Overview: Ukraine’s Mariupol refuses to surrender as the war is turning more brutal according to reports. Iran-backed rebels in Yemen struck half of a dozen sites in Saudi Arabia, driving oil prices higher. China’s prime lending rates were unchanged. The MSCI Asia Pacific Index, which rallied more than 4% last week, traded heavily today though China and Taiwan’s markets managed to post small gains. Tokyo was closed for the spring equinox. Europe’s Stoxx 600 is steady...

Read More »FX Daily, March 17: Investors are Skeptical that the Fed can Achieve a Soft-Landing. Can the BOE do Better?

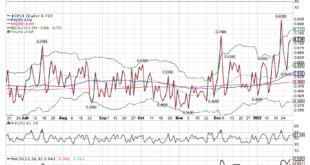

Swiss Franc The Euro has risen by 0.14% to 1.0387 EUR/CHF and USD/CHF, March 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets continue to digest the implications of yesterday’s Fed move and Beijing’s signals of more economic supportive efforts as the Bank of England’s move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the...

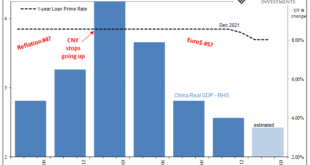

Read More »China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated. The FOMC will vote to raise the federal funds range (and IOER plus RRP) for the first time since December 2018 Over in China, however, it’s nearly certain to be the opposite....

Read More »China and Hong Kong Stocks Plummet, Yields Soar

Overview: While the World Health Organization debates about downgrading Covid from a pandemic, the rise China and Hong Kong cases is striking. A lockdown in Shenzhen and restrictions in Shanghai, coupled with a record fine by PBOC officials on Tencent drove local stocks sharply lower. China’s CSI 300 fell 3% and a measure of Chinese stocks that trade in HK plunged more than 7%. The Hang Seng itself dropped 5%. Covid in China and Hong Kong adds to the risk of...

Read More »Risk Assets Given a Reprieve

Overview: US equities failed to sustain early gains yesterday, but risk appetites have returned today. Asia Pacific equities had a poor start, with Chinese and Japanese indices losing ground, but the equity benchmarks in Taiwan, Australia, India, and most of the smaller markets traded higher. Taiwan’s 1.1% gain is notable as foreign investors continued to be heavy sellers. Europe’s Stoxx 600 is snapping a four-day drop with an impressive 3.3% gain, led by the...

Read More »Vladimir Nogoodnik Roils Markets

Overview: The economic disruption seen since the US warning of an imminent Russian attack on February 11 continue to ripple through the capital and commodity markets. Equities are being slammed. Most Asia Pacific bourses were off 2-3% today. Europe’s Stoxx 600 gapped lower ad has approached February 2021 levels, orr about 2.6% today. US futures are around 1.5% lower. The reaction in the major bond markets is subdued. The US 10-year yield is near 1.72%, off...

Read More »ECB Meeting and US and China’s CPI are the Macro Highlights in the Week Ahead

One of the most significant market responses to Russia's attack on Ukraine is in the expectations for the trajectory of monetary policy in many of the high-income countries, including the US, eurozone, UK and Canada. The market has abandoned speculation of a 50 bp hike in mid-March by the FOMC and the Bank of England. It has also scaled back the ECB's move to 20 bp this year from 50 bp. Even after the Russian invasion, the market had discounted a 75% chance that...

Read More »Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia, and India managed...

Read More »European Currencies Continue to Bear the Brunt

Overview: Russia’s invasion of Ukraine and the global response is a game-changer, as Fed Chair Powell told Congress yesterday. The UK-based research group NISER estimated that world output will be cut by 1% next year or $1 trillion, and global inflation will be boosted by three percentage points this year and two next. The recovery in US stocks yesterday may have helped lift Asia Pacific shares today (China and India are notable exceptions). However,...

Read More »Weekly Market Pulse: Are We There Yet?

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness. I know a lot of people liked that rally into the close on Friday and it was a nice way to end a wild week but it also shows that traders/investors are all too...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org