Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold and trust the miners that it is there – Blockchain and gold will likely make a “good team”, but they’re not ready yet Bitcoin Gold, 2012 - 2017 - Click to enlarge Are we nearly there yet? Gold on the blockchain. In the last few weeks there have been significant developments in the world of gold, digital gold, blockchain and bitcoin. Those who have expressed an interest in gold investment, may have received articles from friends and family about how bitcoin prices reached parity with the yellow metal. We have long argued that bitcoin and gold should be seen as complementary assets. But not everyone agrees and it doesn’t make a good story.

Topics:

GoldCore considers the following as important: Bitcoin, Blockchain, Bond, Business, Canadian government, Central Banks, China, Counterparty, Cryptocurrencies, Digital currency, Dubai, economy, ETC, Ethereum, Featured, Finance, Gold as an investment, Gold coin, Gold Standard, Google, Greece, Hong Kong, India, Monetary Policy, Money, newsletter, Precious Metals, Reuters, RMG uses blockchain technology, Securities and Exchange Commission, Sovereign risk, The Economist, UK Government, United Kingdom, US Federal Reserve, Volatility, Zurich

This could be interesting, too:

investrends.ch writes Credit Spreads auf historischen Tiefständen: Sind das Zeichen einer Blase?

investrends.ch writes KI-Ängste erschüttern die Finanzmärkte: Nun werden auch Finanzdienstleister erfasst

investrends.ch writes Bitcoin nach Kurseinbruch mit fulminantem Comeback

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

|

Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold and trust the miners that it is there – Blockchain and gold will likely make a “good team”, but they’re not ready yet |

Bitcoin Gold, 2012 - 2017 |

|

Are we nearly there yet? Gold on the blockchain. In the last few weeks there have been significant developments in the world of gold, digital gold, blockchain and bitcoin. Those who have expressed an interest in gold investment, may have received articles from friends and family about how bitcoin prices reached parity with the yellow metal. We have long argued that bitcoin and gold should be seen as complementary assets. But not everyone agrees and it doesn’t make a good story. Given bitcoin was first touted, and still is by some, as ‘digital gold’ or ‘as good as gold, but better’ then it has been inevitable that each time there is a significant movement in the bitcoin price then the media starts once again to pitch them against one another in a simplistic ‘cash of the currency titans’ narrative. Below, we ask if there should be all this hype when a digital currency reaches parity with gold, and what this means for blockchain products such as the Royal Mint’s RMG or OzcoinGold which is purporting to be the first gold-backed cryptocurrency – fyi – there have been many attempts. Ultimately it comes down to investing in and legally own a piece of gold that will serve your portfolio in the same way it has served millions of people in years gone by – as an asset that is a form of financial insurance, that cannot be devalued by central banks and will not be confiscated whether through bail-ins or more forceful means. If using gold, blockchain and bitcoin together means that investors’ portfolios can meet the above criteria then we are on the dawn of something very exciting, but as you will see from the below, we don’t believe that we are quite there yet. |

One bitcoin or an ounce of gold?

Let’s first address why bitcoin exceeding the gold price is or isn’t a big deal.

Lots of things cost more than an ounce of gold, the handbag I am pining for, a night at the seven-star Burj Al Arab or a gold MacBook Pro. So what? You might ask. Exactly, if lots of things cost more than a lump of gold, then why all the fuss about a bitcoin?

Especially when most of the people making a fuss couldn’t really tell you what a bitcoin is, and no one really knows how to trade using this information.

Whilst we can argue that the bitcoin price superseding the gold price is arbitrary, we can’t deny that this it is significant psychologically.

As noted above, bitcoin is often hailed as a form of digital gold, one that is perhaps more convenient and up-to-date with this technological world. Whether you agree or not, many people do hold this opinion and it is one that is widely reported on, hence the psychological importance of this price move.

There are many naysayers in the world of bitcoin and gold. Some would class them as two separate asset class, to them gold is a commodity and bitcoin is a technology. It still takes a lot of persuasion to the mainstream that both are currencies and that both manage to be so without the control of central banks, monetary policy and borders to restrict them.

This is why it is exciting when they reach parity or bitcoin exceeds gold. It means that more of the world is waking up to the issues with fiat money. It does not mean that bitcoin is better than gold nor does it mean that the world has flipped on its head and more people would rather own a bitcoin than hold a piece of gold.

The gold market is still worth more than 300 times that of the 16.2 million bitcoins in circulation. And if you consider the size of the $20 billion bitcoin market next to the Facebook, Amazon, Netflix and Google (FANGs) of the world then you’re not looking at something that is about to turn the world upside down.

Bitcoin is also incredibly volatile, despite calming down in recent years, and can still react like a hormonal teenager to an government announcement or ruling.

Just this weekend, bitcoin collapsed 18% after the U.S. regulator, the Securities and Exchange Commission (SEC), rejected a proposal by the Winklevoss twins for a publicly traded fund based on the digital currency. As Bloomberg put it, this dashed “hopes that a government-approved investment vehicle would lead to wider interest in virtual money.”

This volatility is likely to be the biggest barrier to it gaining the widespread adoption that gold already has – especially in the Asian world.

However, as I often tell people, bitcoin is incredibly young. Bitcoin fans (myself included) are getting excited about this as, given the short history of the cryptocurrency compared to the likes of gold and the masters of the online universe, its future price movements seem heavily weighted to the upside. Just like gold, it cannot be printed at will, devalued, confiscated (whether legitimately or by bail-in).

We cannot know the future of bitcoin when consortiums such as R3 are backing away from blockchain, or companies such as Microsoft, Intel and JPMorgan are embracing Ethereum.

The high bitcoin price tells us more about what we don’t know that what we do – we know it is likely to go higher but we have no idea how high, we know that it is being taken seriously but we do not know what this means for its role as an investment or monetary option.

The main lesson to learn from this price hike is that bitcoin is here to stay and that more people are looking for alternatives outside of the fiat monetary system. This is good for the gold market and those who already own a diversified portfolio including gold.

The downside to the hike in the bitcoin price is that whilst a price climb suggests more trust in the currency, the mainstream still like to play on the falsehood that it is anonymous and ‘unbacked’ by a central bank or authority, and so digital gold providers can take advantage of this. And this is where the likes of the government-owned mints or cryptocurrency builders are stepping in.

Royal Mint expects a gold rush

The government would like you to give them some money. It’s a great deal, honestly. You give them some money and they won’t charge you for keeping it. CME group are helping them to take your money and blockchain is also involved somehow. What do you think? Fancy handing over some of your life savings? No?

Funny that. The above is exactly what is going on. Except there are a couple of steps I didn’t mention. The government would like your money but would prefer that you bought gold from them first and they kept a hold of it. It seems to make the process of handing over funds a lot more gentlemanly, or British if you like.

Under the guise of investing in gold, the Royal Mint claims that they are ‘bringing to market a new way to invest in and digitally trade physical gold bullion.’

When the government-owned Royal Mint announced a new digital gold investment service entitled RMG, in December, they did so with much fanfare and excitement.

Despite a lack of mention of it in their recent literature, RMG uses blockchain technology. As we explained in December

“As one would expect from a trading solution using blockchain, it will ‘log each transaction’. The two parties [Royal Mint and CME Group] will collaborate on a digital gold asset called Royal Mint Gold (RMG) and will ‘transform the way traders and investors trade, execute and settle gold.”

We also quoted the economist Ashe Whitener, back in December, who echoed our thoughts:

“In my opinion, this is only news because the Royal Mint is basically a government-owned entity experimenting with blockchain. Just because something tangible like gold has a serial number on a blockchain, doesn’t mean that it is any more secure, safe or less risky.

Since the underlying asset is still physical, we still must place our trust with the Mint in terms of vaulting the gold. So nothing here really changes.”

More information has been released in recent weeks, but it hasn’t added much meat to the bone of this latest digital gold product.

The fact remains that the Royal Mint have released a digital gold platform, following in the footsteps of BullionVault.com and GoldMoney.com that allows you to buy and sell one gram at a time. Once again, we have to draw and attention to (and ask why) the fact that the government-run Royal Mint is getting the press and naive gold investors excited about RMG, when really very little has changed.

We recently wrote about unallocated gold. We mentioned that whilst new gold investors might think that owning gold without having to pay storage fees seems highly attractive, it also comes with risks and, arguably hidden costs. Unallocated gold is free to store because the bank or institution that you have chosen to buy it through, is using it for it’s own purposes.

The Royal Mint’s RMG is not unallocated, however it does come without storage fees. We have long pointed out the risks in owning unallocated gold and one has to be extremely confident of the solvency of the provider.

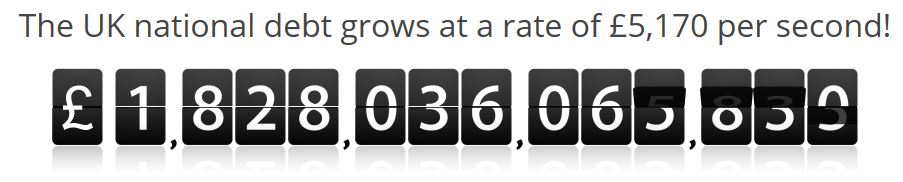

We’re all familiar with the expression ‘if it sounds too good to be true then that’s because it usually is. The Royal Mint is owned by HM Treasury, it pays an annual dividend their way every year. It goes without saying that the United Kingdom is pretty broke at the moment

and with the fallout of Brexit still playing out, against a backdrop of geopolitical uncertainty who knows how much worse it will become.

And when it does, how is the government planning on paying to keep the country going? Who knows, but it’s all happening at the same time that the government is trying to encourage you to hold gold in their vaults.

One other odd thing that they are offering is to ‘buy back’ any RMG should the price of RMG fall below the spot price of gold, “The Royal Mint will buy back any RMG if the trading price of RMG falls below the spot price of gold for longer than 24 hours it will be bought back.”

This surely goes against the idea of owning gold? The beauty of holding gold is that there is a global market for it and it is one of the most liquid markets in the world which protects against price risk. If the gold you own comes with a sticker on it that says it can only be sold as RMG then what was the point in buying it in the first place?

Of course, the Royal Mint are also hoping that the reverse might happen: that RMG will begin to trade at a premium to the gold price. But when this happens, why would people look to buy this when the gold market is one of the most global and liquid ones in existence.

The beauty of gold is that it is gold. We discourage buying gold jewellery as an investment as it receives a huge mark-up quite simply because it is jewellery. We also discourage buying collector coins as they too receive a huge mark-up which does not reflect the gold or silver content.

The Royal Mint is hoping RMG will trade higher than the market-price of a gold-gram because of its association with the 1,000 year old Mint. But, surely then, on the flip side an association with a government-owned institution is not always going to be a positive thing.

Is the Loonie about to get touch of gold?

Let’s look to the Royal Canadian Mint to get more of an idea about where this might go. Last year digital gold provider GoldMoney and the RCM announced that they would be joining forces.

Customers of GoldMoney are able to buy Canadian Mint gold via the company’s permissioned blockchain. We could go into the tech of all of this and ask why a permissioned blockchain is even necessary (in brief – you can just use a secure ledger system, there’s no need for a private blockchain to overcomplicate things. It just sounds good) but instead we note the same issue we do with RMG. The Royal Canadian Mint is owned by the Canadian Government.

While we are big fans of tech and technology solutions in the gold market, it must be acknowledged that there are risks in investing in gold through the intermediary of digital gold platforms.

Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, IT, websites etc of the digital gold platforms and their portals.

Buying gold through an electronic platform can be very convenient and very fast. You can buy significant sums and pay low spreads and low fees, your storage costs for such investments can be extremely cheap too.

These electronic platforms spend a lot of money advertising, and some even claim to give you allocated gold. We do not consider a part ownership of a large 400 oz bar of gold as being allocated. You are in fact a pooled gold investor and one who has no idea of what particular part of a gold bar you own. You can not, unlike GoldCore Secure Storage, drive to a vault in Zurich, Singapore, Hong Kong, Dubai or London and take delivery of your gold, without entering into a sale transaction.

In addition many such platforms force you to only buy and sell through their market board and their online platform and website. Digital gold platforms are “closed loop systems” where liquidity and pricing are dependent on a single platform, website and company. A buyer can only buy and sell through that one online platform. An investor is in effect “captive”.

Besides the dual technological and liquidity risk, there is also the sovereign risk, An investigation by CBC News found that, just two years ago the Mint lost money and continues to struggle, “Revenue is down sharply, jobs have been chopped, morale is in the tank, and formerly successful lines of business are being shut down — even as the mint spends millions of dollars on new executive offices.”

In the third-quarter of 2016 revenues were down by 27% and profits by 61%. All of this is despite efforts to raise funds such as minting collectible coins.

Similar to the RMG, storage is free (for purchases up to 1kg). We don’t need to repeat the above, save asking if this is a trend that will start to appear in other sovereign mints within countries that are part of the huge, growing debt-bubble that will inevitably pop.

To buy and store gold with a government institution is to go against the reasons to buy gold. Investors should not be fooled that the implementation of a blockchain, or the offering of free storage, suddenly means one can disregard centuries of logical gold investment as a store of value and a form of insurance against these very entities.

|

OzcoinGold We’re perhaps being unfair to the Royal Mint and Royal Canadian Mint. They aren’t the only ones using the distrust in the monetary system, distrust of bitcoin, its increased profile and blockchain to their advantage. One of the similarities drawn between gold and bitcoin is that they are finite. Gold is finite because it is natural, it has to be mined from the earth (let’s ignore the mad notion of space mining for now!) and alchemy still eludes us. One gold mining company has taken advantage of this and decided that the best way to raise money (usually a very expensive process full of regulatory and legal costs) is by issuing its own cryptocurrency which is 2/3 backed by gold from its mine. The other third is backed by gold in the Perth Mint. The company proudly state that the coin is backed by 24k gold. 24k is an odd way for gold bullion dealers to describe the product, we usually refer to gold’s millesimal fineness i.e. in three or more digits, rather than karats, most selling 999.99 or 999.999 (if you’re Chinese). 24k is just 999 and therefore not quite as pure, however this is the highest gold content for jewellery. Unsurprisingly, as the majority of it is still in ground, there are no storage fees to pay on the gold and lucky investors can come back in March 2022 and redeem their currency for physical 24k coins. When investors choose to invest in physical gold, they often do with the intention of holding it for the long-term but they are also doing it as a form of insurance. The joy of buying gold is that when done properly (as allocated and segregated gold coins and bars) is that you can take delivery of it at any time. In the above scheme, this is not possible. There is no possible way that the gold can be allocated or segregated from others’ holdings. The ability to do this, is the attraction of investing in gold. Gold investment is also done to reduce counterparty risk. This way to invest in gold relies hugely on counter parties, the main one being the ability of the mining company to actually efficiently run their gold mine so as to extract the gold. Where are the guarantees that this will happen? What happens if the company goes bust? There will be no gold for those investors who thought they were buying a safe haven and form of financial insurance. We support the gold mining company, this is an innovative way to raise funds. However, it must not be presented under the guise of innovative gold investment and as a quite high risk speculation. |

|

|

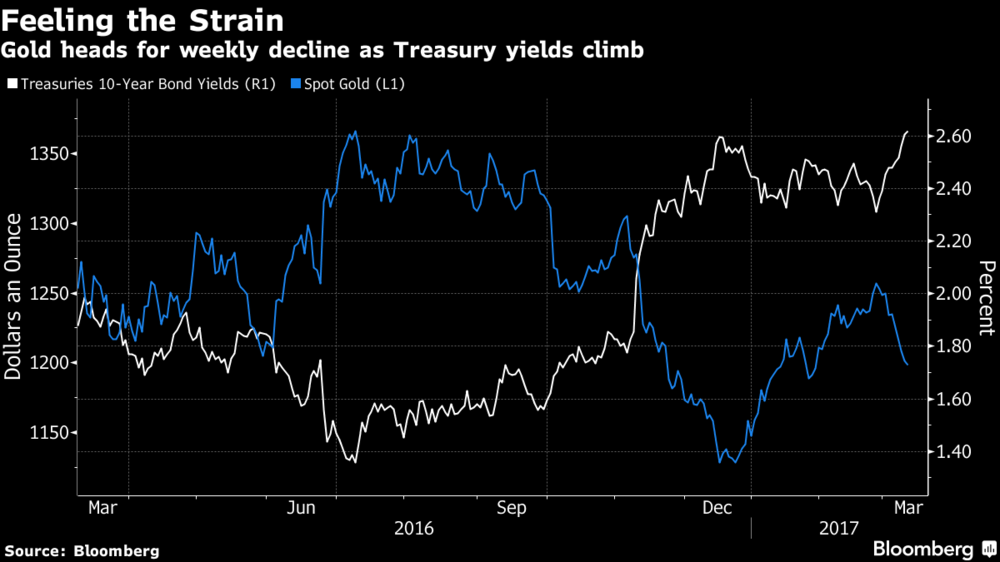

What does it all really mean? Whatever you think of bitcoin, gold and the various digital offerings, one can’t ignore what their existence and growing interest in them means: there are several serious risks both today and on the horizon that will see investors favour those assets that cannot be manipulated, devalued or confiscated. And this all boils down to why we invest in and more importantly legally own physical gold, or even bitcoin – because we want to diversify and own a store of value. So why would you choose to buy gold that is being ‘protected’ by the very government that is at least in part responsible for driving you to own physical bullion precious metals in the first place? Or why would you choose to buy gold that you are unable to retrieve in your preferred coin or bar format at short notice? We shouldn’t, however, dismiss government-backed institutions offering gold products and gold-backed blockchain products, with the same brush. The way people have chosen to invest in physical gold has evolved over hundreds of years, thanks to technology. Our clients from over fifty countries around the world would not be able to be invest in allocated, segregated gold through us, if it were not for technology. Blockchain really can contribute in this space, but we do not believe that those examples mentioned above are the right ones. Digital gold is digital gold and physical gold is physical gold. There is a huge opportunity for digital gold and blockchain to come together, but it is probably best if the combination does not involve government institutions seeking to profit from investors and store of value gold buyers seeking the hedging qualities and safe haven qualities of actual gold bullion. |

Gold Weekly, Mar 2016 - 2017 |

Tags: Bitcoin,Blockchain,Bond,Business,Canadian government,central banks,China,Counterparty,Cryptocurrencies,Digital currency,Dubai,economy,ETC,Ethereum,Featured,Finance,Gold as an investment,Gold coin,gold standard,Google,Greece,Hong Kong,India,Monetary Policy,money,newsletter,Precious Metals,Reuters,RMG uses blockchain technology,Securities and Exchange Commission,Sovereign Risk,The Economist,UK Government,United Kingdom,US Federal Reserve,Volatility,Zurich