The regime is trying to whip up maximum hysteria or the chances that the US government could default on its debts if the debt ceiling is not raised. Anyone whose been paying attention for a while, however, knows there’s a 99.99 percent chance that the parties involved will soon raise the debt ceiling and the US will go back to adding to its $30-trillion-plus debt hoard as usual. Yet the political posturing over the debt ceiling always offers the media and Democratic...

Read More »Another Recession Sign: Part-Time Work Is Growing Faster than Full-Time Work

The Bureau of Labor Statistic (BLS) released new jobs data on Friday. According to the report, seasonally adjusted total nonfarm jobs rose 517,000 jobs, which was well above expectations. The words used by the media to describe the report included “stunner” and “wow.” President Joe Biden claimed the number proves his administration has delivered economic prosperity. The administration has also noted that in the official numbers, the unemployment rate is at a...

Read More »The Price-Gouging State

Friends and family are talking, on Facebook, about the rapid rise in the price of eggs. Their posts also report that there are plenty of eggs in the dairy sections of local grocery stores. A few people, along with some reporters, blame this rapid increase in the price of eggs on price-gouging corporations. State governments take price gouging seriously. Section 396-R of New York’s General Business law defines price gouging as “unconscionably excessive pricing of...

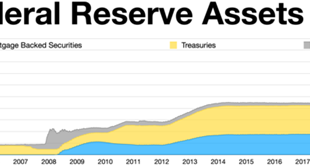

Read More »The Fed’s Portfolio Is Nonexistent: The Fed Does Not Invest. It Destroys Investments

Every so often, I check my investment portfolio to see how it is doing. (I stay out of stocks these days, but that is due to my personal situation and is not to be taken as investment advice.) Portfolios are collections of various financial instruments that one is holding, and one always hopes that their value will head in the right direction over time. When I purchase a financial instrument, I do so because I hope it will perform well in the future. I certainly do...

Read More »Managing Money Is as Important as Making It: The Sad Case of Athletes Going Broke

Lacking a solid team is a recipe for organizational failure, and those intending to excel in business—or any other sector—must invest in management. Considering that many professional athletes encounter bankruptcy shortly after retiring, they are a demographic that could greatly benefit from quality financial management teams. Elite athletes earn millions of dollars during a short time, but few succeed at multiplying their earnings to create wealth. An investigation...

Read More »Subsidizing Higher Education Is Not Creating Widespread External Benefits

President Biden’s student debt relief proposal created a storm of controversy. That is not surprising, since it was a transparent (and apparently successful) attempt to buy the votes of an important Democratic constituency, even though it created a target-rich environment for critics. It is sharply pro-rich at the expense of those far poorer, from a party pretending to stand for the opposite. It is very costly to everyone else (the National Taxpayers Union put the...

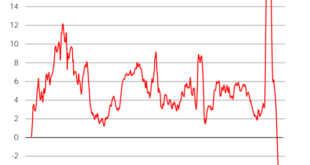

Read More »You Think the Global Economy Is Brightening? Beware: The Big Hit Is Yet to Come

Relief is spreading among economic analysts and stock market experts. Energy prices are decreasing noticeably. The energy supply this winter seems secure; in Europe, government support for consumers and producers is available if needed. China is turning away from its zero-covid policy, and production is ramping up again. High goods price inflation is still a major concern for consumers and producers, but central banks are delivering at least some interest rate...

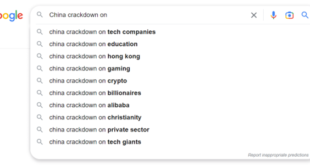

Read More »The Chinese Communist Party Is Creating a Crackdown Economy

True story: Many weekends during my studies in Changzhou, China, my friends and I would go out to have a drink only to realize that our favorite bar was not open that night. In fact, all of the city’s clubs would be closed. The reason? Police had decided to crack down on these nightclubs. These would mostly be drug-related crackdowns, but other reasons such as prostitution would make the list. This seemed to happen in cycles. Once the crackdown happened, things would...

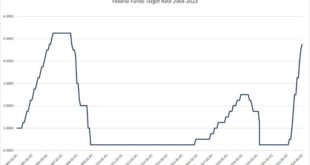

Read More »The Fed Is Already Flashing Signs It’s Done Raising Rates

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday raised the target policy interest rate (the federal funds rate) to 4.75 percent, an increase of 25 basis points. With this latest increase, the target has increased 4.5 percent since February 2022, although this latest increase of 25 basis points is the smallest increase since March of last year. Indeed, the FOMC has slowed its rate of increase over the past three months. After four 75 basis...

Read More »2023 Libertarian Scholars Conference

Join the Mises Institute at the 2023 Libertarian Scholars Conference on Saturday, September 23. We’ll meet at the Grand Hyatt in Nashville, Tennessee. The first Libertarian Scholars Conference was held in New York City in 1972 under the aegis of the Center for Libertarian Studies. The conference was held annually (except for 1973) throughout the 1970s in New York or Princeton, New Jersey (1977, 1978), with the 8th and last “national” conference taking place at the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org