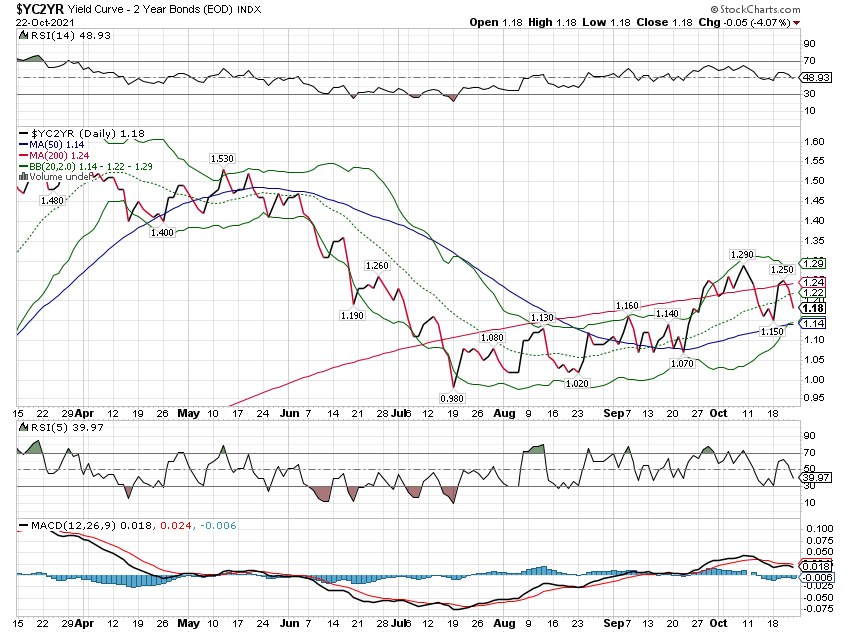

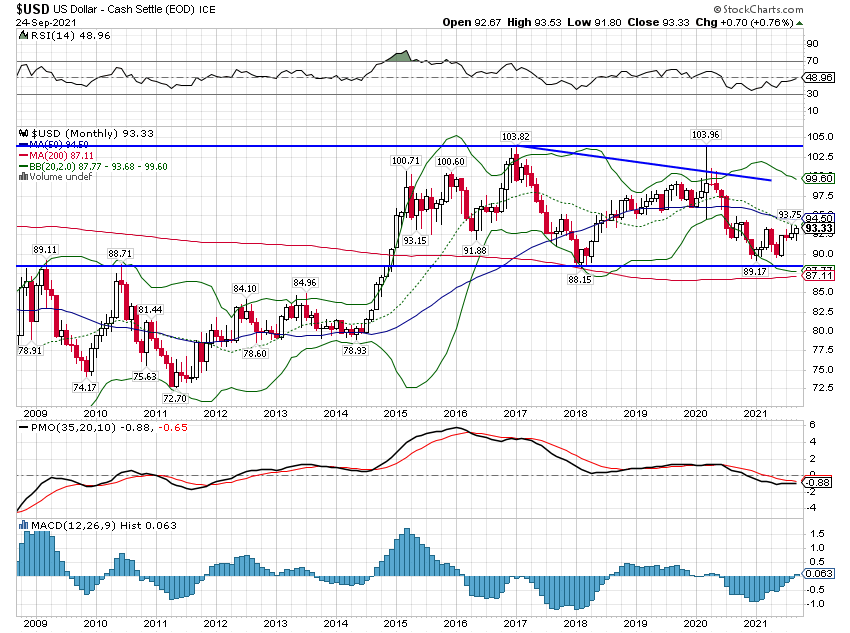

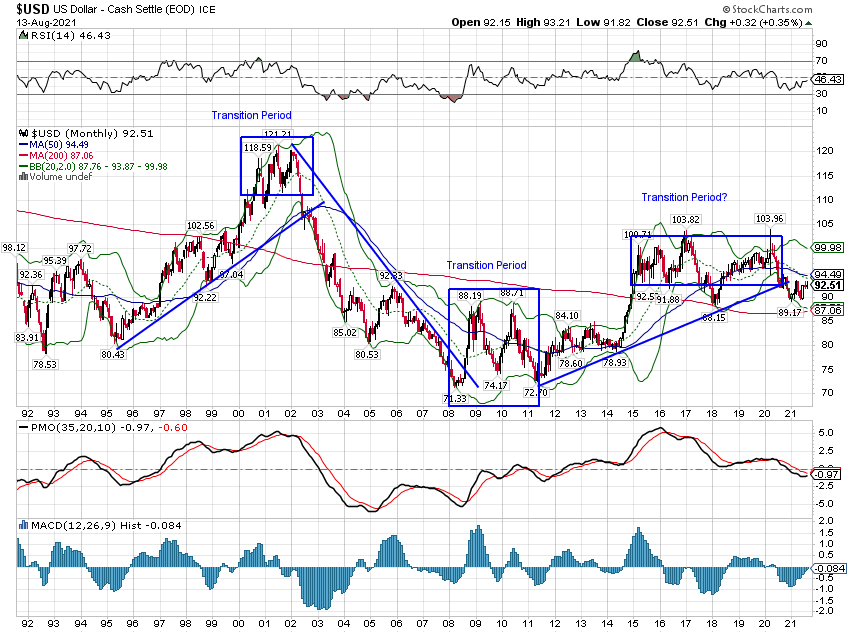

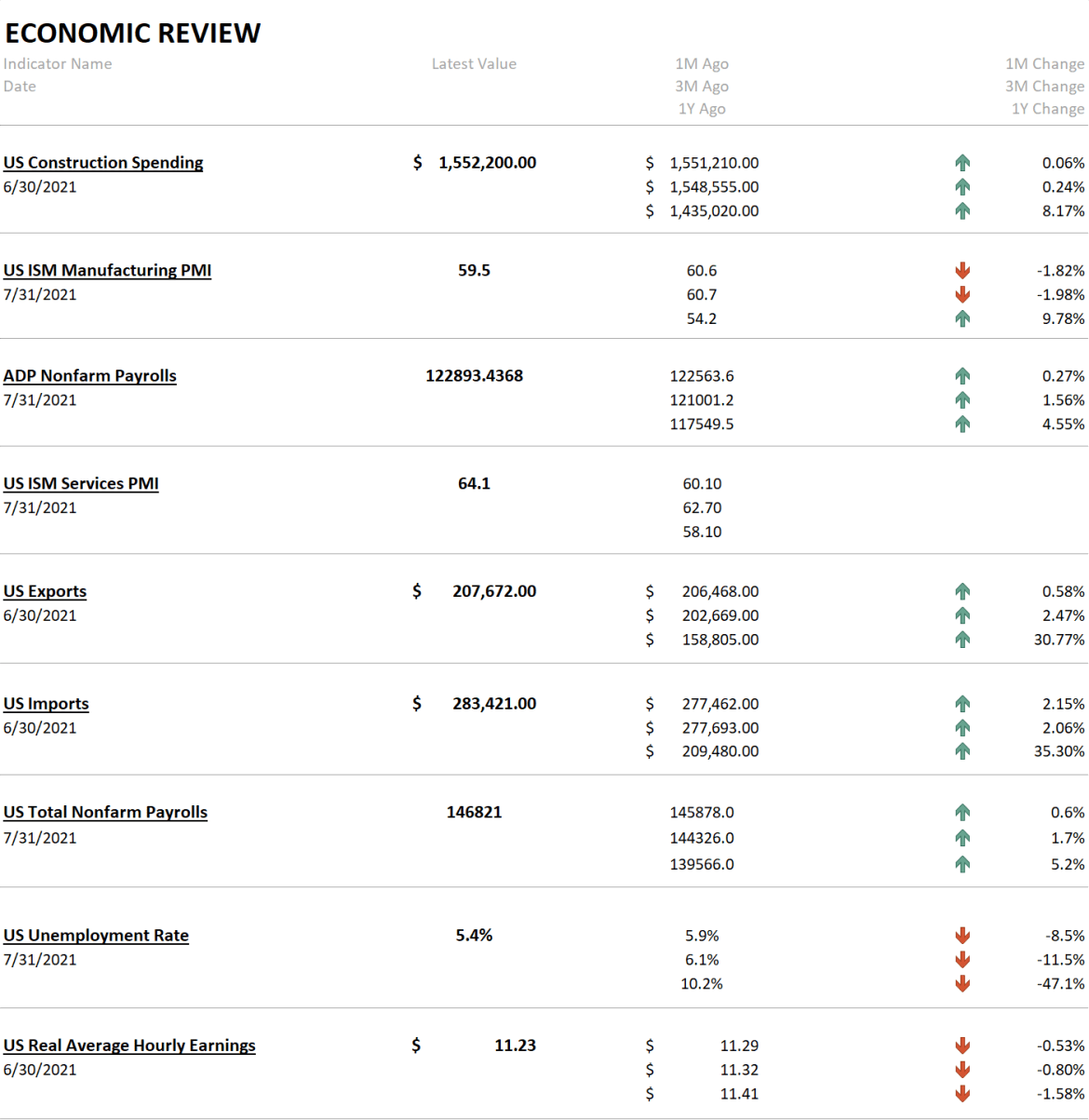

Alhambra CEO talks about last week’s reversal in bonds yields, if there’s a growth scare, what the yield curve is saying, plus reports on wages & salaries, core capital goods, and jobless claims. [embedded content] [embedded content] You Might Also Like Weekly Market Pulse: Inflation Scare! 2021-10-25 The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year. Weekly Market

Topics:

Marcelo Perez considers the following as important: 5.) Alhambra Investments, Alhambra Research, bonds, commodities, currencies, economy, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, Real estate, stocks, Taxes/Fiscal Policy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Alhambra CEO talks about last week’s reversal in bonds yields, if there’s a growth scare, what the yield curve is saying, plus reports on wages & salaries, core capital goods, and jobless claims.

Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks,Taxes/Fiscal Policy