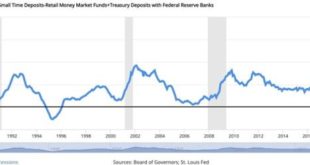

The Federal Reserve was supposed to prevent recessions that people blamed on the lack of central banking. Not surprisingly, the post-Fed recessions have been worse. Original Article: “How Bad Were Recessions before the Fed? Not as Bad as They Are Now” With a recession looming over the average American, the group to blame is pretty obvious, this group being the central bankers at the Federal Reserve, who inflate the supply of currency in the system, that currency...

Read More »The Role of Ideas

1. Human Reason Reason is man’s particular and characteristic feature. There is no need for praxeology to raise the question whether reason is a suitable tool for the cognition of ultimate and absolute truth. It deals with reason only as far as it enables man to act. All those objects which are the substratum of human sensation, perception, and observation also pass before the senses of animals. But man alone has the faculty of transforming sensuous stimuli into...

Read More »Foreign Policy Fail: Biden’s Sanctions are a Windfall For Russia!

It’s easy to see why, according to a new Harris poll, 71 percent of Americans said they do not want Joe Biden to run for re-election. As Americans face record gas prices and the highest inflation in 40 years, President Biden admits he could not care less. His Administration is committed to fight a proxy war with Russia through Ukraine and Americans just need to suck it up. Last week a New York Times reporter asked Biden how long he expects Americans to pay record...

Read More »Entrepreneurship Should Be the Goal, Not White-Collar Jobs

Black entrepreneurship in the United States has a remarkable history. Even during the inhospitable climate of Southern slavery, both enslaved and free blacks managed to establish lucrative ventures. Research on black entrepreneurship has revealed that in the Antebellum South black entrepreneurs’ pursuits spanned the entire gamut of industry, ranging from merchandising to transportation. Indeed, the success of some black entrepreneurs was so astounding that the demand...

Read More »Here We Go Again: The Fed Is Causing Another Recession

Cause of the Boom-Bust Business Cycle The primary cause of the recurring “boom and bust” business cycle is central banks like the Federal Reserve creating money out of thin air. This was first explained by Austrian economist Ludwig von Mises over a century ago. His student F.A. Hayek won the 1974 Nobel Prize in economics for his work on this theory, which is now known as Austrian business cycle theory. The basic outline of Austrian business cycle theory is as...

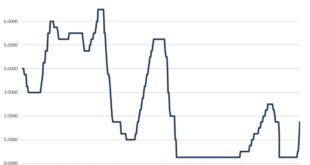

Read More »Krugman Is Wrong (Again): Artificially Low Interest Rates Created Bubbles

In his June 21 New York Times article “Is the Era of Cheap Money Over?,” Paul Krugman argues against the view that the Fed has kept interest rates artificially low for the past ten to twenty years. Other commentators have argued that these low interest rates have inflated bubbles everywhere as investors desperately look for something that will yield a decent rate of return. Krugman expresses strong disagreement that the decline in interest rates caused bubbles and...

Read More »To Avoid Civil War, Learn to Tolerate Different Laws in Different States

Most commentary on the Supreme Court’s decision in Dobbs v. Jackson Women’s Health Organization—which overturns Roe v. Wade—has focused on the decision’s effect on the legality of abortion in various states. That’s an important issue. It may be, however, that the Dobbs decision’s effect on political decentralization in the United States is a far bigger deal. After all, the ruling isn’t so much about abortion as it is about the federal government’s role in abortion....

Read More »Powell Is the New Arthur Burns, Not the New Paul Volcker

Last year, just as it was becoming increasingly clear that price inflation was mounting, Jerome Powell repeatedly denied there was any reason for concern. He called inflation “transitory.” A few months later, he admitted it was not transitory, but denied it was “entrenched.” Then, by late 2021, he admitted price inflation was getting out of control but still took no action of any consequence. Through it all, the Powell plan was repeated delay and opposition to any...

Read More »How Money Printing Destroyed Argentina and Can Destroy Others

Inflation in Argentina is far worse than neighboring countries. It has only one cause: an extractive and confiscatory monetary policy—printing pesos without control and without demand. Original Article: “How Money Printing Destroyed Argentina and Can Destroy Others” The most dangerous words in monetary policy and economics are “this time is different.” Argentine politicians’ big mistake is to believe that inflation is multicausal and that everything is solved...

Read More »Peter Lewin and Steven Phelan: How Do Entrepreneurs Calculate Economic Value Added? Subjectively.

At the core of the entrepreneurial orientation that is the engine of vibrant, growing, value-creating, customer-first businesses, we find the principles of subjectivism and subjective value. Subjective value embraces not only the value the customer seeks, but also the value that entrepreneurs establish in their companies: capital value. Once businesses master these two principles in combination, they can open new horizons of innovation and growth. Key Takeaways...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org