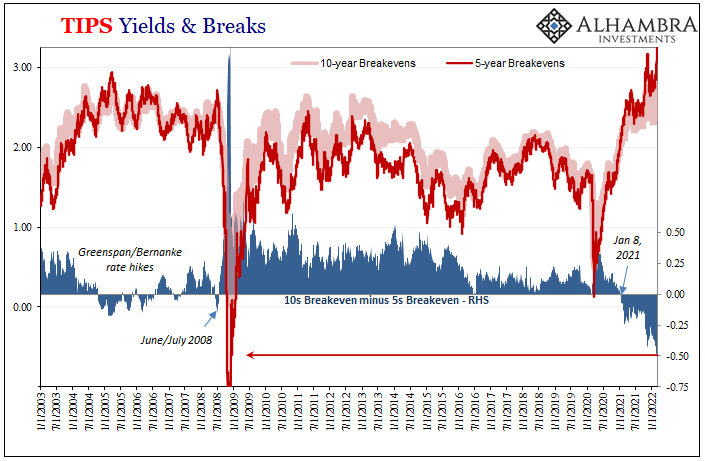

| India’s rupee has today dropped to a new record low as the yield curve flattening continues and continues to flirt with invert-sion. The eurodollar futures curve way upside down for weeks, inverted going back to early December. At the same time, swap spreads outright rejecting rate hikes (30-year swap spread lowest since last July).Even the TIPS market is doing the same – if in its own lurid way (record upside down here, too). |  |

| The entire great span(s) of the global monetary and financial system is drawn together warning the world that the Fed’s version of events is all wrong. The risks have long since piled up the other way. And it’s not just about the US economy and its CPI rates, rather there’s harm which is being actively injected across the whole planet right now.

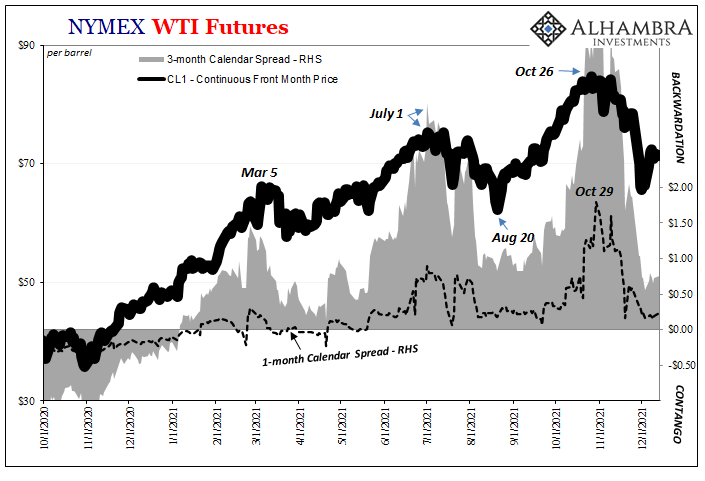

Oil is a big one, and some of it lately is indeed Russia, but this really goes back to last February and March. Long before war in Eastern Europe, the shadow money system has shown itself to be increasingly fragile. That was the thing about Fedwire, and all the at-first tiny little fractures that have since radiated out from it spreading all over the world. All these things have been building right out in the open for over a year already. |

|

No one knew, hardly anyone still knows, because the Fed and bank reserves are said to be the full extent of the monetary universe. Even India’s rupee “knows” this can’t be true.

|

|

Tags: Bonds,collateral,currencies,Deflation,dollar,economy,Featured,Federal Reserve/Monetary Policy,fedwire,India,Markets,newsletter,repo,repo fails,reverse repo,rrp,rupee,U.S. Treasuries