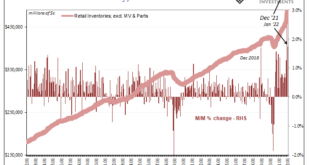

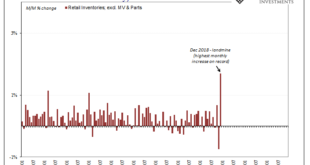

Retail sales stumbled in December, contributing some to the explosion in inventory across the US supply chain – but not all. Inventories were going to spike even if sales had been better. In fact, retail inventories rose at such a record pace beyond anything seen before, had sales been far improved the monthly increase in inventories still would’ve unlike anything in the data series. And now those inventories have been revised upward. While so, the more...

Read More »The Red Warning

Now it’s the Russian’s fault. Belligerence surrounding Donbas and Ukraine, raw materials and energy supplies to Europe threatened by Putin’s coiled bear. Why wouldn’t markets grow worried? There’s always a reason why we shouldn’t take these things seriously, or quickly dismiss them out of hand as the temporary product of whichever political fear-of-the-day. This isn’t to write that these things aren’t important in any sense; no doubt anyone in or near Ukraine right...

Read More »Weekly Market Pulse: Are We There Yet?

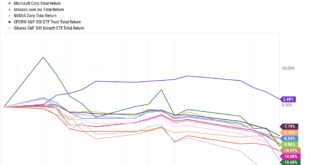

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness. I know a lot of people liked that rally into the close on Friday and it was a nice way to end a wild week but it also shows that traders/investors are all too...

Read More »FOMC Goes With Unemployment Rate While This Huge Number Happens To Far More Relevant Economic Data

The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters. All that was missing by then was the economic data to confirm...

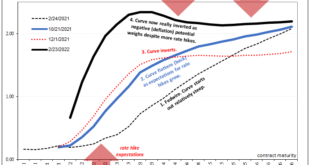

Read More »After Today’s FOMC, Yield Curve Is Already As Flat As It Was In Mar ’18 **Without A Single Rate Hike Yet**

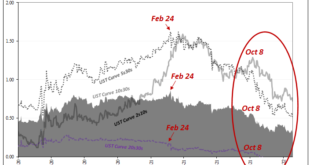

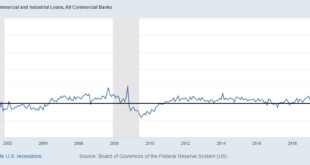

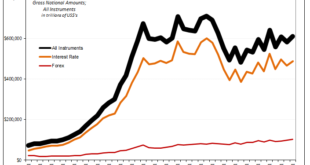

It’s not hard to reason why there continues to be this conflict of interest (rates). On the one hand, impacting the short end of the yield curve, the unemployment rate has taken a tight grip on the FOMC’s limited imagination. The rate hikes are coming and the markets like all mainstream commentary agree that as it stands there’s nothing on the horizon to stop Jay Powell’s hawkishness. And yet, on the other hand, growth and inflation expectations, the long end could...

Read More »The Hawks Circle Here, The Doves Win There

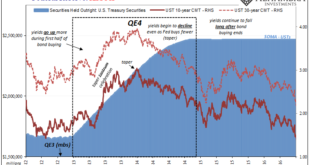

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A full and complete...

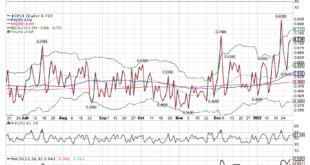

Read More »Weekly Market Pulse: Fear Makes A Comeback

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline. Philip Roth Be fearful when others are greedy and be greedy when others are fearful. Warren Buffett The new year hasn’t gotten off to a great start for growth stocks or any of the other speculative assets that have drawn so much attention over the last couple of years. Bitcoin is down 25% since the...

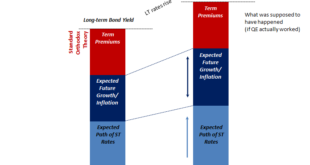

Read More »Good Time To Go Fish(er)ing Around The Yield Curve

It should be as simple as it sounds. Lower LT UST yields, less growth and inflation. Thus, higher LT UST yields, more growth and inflation. Right? If nominal levels are all there is to it, then simplicity rules the interpretation. Visiting with George Gammon last week, he confessed to committing this sin of omission. Rates have gone up, he reasoned reasonably, therefore it would seem to follow how the market must be shifting expectations toward the more optimistic...

Read More »Weekly Market Pulse: A Very Contrarian View

What is the consensus about the economy today? Will 2022 growth be better or worse than 2021? Actually, that probably isn’t the right question because the economy slowed significantly in the second half of 2021. The real question is whether growth will improve from that reduced pace. The Atlanta Fed GDPNow tracker now has Q4 growth all the way down to 5% from the 6.8% rate expected just a week ago (a result of a less than expected retail sales report). That’s still a...

Read More »US CPI Reaches Seven On US Goods Prices, With Disinflation Setting In Everywhere Else (incl. US Services)

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation? The short end of the curve, as noted here, is being pressured by only the last of those things, rate hikes, and from them creating...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org