There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.” The Japanese provide us instead with an almost perfect demonstration of what happens when authorities don’t do all that. The Bank of Japan stands out for its incompetence even among the cohort of central banks, which is really saying something. For an industry that can’t get much of anything right, being near or at the top of that list is a truly dubious distinction, much less staying in that position for so long. The FOMC was absolutely correct in 2003 to criticize BoJ actions but not for the reasons they thought. The Fed was merely several years behind in making the same mistakes. If there is one success of QQE it surely has been how it restarted the performance benchmark for Japanese monetary policy. Practically no one remembers that QQE was at best QE10, at worst QE22.

Topics:

Jeffrey P. Snider considers the following as important: Bank of Japan, consumers, CPI, currencies, depression, Economics, economy, Featured, Federal Reserve/Monetary Policy, household income, household spending, inflation, Japan, Markets, newsletter, orthodox economics, QQE, The United States, they really don't know what they are doing

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.” The Japanese provide us instead with an almost perfect demonstration of what happens when authorities don’t do all that.

The Bank of Japan stands out for its incompetence even among the cohort of central banks, which is really saying something. For an industry that can’t get much of anything right, being near or at the top of that list is a truly dubious distinction, much less staying in that position for so long. The FOMC was absolutely correct in 2003 to criticize BoJ actions but not for the reasons they thought. The Fed was merely several years behind in making the same mistakes.

If there is one success of QQE it surely has been how it restarted the performance benchmark for Japanese monetary policy. Practically no one remembers that QQE was at best QE10, at worst QE22. Restarting the clock, so to speak, by committing to the big one, its colossal size and open ended structure, was practically a “do over” that might have been enormously helpful had Japanese economists understood anything more than textbook Economics. Instead, all QQE really did is prove without a doubt they really don’t know what they are doing.

We might often forget that QQE was but the tool rather than intent. Central bank orthodoxy works on credibility and expectations, meaning that under ideal circumstances monetary policy declares a thing and the rest of the markets and economy create that thing simply because they believe the central bank will if forced to. If everyone believes that a central bank is all-powerful, or at least something close to it, then if that central bank declares 1% inflation to be its target 1% inflation it is very likely to find.

With Abe’s election in late 2012, the Bank of Japan as part of Abenomics re-evaluated what was thought was missing from Japan’s economy. It had been accepted doctrine that the island nation suffered from what sounds like mass delusion to economists, this “deflationary mindset” where the Japanese people are too dour for their own good. The recovery some two decades after its fateful break in trend would be realized whenever the BoJ might re-establish its dominance. In other words, if it were to call down the thunder, by god the people will finally move as they are supposed to!

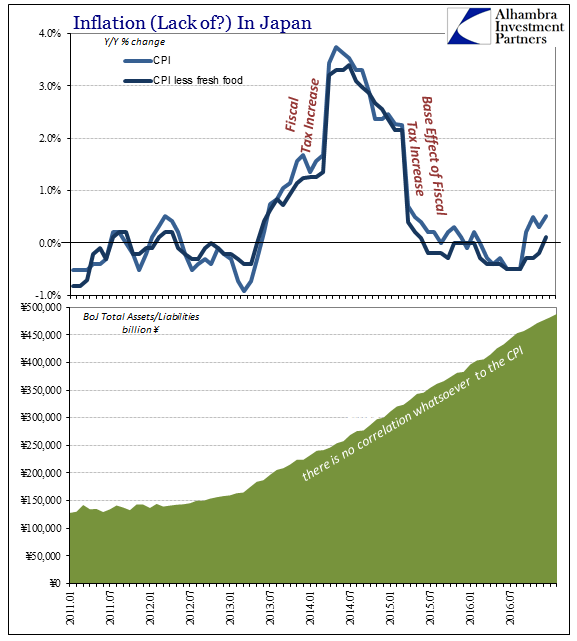

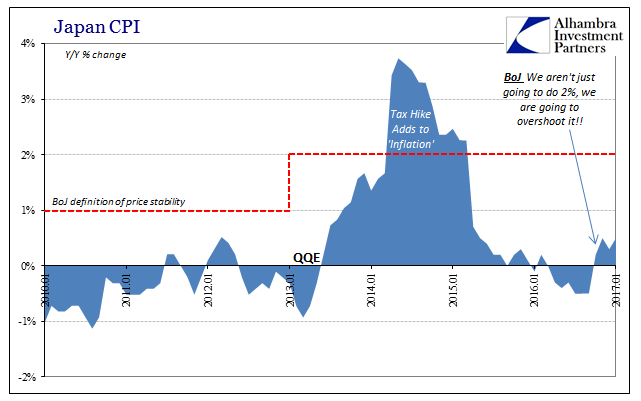

| QQE was meant to do just that, a promise to keep buying up assets and “printing money” at an astounding rate until such time that CPI met and maintained the policy target. To show that the BoJ was truly serious they even changed their definition of price stability, to where they would now target to 2% as compared to just 1% where it had been prior as merely a “goal.” As early as March 2013, Haruhiko Kuroda, BoJ’s chief, began explicitly stating that two years’ time would be sufficient to see that target reached.

That was just about four years ago, and apart from a brief period in 2014 due mostly to the tax change that year the CPI hasn’t come close. Worse, for Kuroda anyway, not for Japan’s people, what the whole episode established was the utter and complete disassociation of BoJ “money printing” from Japanese consumer prices. The whole theory, from methodology to quantity, has been disproved just that thoroughly. |

Inflation In Japan 2011-2016 |

| Rather than acknowledge what is clear reality, Kuroda’s group instead in September 2016 actually (and out loud) committed to “overshoot” the 2% inflation target. I have little doubt BoJ officials were serious about it, largely because the bubble in which central bankers and economists operate is often just that impenetrable so as to prevent the slightest self-awareness. It doesn’t seem as if anyone in the media asked them how they planned to do so, and with good reason for Kuroda in particular has been reduced to the status of King Canute (though Canute beats Kuroda hands down because he at least knew that his commanding of the tides was a futile gesture, a fact of life the Bank of Japan appears very intent on ignoring even after a quarter century and all that it has done).

The farce was completed on November 1 when Kuroda, even after promising to “overshoot” barely six weeks earlier, admitted that 2% wasn’t going to happen at least during his tenure. The new estimate is for later 2018, months after his term mercifully expires, which would be more than five years after the target was stated. Given that the BoJ had pushed back the “two year” timeframe four times already, what credibility is there left?

|

Japan Consumer Price Index 2010-2017(see more posts on japan c, ) |

| I frame this discussion satirically because at this point what else can you do? How much more evidence do economists need to demonstrate once and for all they have no idea? That’s where the parody comes in, for there is actually no amount of evidence that will ever convince them they are wrong. Economics is not a science, and Japan is the very place where that indictment is proven five hundred trillion times over.

|

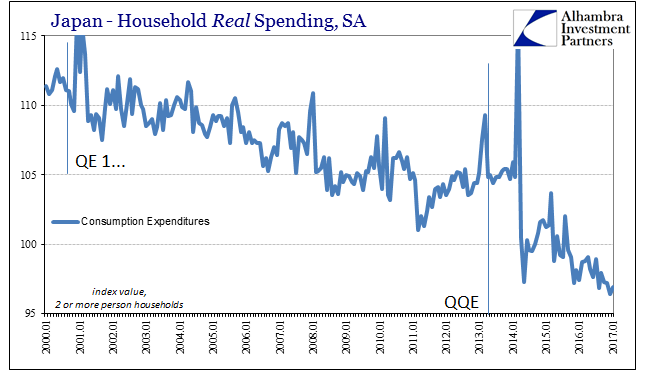

Japan Household Real Spending, SA 2000-2017 |

| But this is all deadly serious stuff. Japan in terms of its social structure is rigid enough to withstand a quarter century of constant depression, where it seems very few actually pay attention anymore to the farce. It’s apathetically accepted now as just the way it is. |

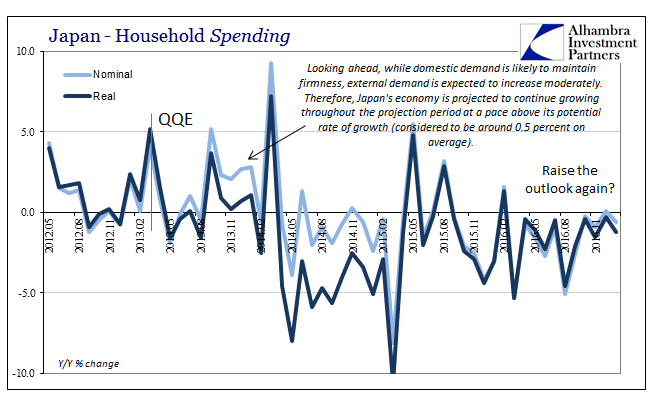

Japan Household Spending 2012-2017 |

| The rest of the world is frustratingly following along in behind Japan’s trailblazing stupidity, however. Economists in the US, Europe, and elsewhere have decided that low growth everywhere is now, too, just the way it is. Unfortunately, that just won’t fly for some undetermined amount of time more, because the weaker social fabrics that are already frayed by a decade of contraction and stagnation will tear apart at some point – raising greatly the risks of triggering the worst scenarios if something isn’t done first to keep these places, including the United States, from suffering what the Japanese have already suffered. |

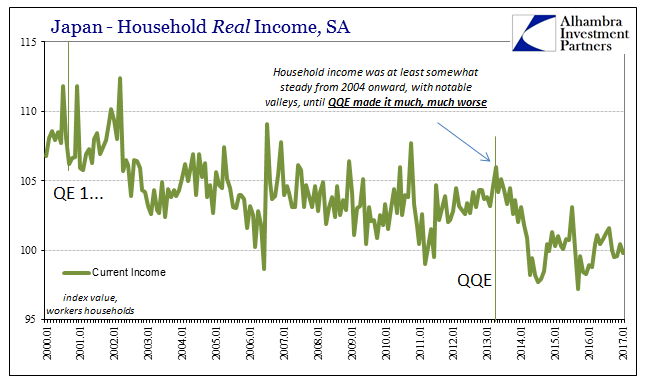

Japan Household Real Income, SA 2000-2017 |

| Their condition is in even this small review shocking. It has been just as lazy to suggest Japanese misfortune is in good part if not totally demographic destiny. That is merely backward justification for inarguable economic failure, and as usual having been pioneered in Japan it is now many years later being applied globally. |

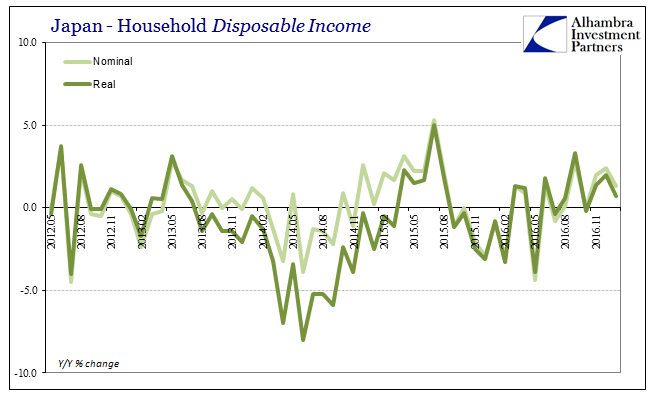

Japan Household Disposable Income 2012-2017 |

| Japan’s population may be now on its downside trajectory, but real Household spending in January 2017 was 13% less than January 2000. In absolute terms, 13% is enormous; in terms of 17 years, it is an incalculable cost that might instead propose the cause of Japan’s demographic severity rather than be of its effects.

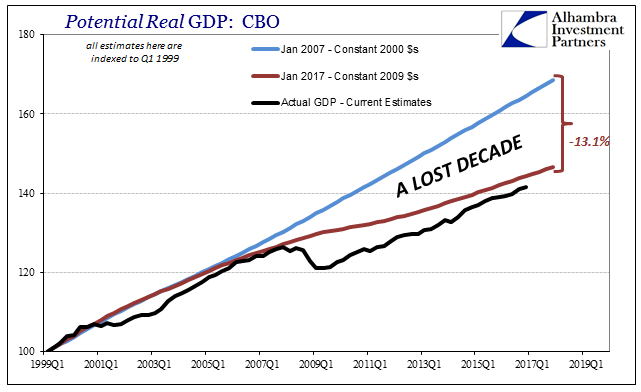

This is why markets are so captured under these various “reflation” ideas (the latest being the fourth). It is only human to recoil at these possibilities and believe them impossible so as to believe instead in the next big genius idea – even, as today, when there isn’t even one on the table. The mere hope for it is enough because to see Japan in our future just doesn’t seem at all plausible, true cognitive dissonance. Unfortunately, so long as economists continue to wield so much influence it is the only realistic baseline. |

Potential Real GDP: CBO 1999Q1-2017Q1 |

Tags: Bank of Japan,consumers,CPI,currencies,depression,Economics,economy,Featured,Federal Reserve/Monetary Policy,household income,household spending,inflation,Japan,Markets,newsletter,orthodox economics,QQE,they really don't know what they are doing