Summary: Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China’s PMI are among the data highlights. Three major central banks meet in the week ahead, and there are several important reports due out that will give investors more insight into how the...

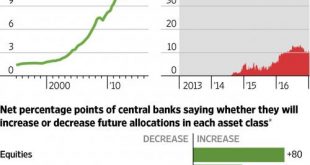

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet. My prognosis is...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More »As Central Bankers Spin

Posted with permission and written by Tim Taschler, Sprott Global I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning. Stock markets trade based on the next set...

Read More »Frontrunning: December 20

Trump wins Electoral College vote; a few electors break ranks (Reuters) European Stocks Head for a One-Year High (BBG) Japan's Central Bank Keeps Policy Unchanged, Upgrades Economic Outlook (BBG) Russia and Turkey vow to keep detente on track after murder (FT) The Political Implications of Events in Ankara and Berlin (BBG) Trump condemns Berlin attack, says things 'only getting worse' (Reuters) Merkel: "No Doubt Berlin Crash Was a Terror Attack" (BBG) Gunman in Zurich mosque shooting is dead...

Read More »S&P Futures Rise Propelled By Stronger Dollar; Europe At 1 Year High As Yen, Bonds Drop

It appears nothing can stop the upward moment of equities heading into the year end, and as has been the case for the past few weeks, US traders walk in with futures higher, propelled by European stocks which climbed to their highest in almost a year, while the dollar rose and bonds and gold fell, failing again to respond to a series of geopolitical shocks following terrorist attacks in Ankara, Berlin and Zurich. The yen tumbled after the Bank of Japan maintained its stimulus plan even as the...

Read More »Signs of life in Japanese inflation

Despite the lack of wage growth, yen weakening and higher commodity prices mean inflation in Japan may start to move higher.The labour survey for October shows that wage growth remains sluggish in Japan, despite increasing signs of tightness in the labour market. Nonetheless, inflation in Japan may start to move higher on account of external factors such as the exchange rate and commodity prices.Japanese workers’ cash earnings rose by just 0.1% year-over-year in October. Earnings have been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org