With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

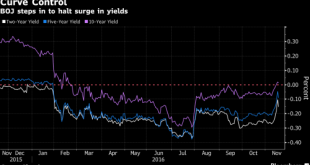

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

Submitted by John Rubino via DollarCollapse.com, At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable: SNB’s U.S. Stock Holdings Hit $62.4 Billion...

Read More »Japan may see modest improvements in growth and inflation

In spite of prospects for a moderate upturn, monetary policy is clearly showing its limits, with structural reforms needed to improve Japan’s economic outlook.At its latest policy meeting on November 1, the Bank of Japan (BoJ) elected to keep its “Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control” policy unchanged and did not announce any further easing measures. In addition, the BoJ revised the trajectory of its inflation projections downward to better reflect...

Read More »FX Daily, November 01: Dollar and Yen Slip in Quiet even if Eventful Turnover

Comment on Swiss Franc by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs EUR/CHF Swiss Franc: The EUR/CHF has fallen again to the SNB intervention levels of 1.08. The dollar has depreciated by more than 1%. Who has followed our blog, knows that the Franc is a proxy for global growth, in particular Emerging Markets. Today’s...

Read More »FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical. The...

Read More »FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical. The...

Read More »FX Daily, October 27: Rising Yields Continue to be the Main Driver

Swiss Franc EUR/CHF - Euro Swiss Franc, October 27(see more posts on EUR/CHF, ). - Click to enlarge GBP/CHF rates have levelled out over the past couple of weeks following some heavy losses earlier this month. The Pound crashed following UK Prime Minister Theresa May’s comments regarding the triggering of Article 50 early next year. Whilst we knew this was coming the timeline was shrouded in uncertainty and the...

Read More »Financial Repression Is Now “In Play”

Submitted by Gordon T Long via FinancialRepressionAuthority.com, A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and...

Read More »Is the Gold Bull Market Over?

ABN Amro, Natixis and Wells Fargo have issued bearish calls on gold. Natixis even expects three Fed rate hikes next year. Pater Tanebrarum discusses these opinions critically.Since gold is correlated to CHF, this is a bearish for the Swiss Franc, too. One additional points speaks against a rate hike. The U.S. capacity utilization that is 75% compared to 90% in 1967. So Far a Normal Correction In last week’s update...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org