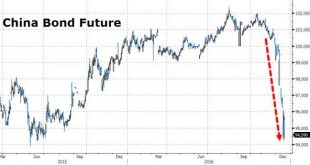

Despite considerably weaker than expected Services PMI, an assassination in Turkey, a terrorist attack in Zurich, and a bloodbath in Berlin, stocks rallied... As a reminder - Chinese bonds crashed overnight again.. Hong Kong stocks tumbled into correction (red for 2016)... And Italian banks all crashed (led by BMPS)... First things first in The US - the market broke today and stocks loved it... The Dow still has not had two down days in a row since before the...

Read More »Rising Trade Tensions

Summary: Obama Administration has taken a hardline against China’s trade practices. Other countries are also resisting China’s arguments that it is a market economy. Last week, US imposed anti-dumping duties on imported washing machines from China. As was the campaign and the initial appointments, the election of an unorthodox candidate promises to change the way things are done in Washington. However, just as...

Read More »FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

Swiss Franc EUR/CHF - Euro Swiss Franc, December 14(see more posts on EUR/CHF, ) - Click to enlarge The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data...

Read More »FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

Swiss Franc EUR/CHF - Euro Swiss Franc, December 14(see more posts on EUR/CHF, ) - Click to enlarge The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data...

Read More »Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

Submitted by Michael Shedlock via MishTalk.com, For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change. But leading experts say the...

Read More »Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

Submitted by Michael Shedlock via MishTalk.com, For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change. But leading experts say the...

Read More »Gold In London And Hong Kong Is Used To Settle COMEX Futures

Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at...

Read More »Gold In London And Hong Kong Is Used To Settle COMEX Futures

Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at...

Read More »Gold In London And Hong Kong Is Used To Settle COMEX Futures

Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at...

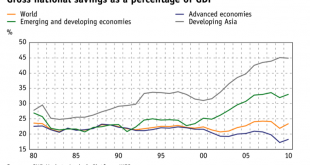

Read More »Net National Savings Rate, the Best Alternative Indicator to GDP Growth

For us the Net National Savings Rate is the best alternative indicator to GDP growth. The Net National Savings Rate (NNSR) is rather positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. The relationship of GDP growth to those four criteria, however, is often a negative correlation. We critized GDP growth that has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org