U.S. Mint suspends silver bullion coin sales after sales double in February Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell With increased investment demand, the Mint is experiencing a resurgence in steady demand with sustained purchases of the silver coins after fluctuating and lower demand in recent years Investment demand for silver set to surge again in the next global debt crisis Sales of Silver Eagles continue to be strong as demand for the official coins surged in February. Moreover, as the Authorized purchases of Silver Eagles jumped by

Topics:

Mark O'Byrne considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

- U.S. Mint suspends silver bullion coin sales after sales double in February

- Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories

- U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell

- With increased investment demand, the Mint is experiencing a resurgence in steady demand with sustained purchases of the silver coins after fluctuating and lower demand in recent years

- Investment demand for silver set to surge again in the next global debt crisis

| Sales of Silver Eagles continue to be strong as demand for the official coins surged in February.

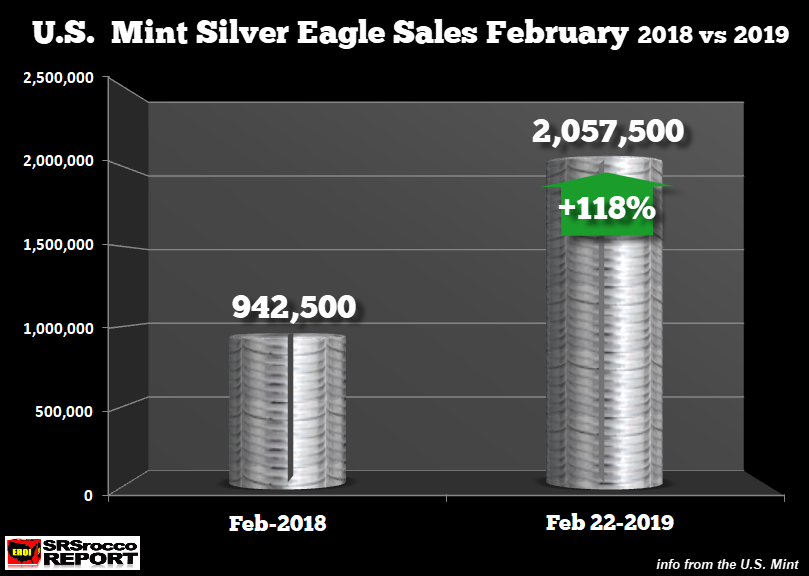

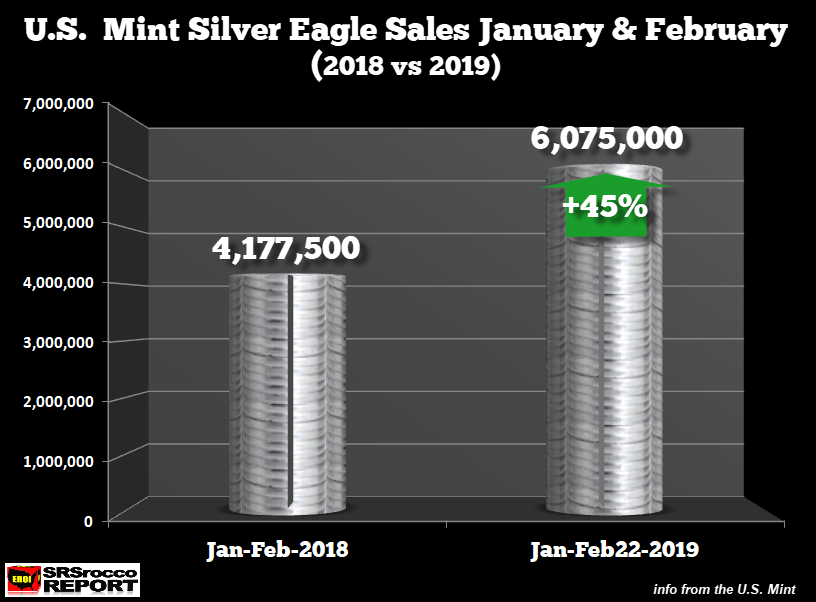

Moreover, as the Authorized purchases of Silver Eagles jumped by 775,000 oz this past Thursday, the U.S. Mint issued a temporary suspension of sales until inventories can be restocked. This is a very positive sign as total Silver Eagle sales last year fell to low of 15.7 million, down more than 50%, compared to the 37.7 million set in 2016. According to the U.S. Mint’s most recent update, Silver Eagle sales as of February 21st were 2,057,500 versus the 942,500 during the same month in 2018. Not only are Silver Eagle sales this month more than double last year, but they also surpassed Feb 2017’s figure by 842,000 oz: Furthermore, Silver Eagle sales JAN-FEB 2019 are 6,075,000 compared to 4,177,500 sold during the same period last year. Thus, sales of Silver Eagles are up 45% versus the first two months in 2018: |

US Mint Silver Eagle Sales, Feb 2018 - Feb 2019 |

| I believe demand for Silver Eagles will remain strong this year, but it will take another financial and economic crisis to push the annual purchases back up to the 35-40+ million range.

And, I believe we may likely see that type of demand in the next few years as the global financial system starts to unwind due to the massive amount of unsustainable debt. Interestingly, the Silver to Gold Eagle sales ratio this year is nearly 80/1 compared to the 70/1 during the same period in 2018. Silver Eagle Sales JAN-FEB 2018 = 4,177,500 Gold Eagle Sales JAN-FEB 2018 = 59,000 oz Silver-Gold Eagle Ratio JAN-FEB 2018 = 70/1 Silver Eagle Sales JAN-FEB 2019 = 6,075,000 Gold Eagle Sales JAN-Feb 2019 = 77,000 Silver-Gold Eagle Ratio JAN-FEB 2019 = 79/1 It seems as if the Authorized Dealers and investors are taking advantage of the higher Gold-Silver price ratio of 83/1 in February versus the average of 81/1 in January. Savvy investors tend to buy more silver when the Gold-Silver ratio is high and more gold when the opposite is true. |

US Mint Silver Eagle Sales, Jan and Feb 2018 - Jan and Feb 2019 |

| Listen on iTunes, Blubrry & SoundCloud & watch on YouTube above |  |

Lastly, the annual record for Gold Eagle sales was 2,055,500 oz set in 1999, due to the Y2K scare. Although, the last peak of Gold Eagles occurred during the financial crisis in 2009 at 1,435,000 oz. Now compare that to the total 245,500 oz of Gold Eagles sold in 2018. However, the largest yearly demand for Silver Eagles took place in 2015 at a stunning 47,000,000.

Unfortunately, as we can see, investors have severely cut back on Silver, and Gold Eagle purchases as the Wall Street Casino has attracted most of the markets’ funds. While it has been a long and frustrating road for precious metals investors, I can assure you; we will have the last laugh.

Tags: Daily Market Update,Featured,newsletter