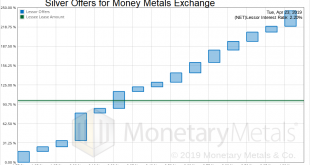

Monetary Metals leased silver to Money Metals Exchange, to support the growth of its gold and silver bullion business. The metal is held in the form of inventory in its vault. For more information see Monetary Metals’ press release. Metal: Silver Commencement Date: May 1, 2019 Term: 1 year Lease Rate: 2.2% net to investors Silver Offers for Money Metals Exchange - Click to enlarge...

Read More »The Spreads Blow Out, Update 1 May

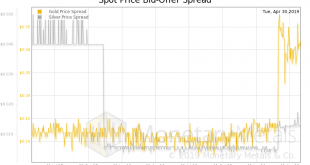

The bid-ask spread of both (spot) gold and silver has blown out. Both, on March 1. In gold, the spread had been humming along around 13 cents—gold is the most marketable commodity, and this is the proof, a bid-ask spread around 1bps—until… *BAM!* It explodes to around 35 cents, or two and half times as wide. On the same day, silver went from half a cent to 1.5 cents, or about triple. We zoomed out far enough—it does...

Read More »Is Keith Weiner an Iconoclast? Report 28 Apr

We have a postscript to our ongoing discussion of inflation. A reader pointed out that Levis 501 jeans are $39.19 on Amazon (in Keith’s size—Amazon advertises prices as low as $16.31, which we assume is for either a very small size that uses less fabric, or an odd size that isn’t selling). Think of the enormity of this. The jeans were $50 in 1983. After 36 years of relentless inflation (or hot air about inflation), the...

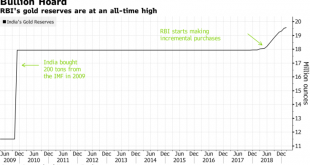

Read More »World’s Central Banks Want More Gold – India May Buy 1.5M Ounces In 2019

Royal Bank of India (RBI) may buy another 1.5 million oz this year according to OCBC Many other central banks including large creditor nations Russia and China are also adding to gold holdings via Bloomberg India’s central bank is likely to join counterparts in Russia and China scooping up gold this year, adding to its record holdings and lending support to worldwide gold bullion demand as top economies diversify their...

Read More »SWOT Analysis:Venezuela Sells $400 Million Worth Of Gold Bullion

Strengths The best performing metal this week was palladium, up 3.52 percent as CPM Group noted that the price could climb to $1,800 on supply constraints. Gold traders and analysts switched from bullish to mostly neutral or bearish on the yellow metal this week, according to the weekly Bloomberg survey. Turkey’s gold reserves reversed this week by rising $227 million from the previous week. The central bank’s holdings...

Read More »The Two Faces of Inflation, Report 22 Apr

We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees. The producer may give you less milk...

Read More »Washington State Politicians Drop Cynical Attempt to Impose Taxes on Gold & Silver

Well, here’s some encouraging news… Efforts in Washington State to impose sales taxes on gold and silver were SHUT DOWN today thanks to intense efforts by the Sound Money Defense League, a group of in-state coin dealers led by Dan Duncan, the Association of Washington Businesses, and a large number of vocal grassroots supporters. Here’s the backstory… Since last month, a few misguided Washington State senators and...

Read More »New Inflation Indicator, Report 14 Apr

Last week, we wrote that regulations, taxes, environmental compliance, and fear of lawsuits forces companies to put useless ingredients into their products. We said: “For example, milk comes from the ingredients of: land, cows, ranch labor, dairy labor, dairy capital equipment, distribution labor, distribution capital, and consumable containers.” There are eight necessary ingredients, without which milk cannot be...

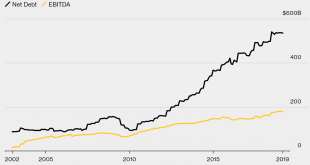

Read More »Debt and Profit in Russell 2000 Firms

This week, the Supply and Demand Report featured a graph of debt vs profitability in the Russell 2000. Here’s the graph again: This graph shows a theme that we, and practically no one else(!) have been discussing for years. It is the diminishing marginal utility of debt. In this case, more and more debt is required to add what looks like less and less profit (we don’t have the raw data, only the graphic). We do not view...

Read More »West Virginia Joins Growing Sound Money Movement – Six Other States Now Weighing Their Own Bills to End Taxes on Gold & Silver

Before the ink could even dry on West Virginia Governor Jim Justice’s signature on a repeal of sales taxation on gold, silver, platinum, and palladium bullion and coins, legislators in Wisconsin and Maine introduced similar measures in their own states. All told, 39 states have now reduced or eliminated sales taxes on the monetary metals, and Wisconsin, Maine, Kansas, Arkansas, Minnesota, and Tennessee are all actively...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org