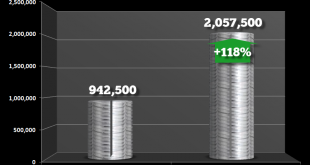

U.S. Mint suspends silver bullion coin sales after sales double in February Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell With increased investment demand, the Mint is experiencing a resurgence in steady demand with sustained purchases of the...

Read More »Swiss private banking giant dips toes into crypto scene

The 125-year-old Swiss private bank is ready for some crypto action. (© Keystone / Ennio Leanza) One of Switzerland’s largest banks, Julius Baer, has entered the cryptoassets world by announcing a partnership with budding crypto bank start-up SEBA. While other Swiss banks, such as Vontobel, Falcon and Swissquote, are already active in the space, Julius Baer’s entrance has attracted particular attention. The obvious...

Read More »Is Lending the Root of All Evil? Report 24 Feb

Ayn Rand famously defended money. In Atlas Shrugged, Francisco D’Anconia says: “So you think that money is the root of all evil? . . . Have you ever asked what is the root of money? Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them. Money is the material shape of the principle that men who wish to deal with one another must deal by trade and give value for value....

Read More »Central Planning Is More than Just Friction, Report 17 February

It is easy to think of government interference into the economy like a kind of friction. If producers and traders were fully free, then they could improve our quality of life—with new technologies, better products, and lower prices—at a rate of X. But the more that the government does, the more it burdens them. So instead of X rate of progress, we get the same end result but 10% slower or 20% slower. Some would go so...

Read More »Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU

Gold prices in pounds and euros as economic growth falters in UK and EU Euro & pound gold tests multi year resistance; likely to surpass due to strong demand Improved risk appetite sees stocks rise which may be hampering stronger gains for gold Investors concerns regarding trade wars, Brexit, Italexit, the economic outlook and looser monetary policies is seeing robust demand for gold bullion Gold prices broke...

Read More »U.S. Congressman Introduces Bill to Remove Income Taxation from Gold and Silver

The battle to end taxation of constitutional money has reached the federal level as U.S. Representative Alex Mooney (R-WV) today re-introduced sound money legislation to remove all federal income taxation from gold and silver coins and bullion. The Monetary Metals Tax Neutrality Act (H.R. 1089) backed by the Sound Money Defense League and free-market activists – would clarify that the sale or exchange of precious metals...

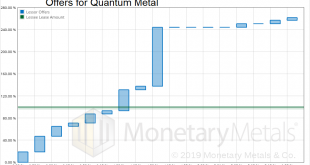

Read More »Quantum Metal Lease #1 (gold)

Monetary Metals leased gold to Quantum Metal, to support the growth of its gold distribution business through retail bank branches. The metal is held in the form of retail Perth Mint bars. For more information see Monetary Metals’ press release. Metal: Gold Commencement Date: January 31, 2019 Term: 1 year Lease Rate: 4.5% net to investors Offers for Quantum Metal - Click to enlarge...

Read More »Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen

-Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen– Growing demand from investors to relocate tangible assets out of the UK– “Zurich continues to be the most sought-after location for storage, but Dublin has already surpassed Hong Kong and will likely usurp the second spot from London” Gold bars sit across a one kilo gold bar at precious metals storage specialist GoldCore....

Read More »What They Don’t Want You to Know about Prices, Report 10 Feb

Last week, in part I of this essay, we discussed why a central planner cannot know the right interest rate. Central planner’s macroeconomic aggregate measures like GDP are blind to the problem of capital consumption, including especially capital consumption caused by the central plan itself. GDP has an intrinsic bias towards consumption, and makes no distinction between consumption of the yield on capital, and...

Read More »Monetary Metals Leases Gold to Quantum Metal

Malaysia’s leading gold distributor saves money with a Monetary Metals lease Scottsdale, Ariz, February 8, 2019—Monetary Metals® announces that it has leased gold to Quantum Metal, to support the growth of its business of selling gold through retail banks. Investors earn 4.5% on their gold, which is held as Perth Mint minted gold bars in inventory. Monetary Metals has a disruptive model, leasing gold from investors who...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org