I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of...

Read More »“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

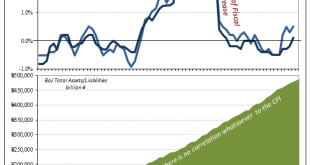

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank’s interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the “the...

Read More »What is the Bank of Japan to Do?

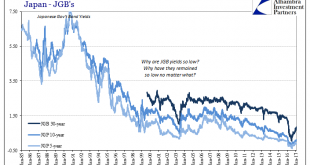

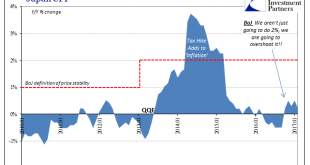

Summary: Policy is on hold. There is several areas which the BOJ can adjust its forecast or forward guidance. BOJ is more likely to err on the side of caution. The Bank of Japan is unlikely to change policy. Its current policy of targeting 10-year bond yields and expanding the balance sheet by JPY80 trillion is aimed at boosting core inflation to 2%. However, the risk is that BOJ Governor Kuroda surprises the...

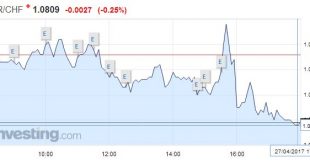

Read More »FX Daily, April 27: Several Developments ahead of the ECB meeting

Swiss Franc EUR/CHF - Euro Swiss Franc, April 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday. Also, after a misdirection over pulling out of...

Read More »Where There’s Smoke…

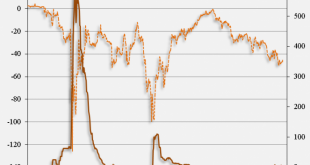

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »The Global Burden

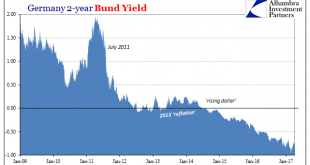

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it. On September 17, 2014, almost exactly fourteen years...

Read More »Systemic Depression Is A Clear Choice

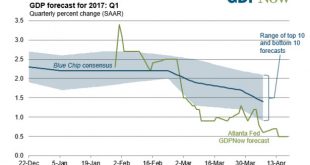

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group. In the US, the Federal Reserve “raised rates” for the first time in a decade on the same day they released industrial production figures...

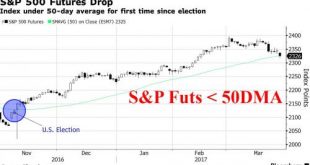

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

Read More »True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org