Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares. China disappointed most observers by failing to cut the one-year medium-term lending facility rate (2.85%) and shares slipped. The dollar is mostly higher. It is up for the 11th consecutive session against the Japanese yen. The euro fell to its lowest level in nearly two years yesterday (slightly below .0760) following the ECB’s meeting that failed to bring forward a change in guidance. Its recovery has been capped around .0830. The Antipodeans continue to trade heavily, while the Canadian dollar and Swiss franc have edged higher. The

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, ECB, Featured, newsletter, Russia, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

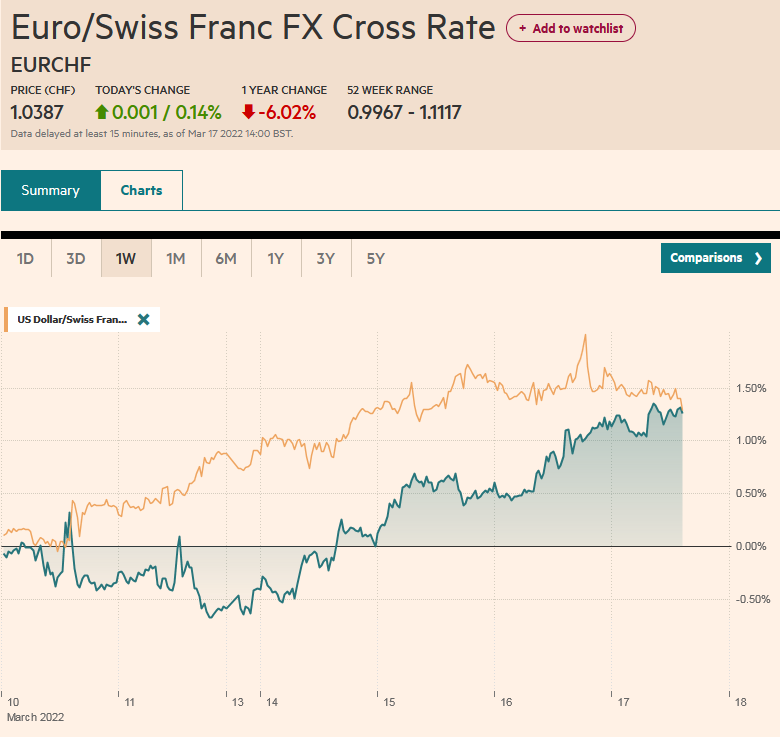

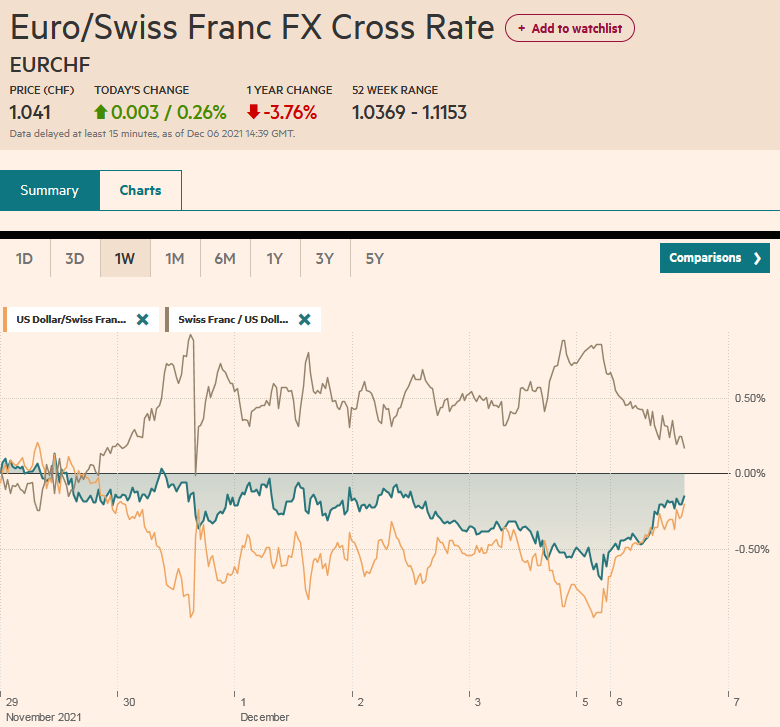

Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares. China disappointed most observers by failing to cut the one-year medium-term lending facility rate (2.85%) and shares slipped. The dollar is mostly higher. It is up for the 11th consecutive session against the Japanese yen. The euro fell to its lowest level in nearly two years yesterday (slightly below $1.0760) following the ECB’s meeting that failed to bring forward a change in guidance. Its recovery has been capped around $1.0830. The Antipodeans continue to trade heavily, while the Canadian dollar and Swiss franc have edged higher. The weakness of the euro weighs on the central European currencies, but the South Korean won, and Taiwanese dollar are the weakest among the emerging market currencies (~-0.4%). Commodity markets are mostly closed today, but gold is firm near $1975. It is the seventh session in the past eight that the yellow metal is appreciating.

Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares. China disappointed most observers by failing to cut the one-year medium-term lending facility rate (2.85%) and shares slipped. The dollar is mostly higher. It is up for the 11th consecutive session against the Japanese yen. The euro fell to its lowest level in nearly two years yesterday (slightly below $1.0760) following the ECB’s meeting that failed to bring forward a change in guidance. Its recovery has been capped around $1.0830. The Antipodeans continue to trade heavily, while the Canadian dollar and Swiss franc have edged higher. The weakness of the euro weighs on the central European currencies, but the South Korean won, and Taiwanese dollar are the weakest among the emerging market currencies (~-0.4%). Commodity markets are mostly closed today, but gold is firm near $1975. It is the seventh session in the past eight that the yellow metal is appreciating.

Asia Pacific

The most important development today is something that did not happen. Despite signs that the Chinese economy is weakening amid the Covid lockdowns, port congestion, and a surge in energy and metals prices, Beijing failed to deliver the expected cut in the benchmark one-year Medium Term Lending Facility. This makes it somewhat more difficult to cut the loan prime rates next week. The State Council (similar to the cabinet) had seemed to say earlier this week that the required reserves would be cut at the “proper time.” The focus has shifted to this after standing pat on the MLF today. Officials want banks to cut the deposit rates.

China reports Q1 GDP early Monday in Beijing. The median forecast (Bloomberg) is for a 0.7% quarter-over-quarter expansion, down from 1.6% in Q4 21. On the other hand, the lockdown of Shenzhen, and now Shanghai is expected to take a significant toll. The virus is still not contained, and the economic impact is serious, and the social pushback represents President Xi’s biggest challenge as he seeks to secure a third term later this year. On the other hand, there may be incentives to err on the side of minimizing the estimate of disruption.

Here we are in the middle of the month, and the dollar has closed lower against the yen once again here in April. Yesterday was the first day this month that it slipped below the previous session’s low. It recovered and approached JPY126.70. The dollar has risen for the sixth consecutive week and for a little more than 10% over the run. The upper Bollinger Band (two standard deviations above the 20-day moving average) is close to JPY127.00. The push above JPY125-JPY126 has fanned talk of a move to JPY130. The Australian dollar is trading heavily and remains pinned around $0.7400. If it does not recover today, it would be the seventh loss in the past eight sessions. Note that the lower Bollinger Band will start the new week near $0.7390. A convincing break of that support would target the $0.7350 area. Yesterday, the dollar tested the upper end of its range against the Chinese yuan that goes back to last November, around CNY6.38. It pulled back today to trade slightly below CNY6.37. Support is seen around CNY6.36. The PBOC set the dollar’s reference rate at CNY6.3896. The median projection (Bloomberg survey) was for CNY6.3880. China’s 10-year bond yield is at a discount of about seven basis points to US 10-year Treasuries. At the end of last week, it offered around a five-basis point premium.

Europe

The ECB affirmed its intention to end its bond purchases at the end of Q2. The rate decision is not going to be forthcoming for months, while this week, both the RBNZ and the Bank of Canada accelerated their hikes, and the Federal Reserve is now widely expected to raise rates itself by 50 bp next month. The timing of the ECB’s move will be “some time” after the bond-buying ends. “Some time” was defined as a week to several months. The euro slumped on the news, or lack thereof, and the German yield curve steepened. In addition to monetary policy divergence, the energy disruption could intensify and the proximity of the polls for the second round of the French elections (April 24) also weigh on sentiment.

Although foreign exposure to the Russian rouble has been slashed, many observers remain fascinated with its vagaries. The rouble appears to have recovered so much after the initial hit that some capital controls have been relaxed and there may be more to come. However, there is a critical one that explains the rouble’s recovery. Russian companies must turn over 80% of their hard currencies to the central bank within three days. In effect what this means is that the gas and oil exporters, like Rosneft and Gazprom, are doing what the central bank cannot do with the lion’s share of its asset frozen. They are buying roubles every day at an estimated rate of more than $1 bln.

Euro activity on this Good Friday is light, as one would expect. There is little enthusiasm for the single currency. The bearish potential of yesterday’s big outside day (trade widely on both sides of Wednesday’s range) was neutralized by the close slightly below $1.0830. There are a couple of option expirations of note today. The first is for about 475 mln euros at $1.0825 and the other is for around 540 mln euros at $1.0810. Sterling was turned back from $1.3150 yesterday. It retreated to about $1.3035 before finding support. It is in a narrow range today–roughly $1.3050-$1.3080. It settled around $1.3025 last week. For four sessions through the middle of this week, sterling traded below $1.30. On Wednesday, sterling fell to about $1.2975, its lowest level since November 2020.

America

The NY Fed president is the only regional Fed president to have a permanent vote on the FOMC and is the Vice-Chair of the FOMC itself. Therefore, the NY Fed President is part of the central bank’s leadership. It is important then that they are on message. There may have been some adjustment when Williams took the helm of the NY Fed, replacing Dudley, but since then Williams is consistently expressing the views of the Fed’s leadership. Yesterday’s comments about a 50 bp rate increase as being a “reasonable option,” provides the latest evidence that a consensus has emerged in its favor. The Fed funds futures strip has a 50 bp hike nearly fully discounted for May and June. For the July meeting, the market leans toward a 50 bp hike as well but is not quite there yet. It appears be consistent with about a 30% chance of 50 bp instead of 25 bp.

The US reports March industrial output data today. A 0.4% increase is expected after a 0.5% gain in February. However, manufacturing output, which jumped 1.2% in February likely moderated to around half that pace, which is still solid. The capacity utilization rate is expected to have risen to 77.8% from 77.6%. Recall that it stood at 76.5% before the pandemic struck and had peaked in 2018 near 80%. Before the industrial production figures, the April Empire State manufacturing survey will be released. A recovery is expected after the March drop to -11.8 from 3.1 in February. Last April it was at 26.3. Late in the day, the February TIC data, (portfolio flows) will be reported. It typically is more for economists than market participants and it is doubly true now.

Falling stocks and the jump in US yields (two-year yields rose 10 bp yesterday, the most in two weeks) helped the greenback recover from CAD1.25 to around CAD1.2640. It is straddling the CAD1.26 area in today’s quiet turnover. The CAD1.2580-CAD1.2620 area may contain the price action into next week. Among next week’s highlights, Canada reports March CPI and February retail sales. The former is expected to have accelerated while the latter probably softened. Meanwhile, the greenback rose against the Mexican peso yesterday for only the fourth time since March 10. Given the persistence of the trend, the counter-trend bounces have been dramatic. That is to suggest that the market positioning lends itself to such exaggerations. Still, the truck protest of the stepped-up inspections at the border with Texas may have been a spark that has spurred the profit-taking. The dollar initially made a new low for the year yesterday against the peso (~MXN19.7325) before reversing higher and closing above Wednesday’s high. This is a key reversal, but there has been no follow-through today. The dollar is in a narrow range near yesterday’s high (~MXN20.0280). The 20-day moving average is around MXN20.0165. The greenback has not closed above the 20-day moving average since March 15.

Tags: #USD,China,Currency Movement,ECB,Featured,newsletter,Russia