Swiss Franc EUR/CHF - Euro Swiss Franc, October 14 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm against most of the major currencies, but within yesterday’s ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain. . Source: Dukascopy - Click to enlarge After recovering from .2130 to .2270, sterling ran out of steam. Near .22, it is off about 1.8% this week after last week’s 4.2% drop. It fell at the start of the week but has been consolidating within Tuesday’s range (~.2090-.2375). Today’s August construction figures were weaker than expected at 1.5% on the month. The median expectation was for a flat report for the second consecutive month. The fact that the July series was revised up to 0.5% offered sterling little consolation. . - Click to enlarge Sterling is not the weakest of the majors. The Swedish krona has the flag position. It is off a little more than 2% against the dollar this week, including about nearly a quarter percent slippage today. News this week has played on fears that the economic recovery will falter before inflation cycle can catch.

Topics:

Marc Chandler considers the following as important: China, China Consumer Price Index, China New Loans, China Producer Price Index, ECB, EUR, Eurozone Trade Balance, Featured, FX Daily, FX Trends, GBP, Italy Consumer Price Index, JPY, newslettersent, Spain Consumer Price Index, Switzerland Producer Price Index, U.S. Producer Price Index, U.S. Retail Sales, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, October 14 2016(see more posts on EUR/CHF, ) |

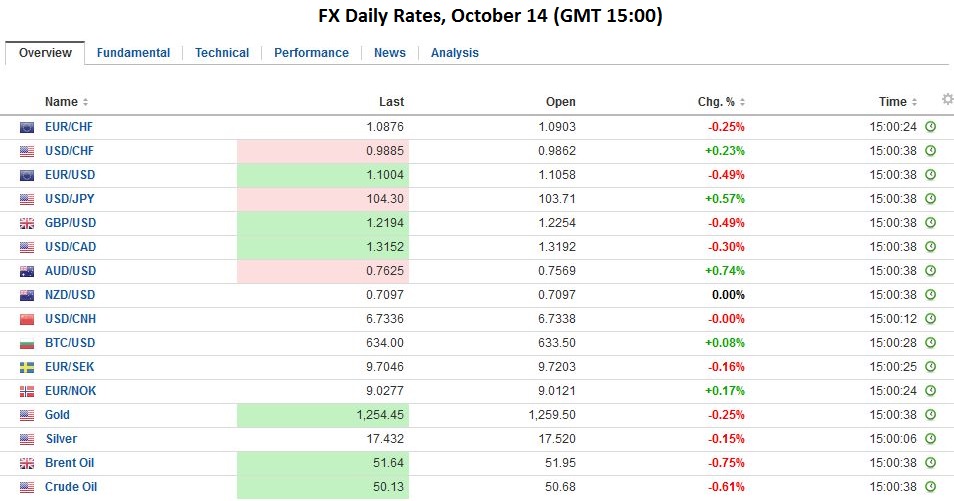

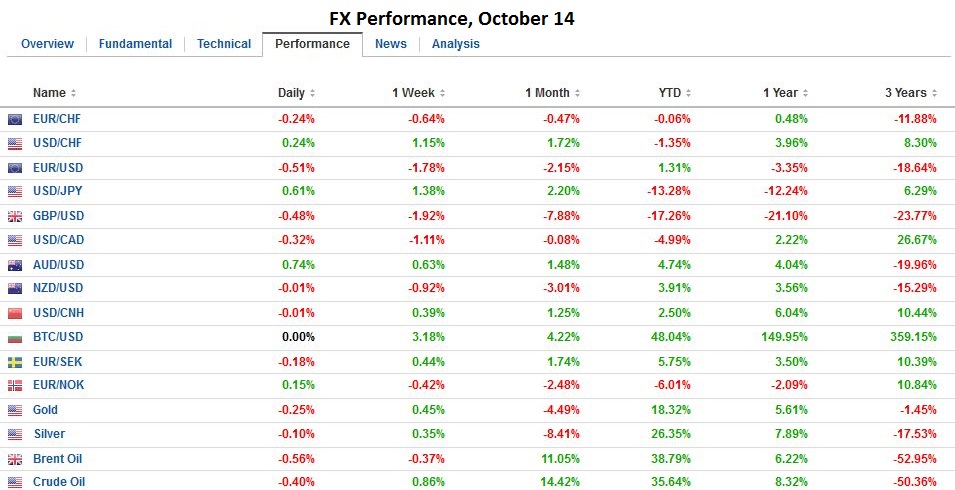

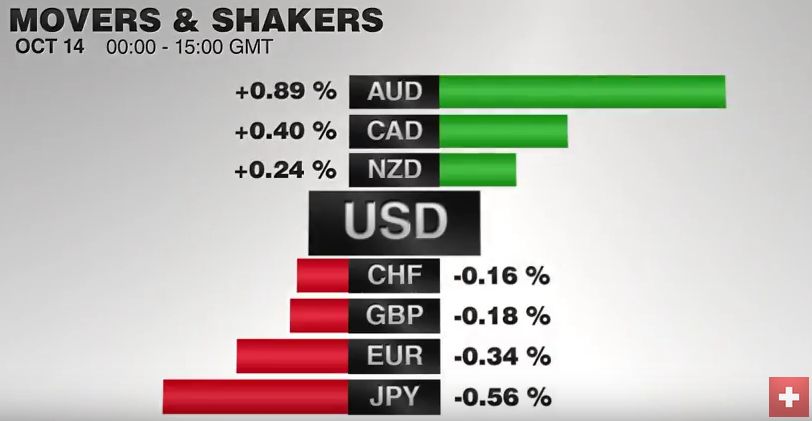

FX RatesThe US dollar is firm against most of the major currencies, but within yesterday’s ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain. |

. Source: Dukascopy - Click to enlarge |

| After recovering from $1.2130 to $1.2270, sterling ran out of steam. Near $1.22, it is off about 1.8% this week after last week’s 4.2% drop. It fell at the start of the week but has been consolidating within Tuesday’s range (~$1.2090-$1.2375). Today’s August construction figures were weaker than expected at 1.5% on the month. The median expectation was for a flat report for the second consecutive month. The fact that the July series was revised up to 0.5% offered sterling little consolation. | |

| Sterling is not the weakest of the majors. The Swedish krona has the flag position. It is off a little more than 2% against the dollar this week, including about nearly a quarter percent slippage today. News this week has played on fears that the economic recovery will falter before inflation cycle can catch. CPI figures surprised on the downside this week after the previous week’s industrial and service production, and forward-looking industrial orders were all disappointments.

The euro briefly dipped below $1.10 yesterday, and although there has been not follow-through selling today, it has not been able to distance itself from that threshold. There was not follow-through buying either after yesterday’s recovery. A nearby cap has been formed in the $1.1060-$1.1070 area, ahead of the prior support at $1.1080. The trendline that connects the January, June and July lows was violated earlier in the week. It comes in near $1.1035, and a violation on the weekly charts is thought to have greater significance than only on the daily charts. |

|

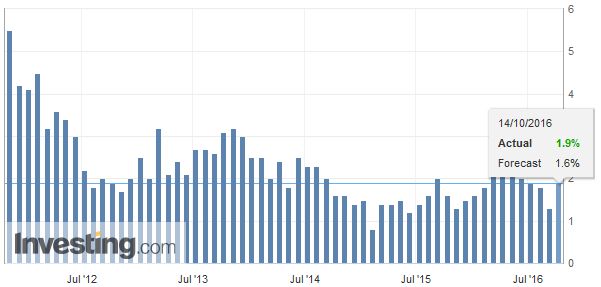

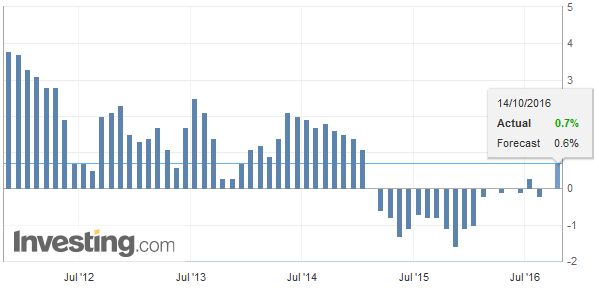

ChinaAhead of the US retail sales report, the main economic news has been Chinese prices, where the surprise was on the upside. Consumer prices rose 1.9% in the year through September after a 1.3% rise in August. The Bloomberg median was 1.6%. Food prices are still an important driver, rising 3.2%. Non-food consumer prices rose 1.6%. |

China Consumer Price Index (CPI) YoY, September 2016(see more posts on China Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

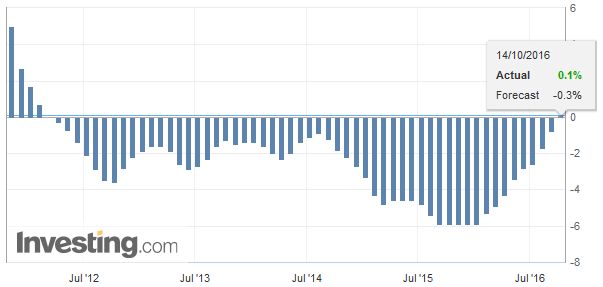

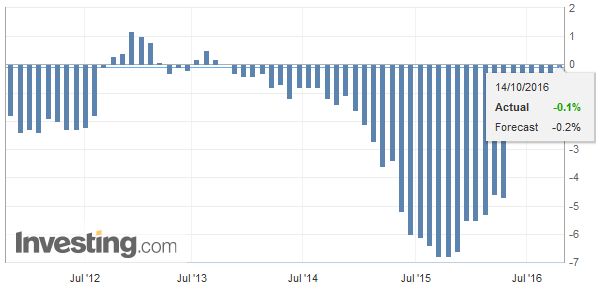

| More noteworthy was the fact that producer prices turned positive for the first time since 2012. The 0.1% year-over-year increase follows a 0.8% decline in August. The Bloomberg median was for a 0.3% decline. This is important, especially after yesterday’s unexpectedly weak exports. Some fear increased risks that China will seek to export deflation. The higher than expected inflation readings may keep such anxiety at bay (for the moment). |

China Producer Price Index (PPI) YoY, September 2016(see more posts on China Producer Price Index, ) . Source: Investing.com - Click to enlarge |

| That said, we note that as the onshore yuan played catch-up with the offshore yuan after last week-long holiday, and recognizing the US dollar’s strength, the yuan is recording its last week loss since January. At the start of the year, it will be recalled that Chinese developments were still shaping the investment climate and risk appetite. Chinese stocks rose 2.0%-2.5% this week.

The MSCI Asia-Pacific Index fell 1.7% but snapped a five-day losing streak today with a 0.2% gain. The big move in the Asian markets today was the 4.5% rally in Thailand, the biggest in three years as the smooth transition following the death of the King, while the military assures stability. Today’s gains still leave the main index off 1.8% for the week. |

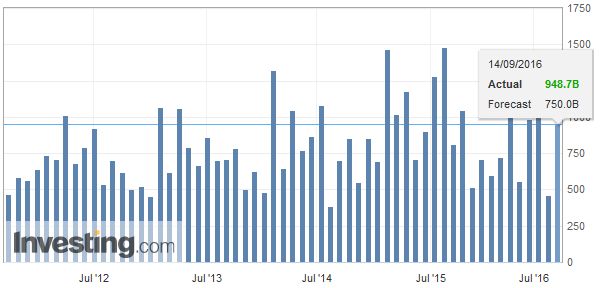

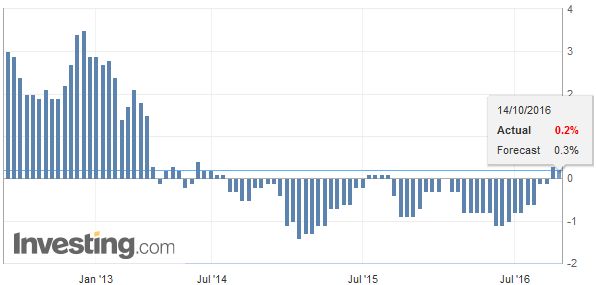

China New Loans, September 2016(see more posts on China New Loans, ) . Source: Investing.com - Click to enlarge |

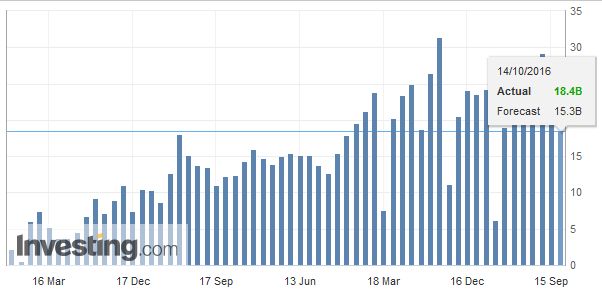

EurozoneEuropean bourses are higher, led by the financials. The Dow Jones Stoxx 600 is up nearly 1.0%, poised to break a three-day slide. The financials are up 1.5%, and Deutsche Bank shares have recouped yesterday’s 2% drop. It has quietly strung together its third weekly advance. Benchmark yields are higher. European bond yields, except for Portugal are 1-2 bp higher. Portugal’s yields have fallen five bp on the day and 12 bp on the week as comments from the finance ministry seemed to ease concern about DBRS review in a week’s time. It is the only one of the four rating agencies that ECB accepts that regards the country as investment grade. There has been concern that it could lose it. We suspect that at most, DBRS will change the outlook from stable to negative. UK 10-year gilts were flat coming into today, but the yield is up six basis points. It is the third weekly increase in the UK 10-year yield and sixth of the past seven weeks. During this seven-week run, the 10-year yield has risen from 56 bp to 1.08%. |

Eurozone Trade Balance, September 2016(see more posts on Eurozone Trade Balance, ) . Source: Investing.com - Click to enlarge |

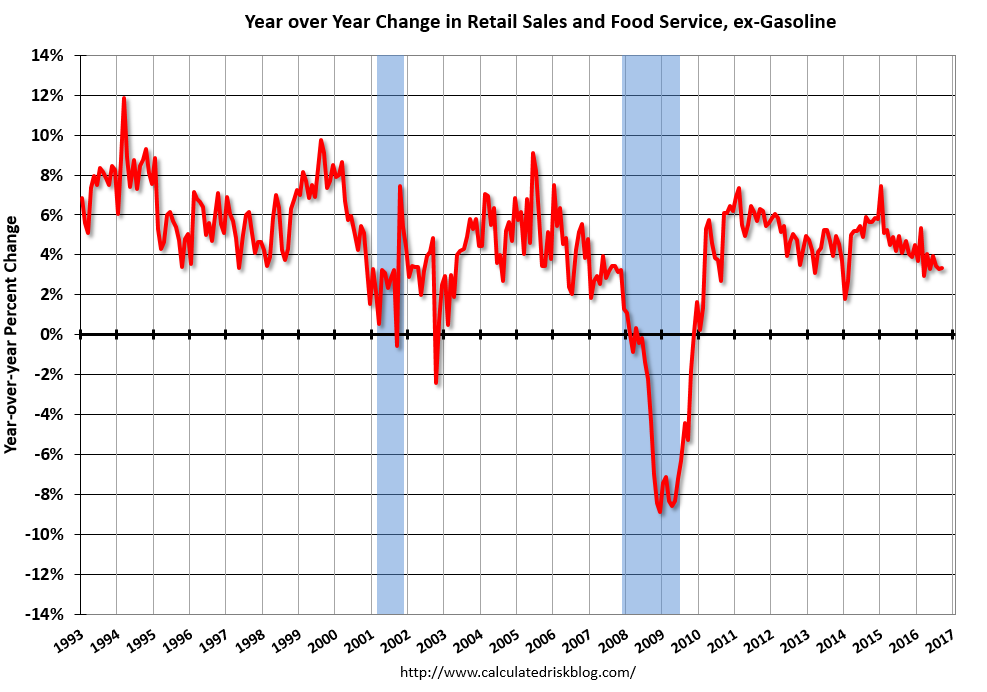

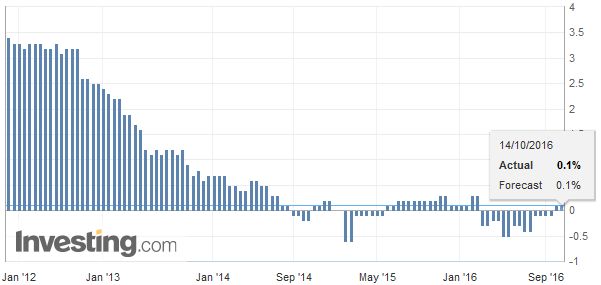

United StatesThe US 10-year yield is up three basis points on the day. At 1.78% it is still a couple of basis points below the multi-month high set in the middle of the week. Much rests on the US retail sales report. It is not good enough that more Americans are working a slightly longer week, and getting paid a little more. Households need to consume. The US reports PPI at the same time as retail sales. Markets are less sensitive to it. However, the takeaway, which will likely be underscored next week, US price pressures are building. This is not a “sky is falling” call, just simply point out a gradual trend. It may not yet be fully reflected in the University of Michigan’s inflation expectations measure. The August business inventories will also be incorporated into GDPtrackers and forecasts. From the Fed, Yellen and Rosengren speak at a Boston Fed Conference. Rosengren dissented in favor of an immediate hike. The market is more sensitive to the Chair’s remarks, but she may not address monetary policy in her opening remarks. But we’ll be watching. |

U.S. Producer Price Index (PPI) YoY, September 2016(see more posts on U.S. Producer Price Index, ) . Source: Investing.com - Click to enlarge |

| Retail sales are around 40% of overall consumption. After a poor August, Americans are believed to have gone shopping again in September. The headline may be flattered by stronger auto sales and higher gasoline prices. The key, however, is the GDP measure which excludes those two items and others goods, like building materials. After falling for two months, it is expected to rise around 0.4%. |

U.S. Retail Sales, September 2016(see more posts on U.S. Retail Sales, ) |

Additional Economic Data Interesting for the reader:Switzerland |

Switzerland Producer Price Index (PPI) YoY, September 2016(see more posts on Switzerland Producer Price Index, ) . Source: Investing.com - Click to enlarge |

Spain |

Spain Consumer Price Index (CPI) YoY, September 2016(see more posts on Spain Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

Italy |

Italy Consumer Price Index (CPI) YoY, September 2016(see more posts on Italy Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.