In a piece of news that shocked the mainstream media, but which shocked no one familiar with the academic industry writ large, retired US Army general John Allen was forced to resign as president of the Brookings Institution after it was revealed the FBI was investigating him for lobbying on behalf of the Qatari monarchy. Of course, the real news, scarcely noted by the Washington Post, New York Times, or any other purported paper of record, is that Allen was only...

Read More »How Bad Were Recessions before the Fed? Not as Bad as They Are Now

With a recession looming over the average American, the group to blame is pretty obvious, this group being the central bankers at the Federal Reserve, who inflate the supply of currency in the system, that currency being the dollar. This is what inflation is, the expansion of the money supply either through the printing press or adding zeros to a computer screen. It has gotten so bad that in the last twenty-two months, 80 percent of all US dollars in existence have...

Read More »What Will It Take to End Rampant Home-Price Inflation?

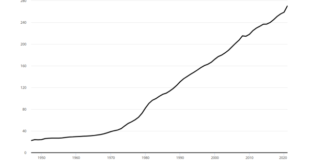

Real wages are falling, inflation is at a 40-year high, and the Atlanta Fed predicts we’ll find GDP growth at zero for the second quarter. Meanwhile, both the yield curve and money-supply growth point to recession. But when it comes to the latest data on home prices, there’s still no sign of any deflation or even moderation. For example, the latest Case-Shiller home price data shows home prices surged above 20 percent year-over-year in April, marking yet another...

Read More »Economic Winter Has Arrived

The average card-carrying Austrian would say that the Federal Reserve is creating money by the bale, with evidence being Consumer Price Index prints of 8.6 percent per the Bureau of Labor Statistics or over 15 percent per John Williams’s shadowstats.com computation based on the way the government calculated CPI back in 1980. Surely, at best, the US dollar is only the cleanest dirty shirt in the currency laundry basket. But Uncle Sam’s dollar continues to strengthen...

Read More »Markets Promote Real Equality Much More Than Progressive (and Conservative) Critics Claim

The economy consists of a huge chain of the division of labor that is interlocked to such a limit where there exists hardly any single individual or firm that produces the whole of the product alone. This is famously illustrated in the essay “I, Pencil,” by Leonard Read. Each element of this complex chain is a firm that consists of many individuals, therefore one of the first questions one might ask is, “Why do individuals engage in these complex economic...

Read More »Wholesale Prices Rise More than 10 Percent, Pointing to Continued Price Hikes

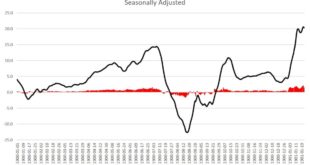

Year-over-year PPI growth came in at over 10 percent for the sixth month in a row. This will put more pressure on the Fed to “do something.” Original Article: “Wholesale Prices Rise More than 10 Percent, Pointing to Continued Price Hikes” The US Bureau of Labor Statistics released new Producer Price Index (PPI) data today, and it’s not good news for consumers. The PPI is a measure of prices at the production phase of goods and services, and is often an indicator...

Read More »The Return of the Anguish of Central Banking: Why the Fed and Inflation Go Hand in Hand

(The following text is a revised update of an article that was first published in 2005.) The recent outbreak of price inflation with the jump to an annual rate of 8.6 percent in May 2022 came as a surprise to the US central bank (the Federal Reserve). Having ignored the warnings of the Austrian school economists, the policy makers were paralyzed in the face of a phenomenon they deemed impossible to happen. None of their forecasting models had triggered an inflation...

Read More »Back to the Future: Progressives Imagine the Good Old Days of Price Controls

When the Bourbon dynasty was restored to power in France in the early 1800s after Napoleon’s abdication, the French statesman Charles-Maurice de Talleyrand famously said of that family: “They had learned nothing and forgotten nothing.” In modern economic parlance, one can say the same thing about progressives, who once again are demanding price controls to “fight inflation.” Not surprisingly, Sen. Elizabeth Warren is leading the way. She recently introduced a bill...

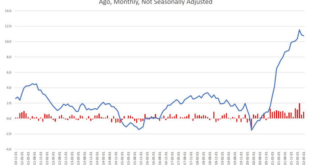

Read More »US Household Saving Rate Vanishes, Credit Card Debt Soars

The United States consumption figure seems robust. An 0.9 percent rise in personal spending in April looks good on paper, especially considering the challenges that the economy faces. This apparently strong figure is supporting an average consensus estimate for the second-quarter gross domestic product (GDP) of 3 percent, according to Blue Chip Financial Forecasts. However, the Atlanta Fed GDP nowcast for the second quarter stands at a very low 1.9 percent. If this...

Read More »The Great Crash of 2022

We are now well past the corona crisis of 2020, and most of the restrictions around the world have been repealed or loosened. However, the long-term consequences of arbitrary and destructive corona policies are still with us—in fact, we are now in the middle of the inevitable economic crisis. Proclaiming the great crash and economic crisis of 2022 is at this point not especially prescient or insightful, as commentators have been predicting it for months. The cause is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org