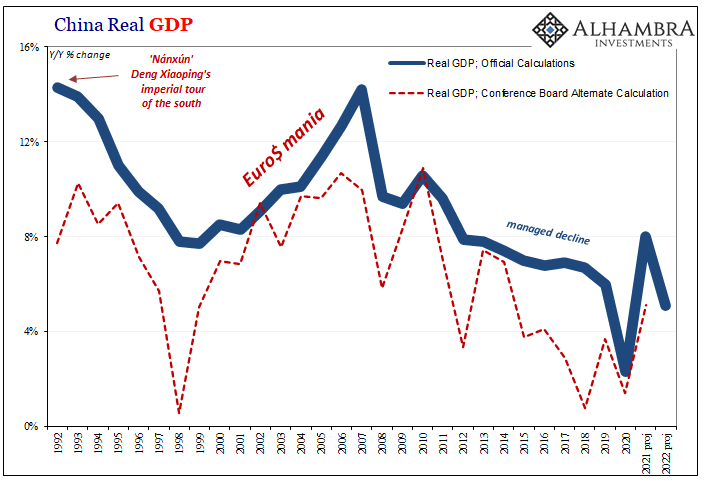

The guy said this was going to be the future. Not just of China, for or really from the rest of the world. Way back in October 2017, at the 19th Communist Party Congress newly-made Emperor Xi Jinping blurted out his grand redesign for Socialism with Chinese Characteristics. A country once committed to quantity of economic growth above everything else would, moving forward, come to prioritize instead the quality of it. This message was a clear signal, way back when, how globally synchronized growth wasn’t anything other than a bumper sticker slogan invented by desperate Western central bankers and Economists to keep their critics from riling an increasingly angry public. Xi’s program was to convert China into a system which would no longer rely so much on external

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, China, common prosperity, currencies, economy, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, no-growth world, Xi Jinping

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The guy said this was going to be the future. Not just of China, for or really from the rest of the world. Way back in October 2017, at the 19th Communist Party Congress newly-made Emperor Xi Jinping blurted out his grand redesign for Socialism with Chinese Characteristics. A country once committed to quantity of economic growth above everything else would, moving forward, come to prioritize instead the quality of it.

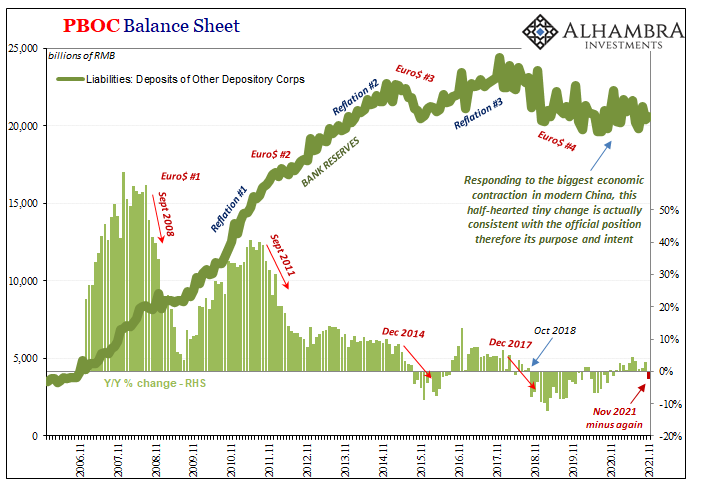

This message was a clear signal, way back when, how globally synchronized growth wasn’t anything other than a bumper sticker slogan invented by desperate Western central bankers and Economists to keep their critics from riling an increasingly angry public. Xi’s program was to convert China into a system which would no longer rely so much on external factors driving its economy simply because, post-2011, it had become clear that the global economy was never coming back. The Chinese had realized they couldn’t count on external demand from being the world’s manufacturer to keep driving toward Deng Xiaoping’s previous vision of future prosperity. There was only going to be less and less external demand because there had been no recovery from the first Global Financial Crisis; the Communists had to plan accordingly. No one outside wanted to believe this. |

|

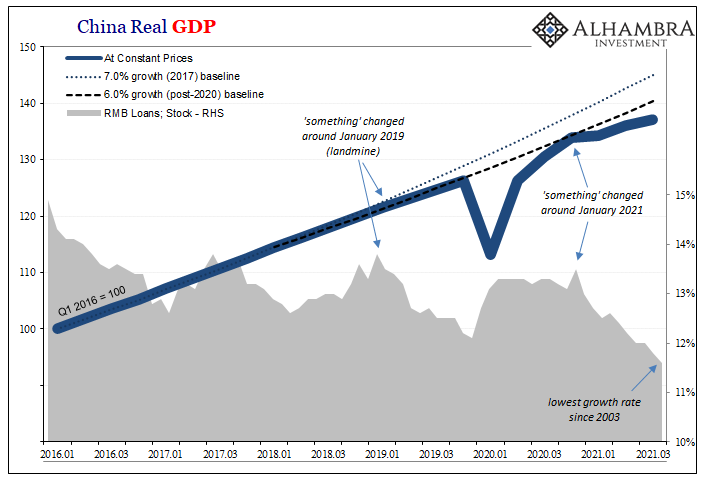

| All that before the outbreak of governmental overreach and pure insanity in 2020’s pandemic arrival. The unwise turn toward huge further worldwide recession in the wake of all that greatly amplified the economic concerns behind Xi’s pursuit of “quality.” Both China and the world economy as a whole couldn’t afford yet another hit still reeling from the previous ones (several since 2008).Last year, the country was filled with the term “common prosperity” which was the usual benign way of further lowering expectations. Some in China may not be so enthusiastic about this whole quality growth plan, especially since the quantity has now gone way beyond, meaning below, formerly untouchable threshold “floors.”

For China’s de facto dictator, what better way to impress upon his sore subjects his continuing vision than his otherwise irrational, insane Zero-COVID? Madness to Xi’s method, to the point of literally starving (slight hyperbole) one of the world’s most populous cities; maybe two. It’s Xi’s way or the lockdown. Zero-COVID allows him the excuse to flex his internal muscle, and not just for those outsider Hong Kong-ers, directly in the face of everyone in mainland China, especially those who might be predisposed to have grown economically unhappy in the increasing absence of quantity growth. Not only that, it does so in keeping with that whole quality thing; see, the government says, we told you we will no longer prioritize the economy over everything else, being so diligent about the corona only exemplifies the Communist’s 19th commitment to less economy. At the end of the day, locked down or not, that’s the inevitable result; less economy. |

|

| Call it quality if you wish, the COVID policy is both the perfect justification for it as well as a wonderful (from the perspective of an evil dictator) demonstration of the original obligation and the absolute determination to stick to the plan by any and every means at the top’s disposal.

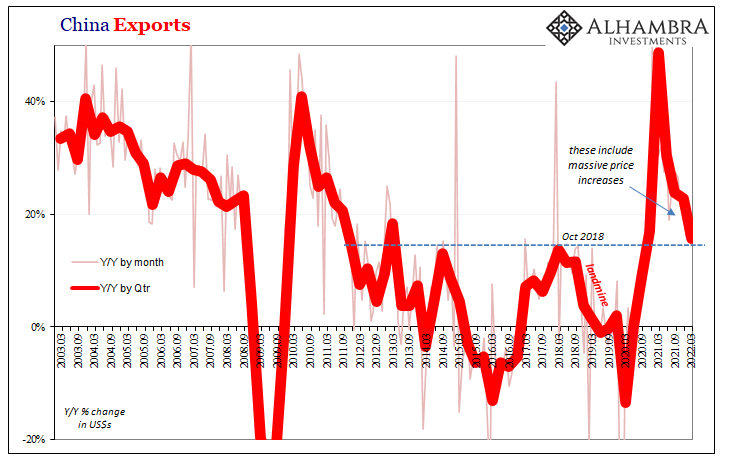

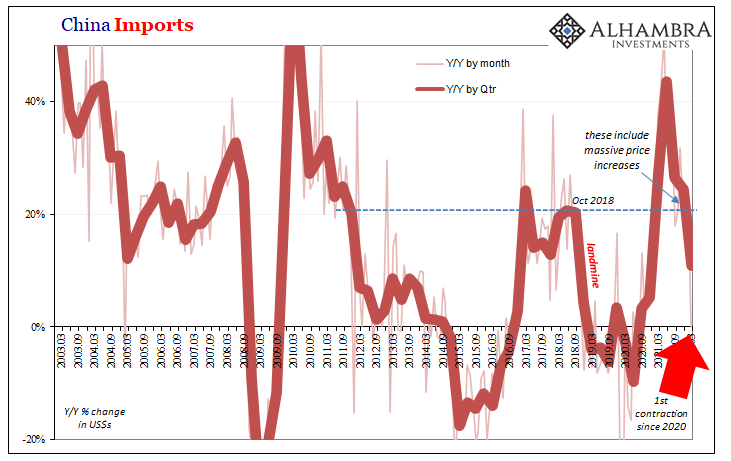

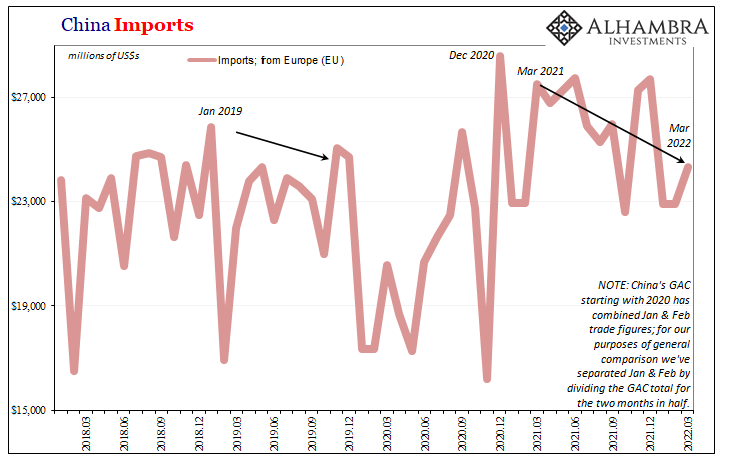

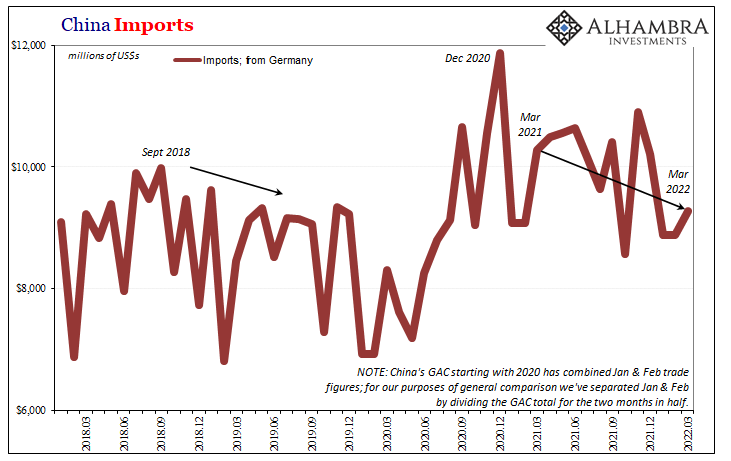

Less economy because of COVID? Too darn bad. Less economy because of de-globalization? Doesn’t matter. Less economy as global recession sneaks onto the horizon? Xi don’t care so you better not either! I mean, this is all Maoism 101. Now analysts are shocked China just reported a drop in March 2022 imports. This sudden appearance of a negative number is being blamed, of course, on the corona and the current lockdowns. I think that’s true, though for vastly different reasons as stated above. According to China’s General Administration of Customs (GAC), exports heading out of the allegedly clogged and blocked Chinese ports rose by 14.3%. Sounds great, except most of it is price changes rather than volumes shipped out. Too hard to sail them, or too many goods already sailed and piling up everywhere else? There is the same price illusion to consider on the import side, which is where the March 2022 update really shocked with its recession-y tendency. |

|

| GAC says total imports by US$ value declined by 0.1% from March 2021 despite price increases – or is it because? | |

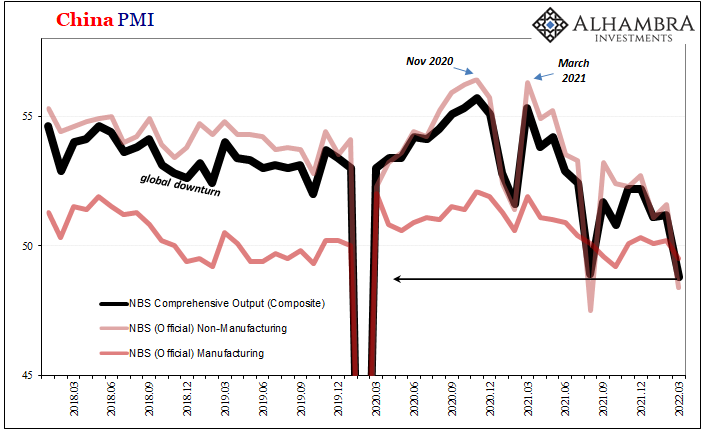

| China’s economy is slowing down and it has been for a year already, if not longer. This has been dismissed up and down the rest of the world as the temporary impediments presented by whichever coronavirus variant of the month; either in China or from whomever grappling with whatever outside the country.Maybe, just maybe it is the underlying less economy now being brutally imposed upon Shanghai using the COVID exercise. These lockdowns sure hurt China in March, and will make a bigger dent in April, but like PMI lows they cannot explain the unbroken trend nor its most likely destination where more and more stats and accounts fall below zero, too.

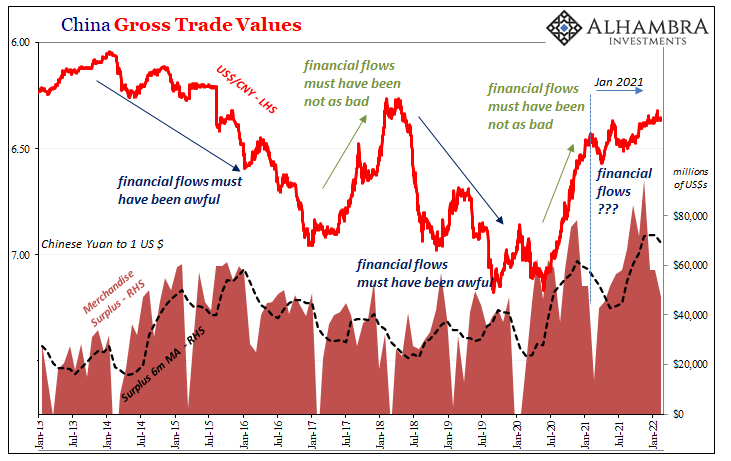

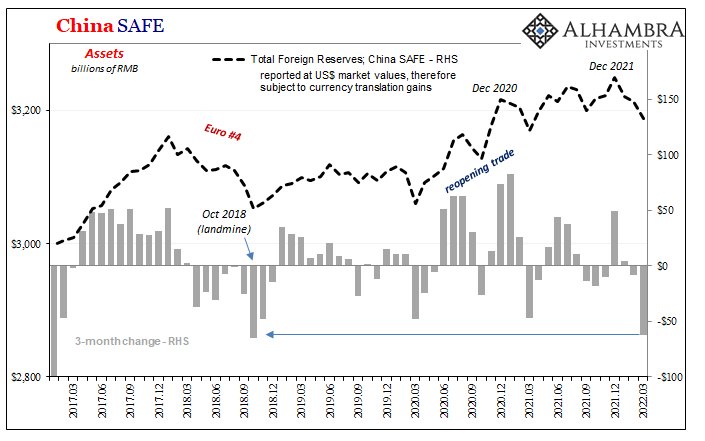

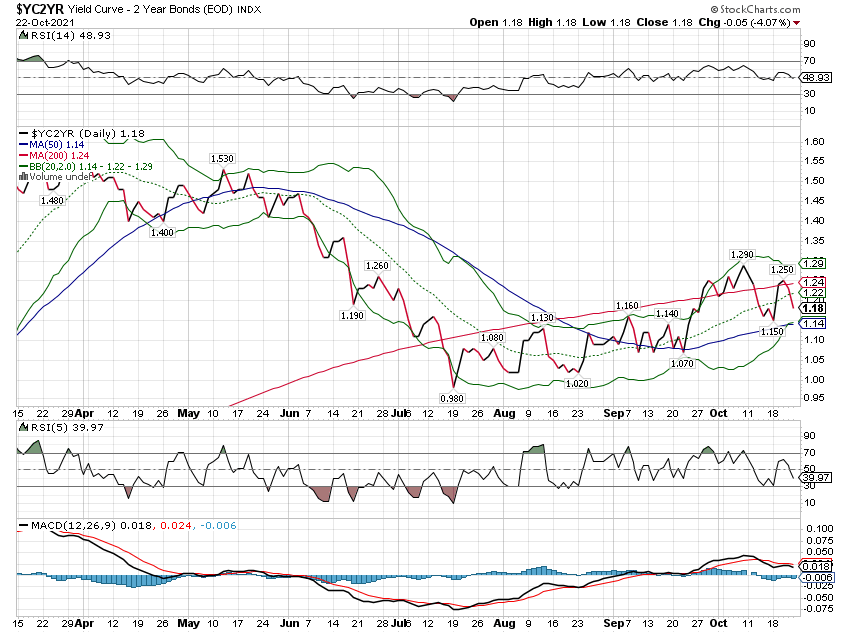

I have to believe the market, and the money (eurodollar), absolutely agree on these risks perceived from a more honest assessment of China’s woeful situation. |

|

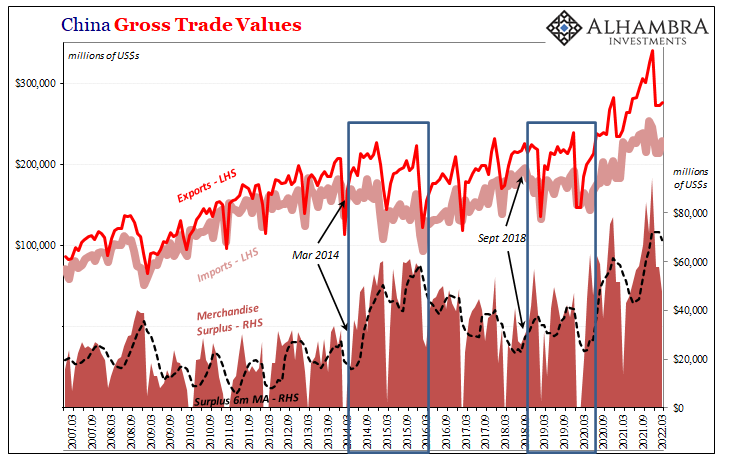

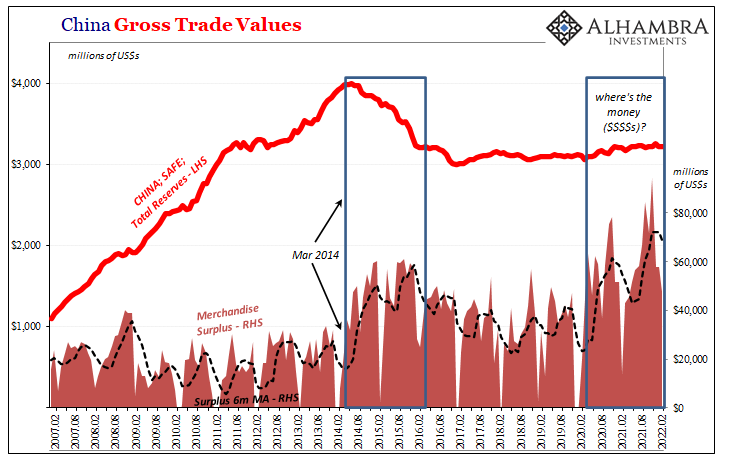

| After all, with exports again much better than imports, China’s merchandise trade surplus reached another sterling high. Record imbalance in its favor, the inflow of dollars from trade by the tens of billions.

So, again, where are they? |

|

| For now, the Chinese appear to be using their merchandise surplus (why wouldn’t they) to keep the exertion of eurodollar-gravity outflows from making China’s increasingly shaky circumstances more obvious. Finance-driven money getting pulled out is, must be, at least as much if not more than the trade surplus leading dollars in.

One forward-looking, the other from other reasons in the past. |

|

| No mystery about why Europe’s “central bank” is taking a far more cautious and determined approach to “inflation”, especially when compared to those at the Fed who still believe theirs is an island of a singular, and isolated, national economy.There’s a pandemic metaphor here.

Why else would Xi pursue what he’s pursuing? The Communists could, like many Western governments now are trying, just declare victory over the coronavirus and move on. Claim the past lockdowns all worked and led to the far less dangerous strain of omicron as representing the successful transition to the disease’s next, post-pure awful phase. This really isn’t about a virus at all. It’s about the 19th Party Congress and where it was always going to end up. As I wrote in October 2017, the newly crowned Emperor of China was welcoming everyone to the no-growth world. Last year’s supply shock effect on worldwide prices temporarily disguised the direction. Make no mistake, Xi’s seemingly unhinged actions continue to speak louder than CPIs. Just like he planned. |

Tags: Bonds,China,common prosperity,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,no-growth world,Xi Jinping