Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around. Or at least that’s how it’s remembered. Whether the cigar-chomping central banker was really...

Read More »Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week. I can only see things as they are today and think about similar times in the past and know that...

Read More »Weekly Market Pulse: Oil Shock

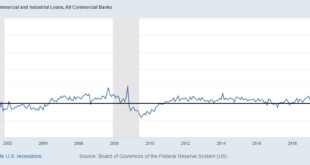

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past...

Read More »Weekly Market Pulse: Fear Makes A Comeback

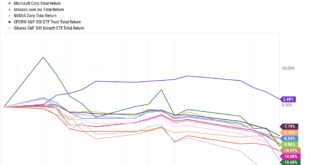

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline. Philip Roth Be fearful when others are greedy and be greedy when others are fearful. Warren Buffett The new year hasn’t gotten off to a great start for growth stocks or any of the other speculative assets that have drawn so much attention over the last couple of years. Bitcoin is down 25% since the...

Read More »Weekly Market Pulse: A Very Contrarian View

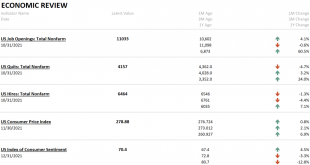

What is the consensus about the economy today? Will 2022 growth be better or worse than 2021? Actually, that probably isn’t the right question because the economy slowed significantly in the second half of 2021. The real question is whether growth will improve from that reduced pace. The Atlanta Fed GDPNow tracker now has Q4 growth all the way down to 5% from the 6.8% rate expected just a week ago (a result of a less than expected retail sales report). That’s still a...

Read More »Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More Inflation is Soaring.. America’s Inflation Burst This morning on Face The Nation, Mohamed El-Erian, former Harvard endowment manager, former bond king apprentice, economist and the man who seems to have a permanent presence on CNBC, had this to say: The characterization of inflation as transitory...

Read More »Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs. But here in the US, the rebound from the Q3 slowdown is in full bloom. Just last week we had pending home sales, ADP employment, both ISM reports,...

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO talks about last week’s reversal in bonds yields, if there’s a growth scare, what the yield curve is saying, plus reports on wages & salaries, core capital goods, and jobless claims. [embedded content] [embedded content] You Might Also Like Weekly Market Pulse: Inflation Scare! 2021-10-25 The S&P 500 and Dow Jones Industrial stock averages made new all time highs...

Read More »Weekly Market Pulse: Growth Scare?

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved. I wrote nearly 2000 words last week about that change in inflation expectations and I’m so glad you took the time to read it. And now you can forget it because over the next four days all but 2 basis points of the move in the...

Read More »Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year. Or are we? Well, yes, the 10 year is back where it was but that doesn’t mean everything else is and, as you’ve probably...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org