It Wasn’t Supposed to Do That… When you’re a central banker in a pure fiat money system and even your ability to print your own currency into oblivion is questioned by the markets, you really have a problem. This is actually funny on quite a number of levels if one thinks about it a bit… Haruhiko Kuroda (a.k.a. Kamikaze) is such a central banker. His valiant attempts to make Japan richer by making its citizens poorer is beginning to be rejected by Mr. Market: Kuroda-san’s latest monetary depredations continue to backfire (from his perspective, that is). The chart of the yen actually continues to look quite bullish here – it is in the process of breaking out and has just attained a new 17 month closing high – click to enlarge. Yes, operation DTY (Destroy the Yen) has been rudely interrupted. It worked for quite a while, but not anymore (or not anymeure, as Clouseau would say). Looking at a weekly chart, one can see a classic saucer-shaped bottoming formation in the yen, which has to look extremely inviting to hedge funds, CTAs, etc. employing technically oriented trading strategies – and there are quite a few of those out there. The yen, weekly, over the past five year. The BoJ under Mr.

Topics:

Pater Tenebrarum considers the following as important: Central Banks, Monetary Metals

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Marc Chandler writes Consolidation Featured

Marc Chandler writes Fragile Turn Around Tuesday

Adam Button writes SNB’s Jordan: I’m not sure whether if the terminal rate has been reached

It Wasn’t Supposed to Do That…

When you’re a central banker in a pure fiat money system and even your ability to print your own currency into oblivion is questioned by the markets, you really have a problem. This is actually funny on quite a number of levels if one thinks about it a bit…

Haruhiko Kuroda (a.k.a. Kamikaze) is such a central banker. His valiant attempts to make Japan richer by making its citizens poorer is beginning to be rejected by Mr. Market:

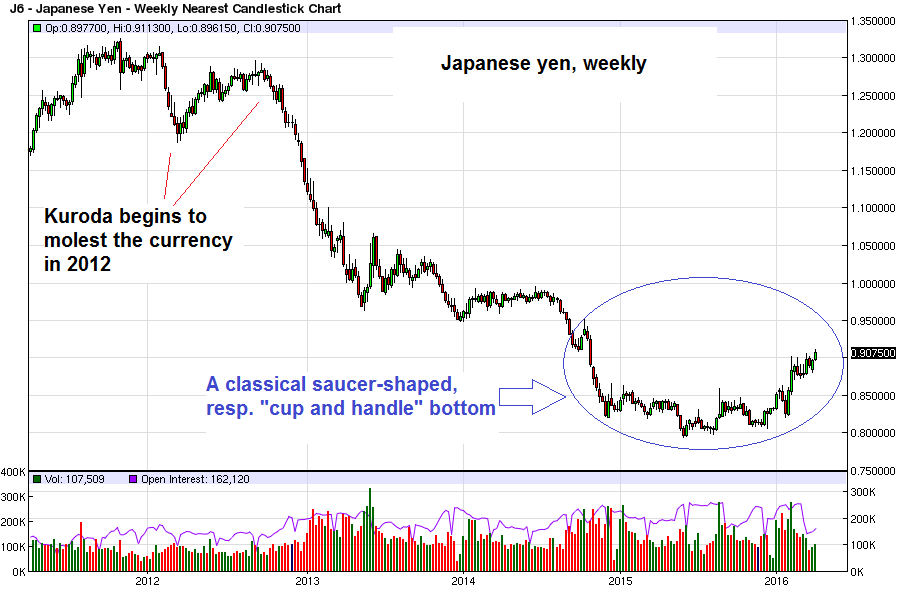

Kuroda-san’s latest monetary depredations continue to backfire (from his perspective, that is). The chart of the yen actually continues to look quite bullish here – it is in the process of breaking out and has just attained a new 17 month closing high – click to enlarge.

Kuroda-san’s latest monetary depredations continue to backfire (from his perspective, that is). The chart of the yen actually continues to look quite bullish here – it is in the process of breaking out and has just attained a new 17 month closing high – click to enlarge.

Yes, operation DTY (Destroy the Yen) has been rudely interrupted. It worked for quite a while, but not anymore (or not anymeure, as Clouseau would say). Looking at a weekly chart, one can see a classic saucer-shaped bottoming formation in the yen, which has to look extremely inviting to hedge funds, CTAs, etc. employing technically oriented trading strategies – and there are quite a few of those out there.

The yen, weekly, over the past five year. The BoJ under Mr. Kuroda at first succeeded in driving it lower, although the move probably owed far more to the markets pricing out extreme macro risks such as an imminent euro zone blow-up than to the BoJ’s so-called “efforts”. Central planners and their claqueurs always like to imagine that things happen solely because of what they are doing, but that is of course complete rubbish – click to enlarge.

The yen, weekly, over the past five year. The BoJ under Mr. Kuroda at first succeeded in driving it lower, although the move probably owed far more to the markets pricing out extreme macro risks such as an imminent euro zone blow-up than to the BoJ’s so-called “efforts”. Central planners and their claqueurs always like to imagine that things happen solely because of what they are doing, but that is of course complete rubbish – click to enlarge.

Given the market’s “muscle memory” of the negative correlation between the yen and the Nikkei, Japanese stocks have been under quite a bit of pressure of late. So what can one conclude from all this? That is actually quite simple: Kuroda-san is going to adopt even more extreme monetary policies.

This conclusion is based on the general Keynesian principle that if a policy fails to bring about the desired results and in fact brings about the exact opposite of what it was supposed to achieve, it must mean you haven’t done enough of whatever it is you’ve been doing.

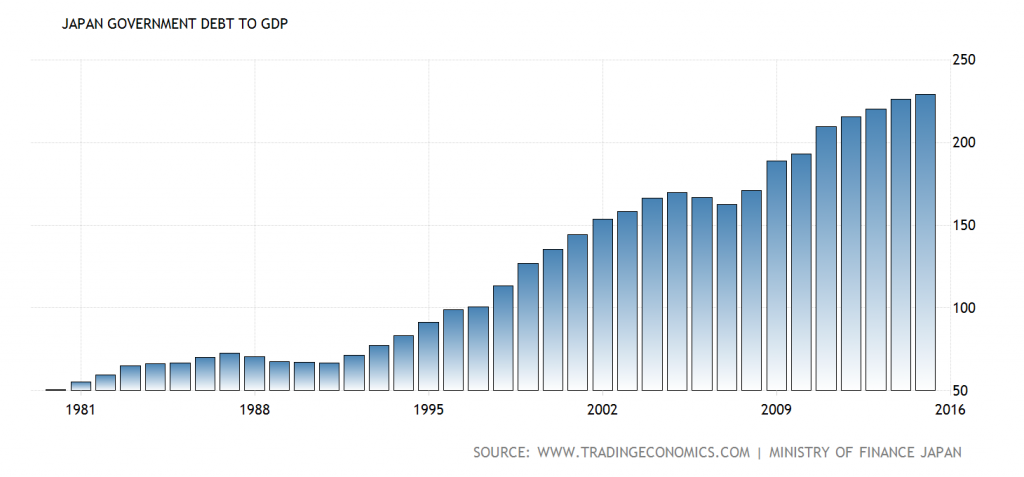

So the fact that Japan has amassed the by far biggest debt load of all developed nations, has gone through so many iterations of “QE” that we’ve lost count, and has failed to achieve even a single one of its economic and monetary policy aims in 26 years running, doesn’t mean these policies are misguided. It only means they must be implemented in even grander style.

If this looks familiar, it is probably because you remember that this is how Einstein reportedly defined insanity, i.e., doing the same thing over and over again, and expecting a different result. Yes, they are insane.

As Bill Bonner has recently pointed out, two well-known Western quack economists, namely Messrs. Krugman and Stiglitz, are currently advising the Japanese government to implement a “looser fiscal policy”. So the insanity is widespread, it is a kind of modern intellectual plague if you will.

Japan’s towering public debt to GDP ratio, which is even putting even that of de facto bankrupt Greece into the shade. Last year’s budget deficit amounted to 6% of GDP, by far the highest in the developed world as well. Paul Krugmann and Joseph Stiglitz, sharp tools that they are, have quickly identified what the problem is: clearly, there hasn’t been enough government spending – click to enlarge.

Japan’s towering public debt to GDP ratio, which is even putting even that of de facto bankrupt Greece into the shade. Last year’s budget deficit amounted to 6% of GDP, by far the highest in the developed world as well. Paul Krugmann and Joseph Stiglitz, sharp tools that they are, have quickly identified what the problem is: clearly, there hasn’t been enough government spending – click to enlarge.

Japan’s “Tolerance Probed”

Are really even more extreme policy measures in the offing, in spite of the fact that more than $5 trillion of Japanese government bonds are trading at negative yields by now, with the JGB market all but dead? A recent article at Bloomberg informs us that “Yen at Strongest in 17 Months Probing Limit of Japan’s Tolerance”, but goes on to suggest that no intervention will be attempted.

We would note to this that Japan is just a place, and as such has no feelings. The only people whose “tolerance is probed” are the bureaucrats infesting Japan’s GOSPLAN agencies. Japanese citizens by contrast should be breathing a sigh of relief, as there is one thing Mr. Kuroda’s policies have actually been very good at: namely, destroying their real incomes at warp speed. Bloomberg writes:

Foreign-exchange traders are challenging Japanese policy makers’ tolerance for a stronger yen as the currency climbed to a level unseen for 17 months. The yen briefly pushed through 110 per dollar on Tuesday to the highest since Bank of Japan Governor Haruhiko Kuroda boosted monetary easing in October 2014, and a level that some strategists see as heightening the risk of intervention. Kuroda has said he’ll keep monitoring the currency and reiterated the potential for cutting interest rates further below zero. The next scheduled policy meeting is April 27-28.

“Dollar-yen’s price action suggests traders don’t see much threat of anything to stop the yen rally,” said Sean Callow, a senior foreign-exchange strategist at Westpac Banking Corp. in Sydney. “Bold easing on April 28 is the most plausible circuit breaker for the dollar-yen rout, but it’s not clear we will see that.”

[…]

Japanese officials won’t engage in actual intervention, and continued jawboning would be “meaningless,” said Tohru Sasaki, head of Japan markets research in Tokyo at JPMorgan Chase & Co. and a former BOJ official. “If you only shoot blanks, it just makes a sound,” he said. “At first everyone is surprised, but once they get used to it, it’s just noise.”

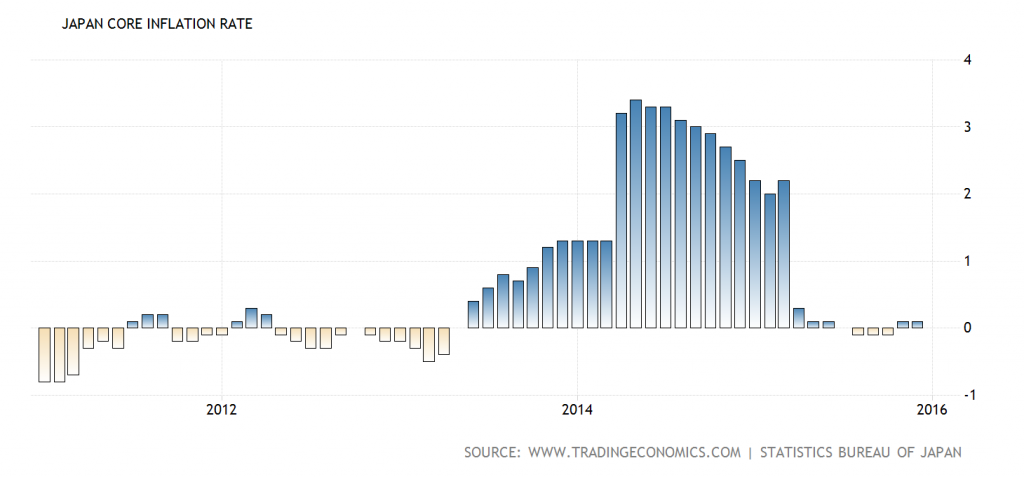

Sasaki sees the yen strengthening to 103 per dollar at year-end, after accurately predicting it would appreciate at the start of 2016. Japan’s currency has surged 9 percent against the dollar this year, the best performer among its 16 major peers, as signs China is slowing reverberated through the global economy and boosted demand for safer assets. A weaker yen has been a key ingredient of Kuroda’s efforts to boost inflation to 2 percent through monetary stimulus. The BOJ’s benchmark consumer-price index has been stuck near zero for a year.

(emphasis added)

Allow us to point out that the yen is actually not a “safe asset”. It is just another fiat confetti currency, and one which is definitely already under the ominous shadow cast by the sword of Damocles. The main reason why it tends to rise when “risk asset” prices are going down is that it is widely used as a funding currency for carry trades, which tend to get unwound in these situations.

Another reason is the fact that in spite of its huge domestic debtberg, Japan continues to be the world’s largest external creditor – and yen tend to be repatriated by Japanese institutions when global markets begin to wobble. Lastly, the end of March is fiscal year-end for many Japanese companies, and this tends to support yen strength as well (also due to repatriation). None of this has anything to do with the yen’s alleged “safety”.

Japan’s “core inflation rate” (excl. food and energy) – stuck at zero. The brief surge in 2014 mainly had to do with a sales tax hike – click to enlarge.

Japan’s “core inflation rate” (excl. food and energy) – stuck at zero. The brief surge in 2014 mainly had to do with a sales tax hike – click to enlarge.

As you can see above, the BoJ hasn’t even been able to push up consumer prices in Japan. Since the country’s population is aging and shrinking quite rapidly, there are fewer and fewer people spending money on consumption. There is also not much reason for commercial bank credit expansion – credit demand is dead as a doornail.

We believe it is possible that this data point will eventually just jump from zero to infinity in one go, when the currency system itself is finally coming under suspicion. Possible doesn’t mean certain of course, and even if it does happen one day, that day is probably still quite a way off – it is definitely not an immediate concern.

In fact, we think the yen is likely to keep rising against other currencies in the short to medium term, and the BoJ will continue to fail in its attempt to push CPI higher. However, we don’t believe for one second it won’t keep trying. The idea that BoJ will refrain from more intervention strikes us as ludicrous. Has Mr. Kuroda ever given any reason to doubt that he will keep pumping? Not that we can recall.

In the meantime, the TANKAN business sentiment survey (quite an aptly named survey as it were) has begun to tank again, mirroring the Nikkei:

The TANKAN business confidence survey is tanking – click to enlarge.

The TANKAN business confidence survey is tanking – click to enlarge.

This is all the more reason to expect that even more BoJ lunacy is just around the corner. Somehow we think that the advice from Messrs. Krugman and Stiglitz will also be welcomed quite eagerly, so deficit spending is likely to surge as well. Given Mr. Abe’s nationalistic and militaristic inclinations (see “Shinzo Abe’s True Agenda” for details on this), the government may well opt for buying more war toys. That would definitely be in the Keynesian spirit, similar to ditch digging and pyramid building.

Conclusion – Implications of a Stronger Yen

From a technical perspective, it seems to us that the yen is set to continue to defy the BoJ’s attempts to rein it in. Occasionally its rally may well be interrupted by additional BoJ easing announcements, but over the medium term, more strength seems highly likely. This probably has implications for a great many other markets, since a rising yen is usually associated with trouble in risk asset land.

The Nikkei is the stronger yen’s first victim…it has begun to decouple noticeably from other stock markets – click to enlarge.

The Nikkei is the stronger yen’s first victim…it has begun to decouple noticeably from other stock markets – click to enlarge.

We don’t see why it should be different this time around. Of course, it is always possible for certain correlations to stop working – so one shouldn’t be too dogmatic about this. Nevertheless, we would recommend to keep a close eye on the yen from here on out. Increasing yen strength could well go hand in hand with the risk apple cart being upset.

Charts by: BarChart, TradingEconomics, StockCharts

Full story here