It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large. George Carlin The quote from Dickens above is one that just about everyone knows even if they don’t know where it comes from or haven’t read the book. But, as the ellipsis at the end indicates, there is quite a bit more to the line than the part everyone remembers. It was the best of...

Read More »Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it. When nominal rates fell from April through July, real rates fell right along with them. The nominal bond yield fell by 63 basis points and the 10 year TIPS yield fell by 57....

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun discusses China’s Evergrand, this week’s Fed meeting, the overpriced stock market, and the latest CPI numbers and reports. [embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-09-20 Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling...

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun discusses China’s Evergrand, this week’s Fed meeting, the overpriced stock market, and the latest CPI numbers and reports. [embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-09-20 Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun responds to questions about a slowing economy, long-term economic impacts of COVID, stock prices and the business cycle. [embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-09-13 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars....

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun talks about last week’s surprising market reaction to the unemployment numbers and why it’s important to study the bond market. [embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-09-13 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars....

Read More »Weekly Market Pulse: Happy Anniversary!

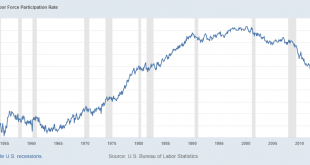

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org